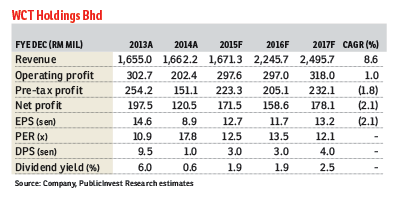

WCT Holdings Bhd (Feb 16, RM1.62)

Upgrade to outperform with a higher target price (TP) of RM1.80: A recent meeting with the management revealed that the group’s de-gearing exercise is underway with the proposed listing of its investment assets and construction arm, with a target set by end-2016.

The de-gearing exercise is in fact already in progress with the recently proposed joint venture (JV) with UEM Sunrise Bhd, which is expected to raise RM215 million in net proceeds.

We understand that the listing of its construction division and investment assets is expected to raise another RM1.3 billion, which would pare down the group’s net gearing from 0.6 times to 0.4 times.

All in, the total proceeds from the de-gearing exercise are estimated to be RM1.5 billion or RM1.11 a share. With the potential value to be unlocked from reorganisation, we upgrade WCT from trading “buy” to “outperform” with a higher TP of RM1.80 from RM1.70 previously based on a 10% discount to our sum-of-parts (SOP).

The arbitration claim of 1.15 billion UAE dirham (RM1.3 billion) would potentially add another 95 sen a share to our SOP valuations. Financial year 2016 (FY16) to FY17 earnings are adjusted by 11% and 6% respectively to account for higher job replenishment and rental income.

Apart from monetising its land bank via its JV with UEM Sunrise, WCT also plans to list its construction division and investment assets. Hence, WCT will be the holding company owning the land bank and stakes in the new construction company and real estate investment trust (REIT).

We understand that it plans to sell 40% of the RM1.5 billion construction initial public offering, potentially yielding RM600 million in cash proceeds. As for investment assets, the group plans to float its Bandar Bukit Tinggi mall in Klang and Paradigm Mall in Kelana Jaya with total asset value of RM1.2 billion.

With 40% ownership, the REIT is projected to raise RM720 million. Both listings are expected to be completed by end-2016. The gateway@klia2 mall is excluded from the REIT listing.

After a record-breaking year in 2015 with RM3.1 billion worth of jobs secured, WCT is hopeful that it could add another RM2 billion in 2016, with RM1.6 billion expected locally and the rest from the Middle East.

We understand that it will focus on infrastructure jobs, which traditionally have higher margins. Among the key jobs eyed are refinery and petrochemical integrated development civil works in Pengerang (RM300 million), Tun Razak Exchange infrastructure and buildings (RM800 million), Kwasa Damansara civil and infrastructure works, KL118 infrastructure, Southern double track, Pan-Borneo Highway, light rail transit 3 and mass rapid transit 2 rail works. Outstanding order book as at November 2015 stood at RM5.3 billion, with RM0.9 billion internal works.

For FY16, the group is targeting to sell RM600 million worth of properties, with the maiden launch of its OUG mixed development project,  The Paradigm Gardens City. The first project in OUG is a residential tower, R2, with an estimated gross development value of RM300 million or RM850 per sq ft.

The Paradigm Gardens City. The first project in OUG is a residential tower, R2, with an estimated gross development value of RM300 million or RM850 per sq ft.

WCT might unveil another residential block, R4, in the fourth quarter of 2016, if the demand is good. We understand that its 60-acre (24.3ha) OUG land will have eight blocks consisting condominiums, offices and a mall.— PublicInvest Research, Feb 16

This article first appeared in The Edge Financial Daily, on Feb 17, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Taman Nusari Bayu 1, Bandar Sri Sendayan

Seremban, Negeri Sembilan

Bandar Baru Sungai Buloh

Sungai Buloh, Selangor

HillPark Avenue @ Puncak Alam

Puncak Alam, Selangor

i32 Puchong Industrial Park

Puchong, Selangor

Parkside Residence @ Setia Federal Hill

KL City, Kuala Lumpur

Merdeka 118 @ Warisan Merdeka 118

Kuala Lumpur, Kuala Lumpur

Bangunan Setia 1

Damansara Heights, Kuala Lumpur