- The projected growth in Malaysia’s GDP of 4.5% to 5.5% for 2025, further digitalisation of the property industry, national infrastructural enhancements, and increased FDIs and DDIs are all considered contributing factors to the positive momentum in the property market for 2025.

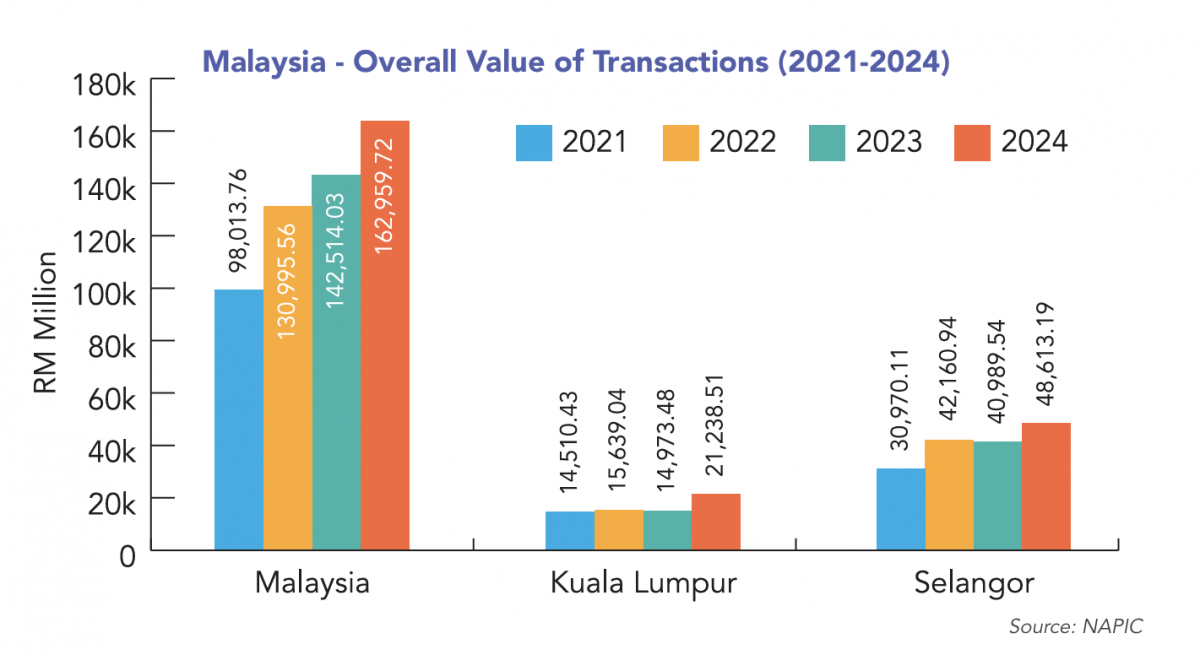

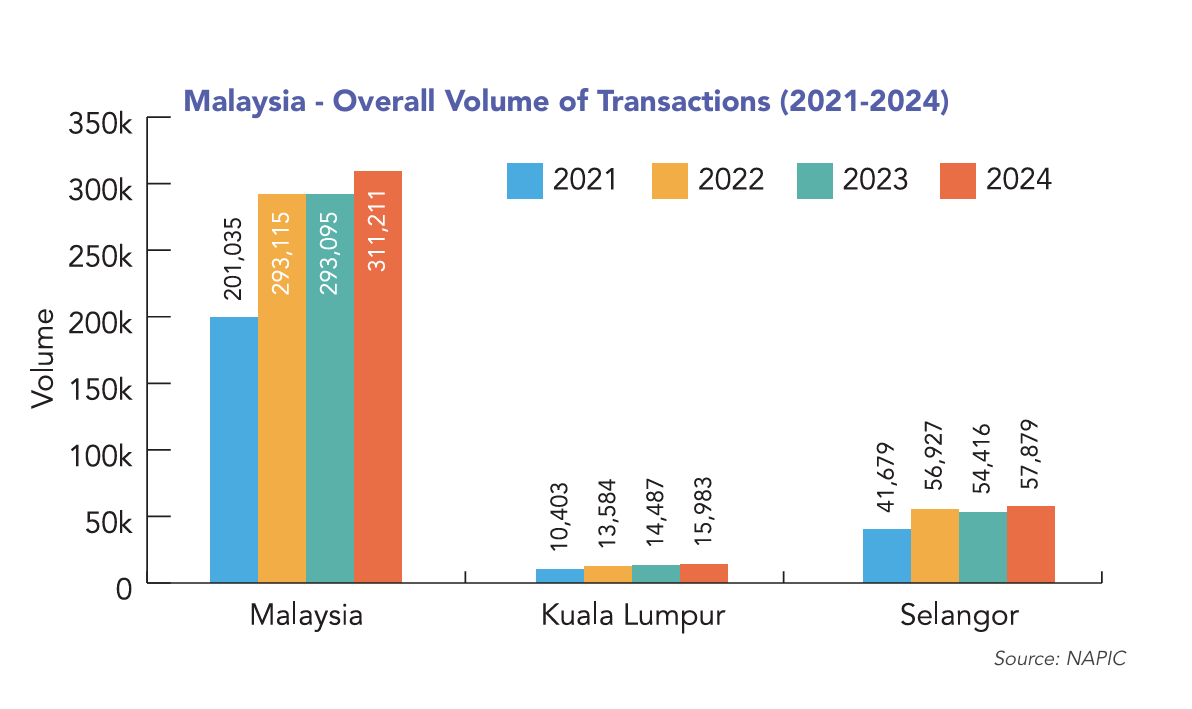

KUALA LUMPUR (Jan 23): Malaysia’s property market saw an overall increase of 14% in transaction value to almost RM163 million and 6% in transaction volume to 311,211 units in the first nine months of 2024, in comparison to the same period in 2023.

Looking forward, the projected growth in Malaysia’s gross domestic product (GDP) from 4.5% to 5.5% for 2025, further digitalisation of the property industry, national infrastructural enhancements, and increased foreign direct investments (FDIs) and domestic direct investments (DDIs) are all considered contributing factors to the positive momentum in the property market for 2025, according to Henry Butcher Malaysia’s “HB Perspective: Malaysia Property Outlook 2025” report, which was presented on Wednesday (Jan 22).

Almost 50% jump in residential new launches in 3Q2024

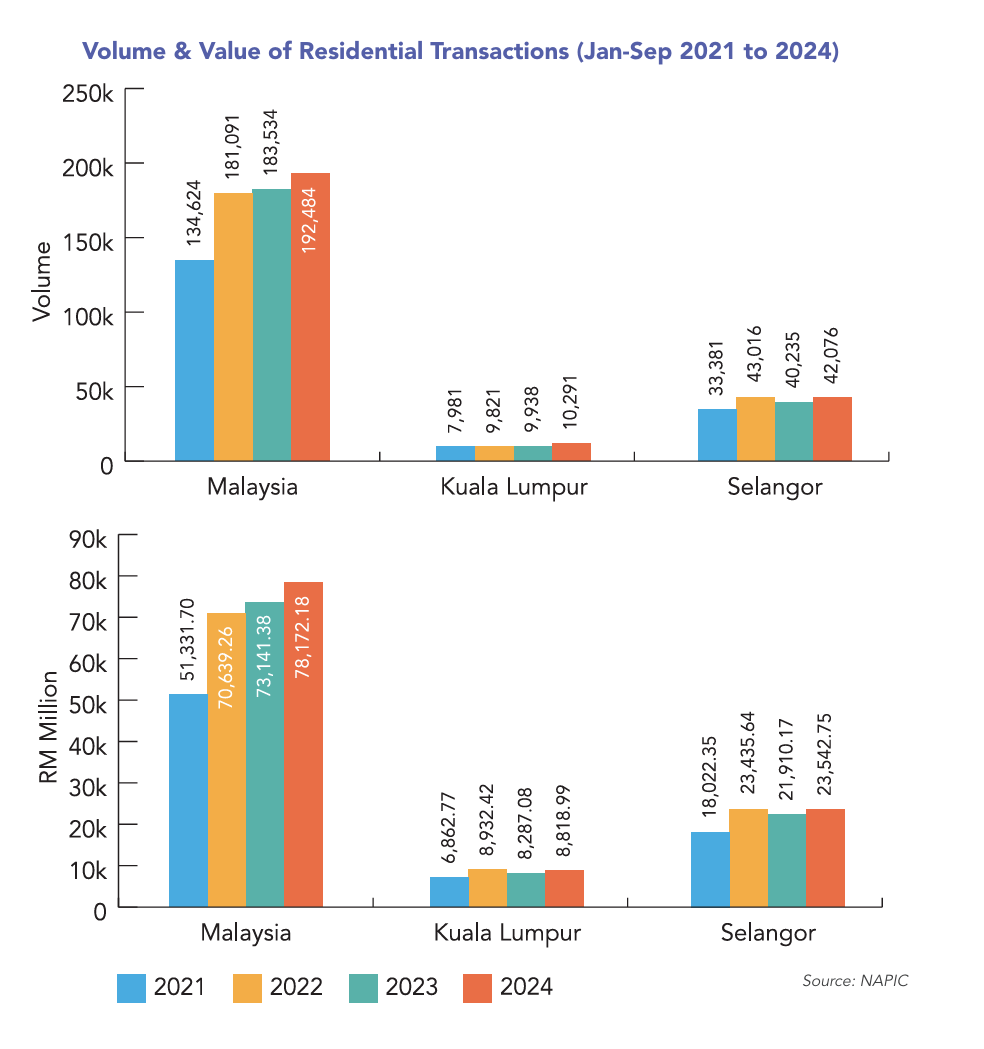

In 3Q2024, there was a 47% hike in the number of new residential units launched nationwide to 192,484 units from 183,534 units in 3Q2023. However, the increase in overall value of residential transactions was only approximately 6.8% for the same period.

Meanwhile, the volume of national residential overhang dropped by 13% in 3Q2024 compared to 3Q2023.

The report also cited the Real Estate and Housing Developers’ Association (Rehda) Malaysia Property Industry Survey for 1H2024, which showed that the number of units launched increased by 7% to 11,814 units. According to the same survey, the number of units sold in 1H2024 reached 13,445 units compared to 11,273 units in 1H2023.

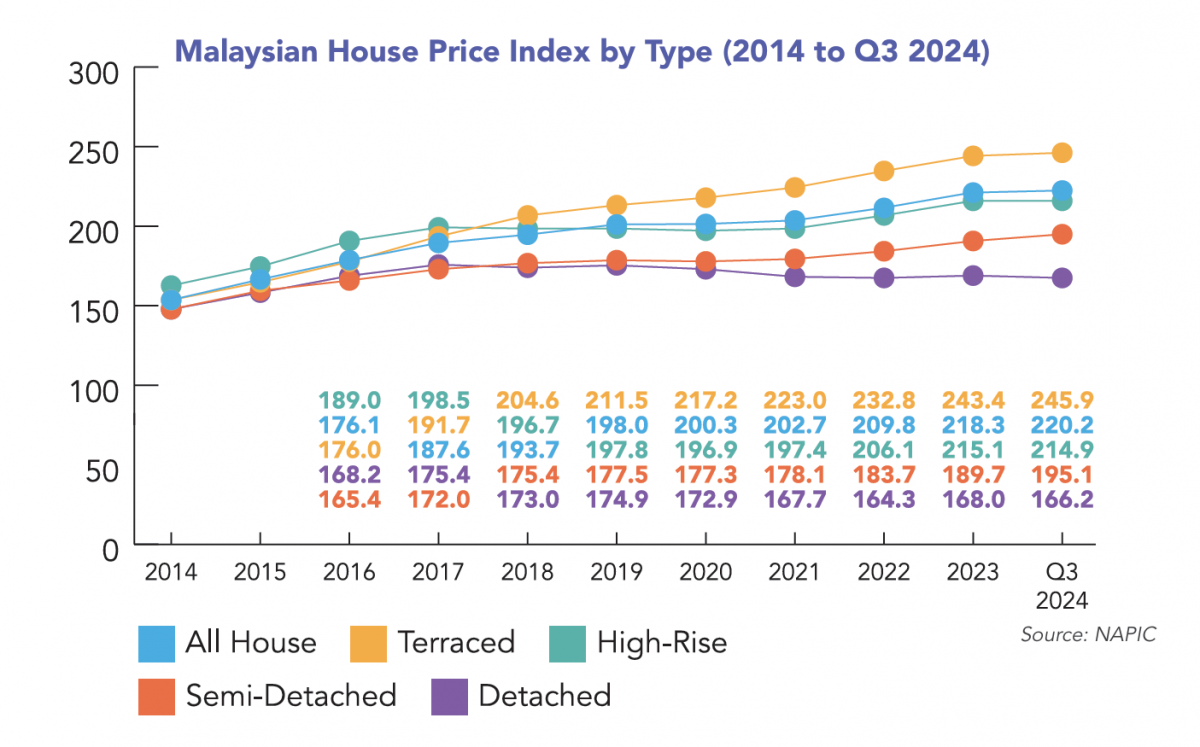

“A majority of the units launched in 2024 were terrace houses, which remained the preferred type of property amongst Malaysians, followed by condominiums and apartments,” observed Henry Butcher Malaysia chief operating officer, agency & project marketing Tang Chee Meng during his presentation.

House prices remain relatively unchanged

In terms of house prices, 2024 saw relative stagnancy, with the Malaysian House Price Index (MHPI) only recording slight increases in price across all property types, except for detached houses and high-rises, both of which slipped slightly. Semidees saw the highest rate of increase of 5.4% to 195.1 as at 3Q2024 from 189.7 in 2023.

“However, there is a possibility that house prices might increase, due to developers trying to recoup higher construction costs, as there is a limit as to how much developers can absorb … although, how fast and how much prices will increase depends heavily on the state of the market,” Tang further observed.

The preference for landed properties continues as a major focus for 2025, and the residential market will need to delicately balance developers’ need to increase prices, and homebuyers’ desires for affordability.

“In general, the focus for 2025’s residential market will be on landed properties, as that remains the preference for most Malaysians, as well as high-rises and condominiums in the affordable price range. The definition of affordability will vary for different regions. For example, in smaller towns, this could mean properties priced RM300,000 and below, while in more populated regions, this could mean RM500,000 to RM600,000. Smaller-sized units can help bring down absolute selling prices, which will also increase affordability,” said Tang.

Conversely, niche high-end products may also be in demand for 2025, due to a low supply from developers over the past few years, with some caveats.

“Developers who are looking to launch such projects need to be cautious and savvy with picking the locations of such projects in order to draw in investors,” said Tang.

“As the market is getting more competitive, it is no longer viable for developers to rely on conventionality. It is likely 2025 will see a growing demand for even more sustainable and innovative designs and concepts,” Tang added.

Industrial sector continues to dominate transactions

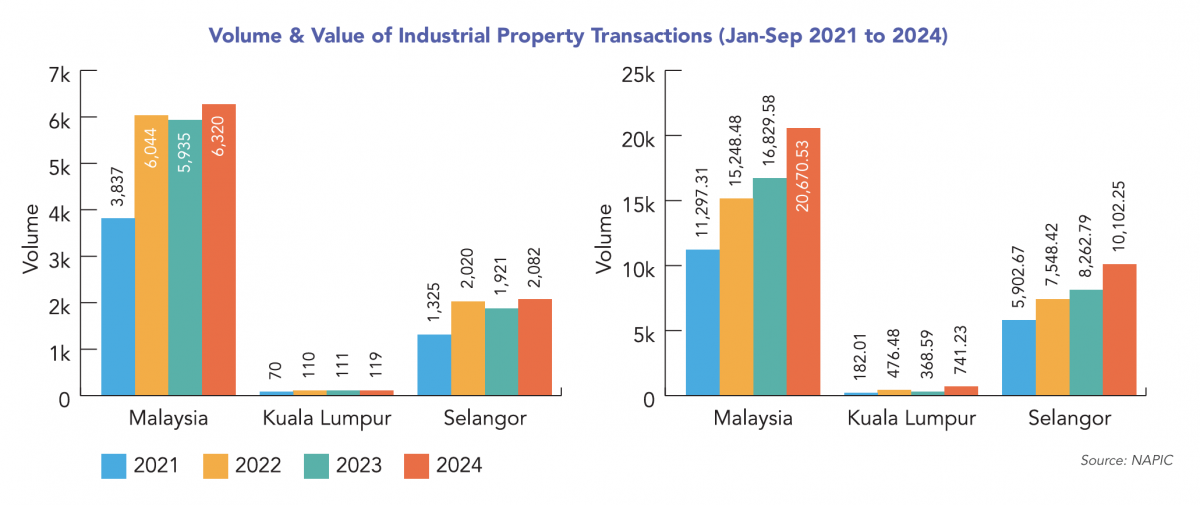

Malaysia saw an increase of 6.5% in 3Q2024 with the volume of industrial transactions, from 5,935 units in 3Q2023, to 6,320 units in 3Q2024. This was coupled with a staggering 22.8% increase in value (from RM16,829.28 million to RM20,670.53 million), highlighting the industrial sector’s continued position as the best performing sector in Malaysia.

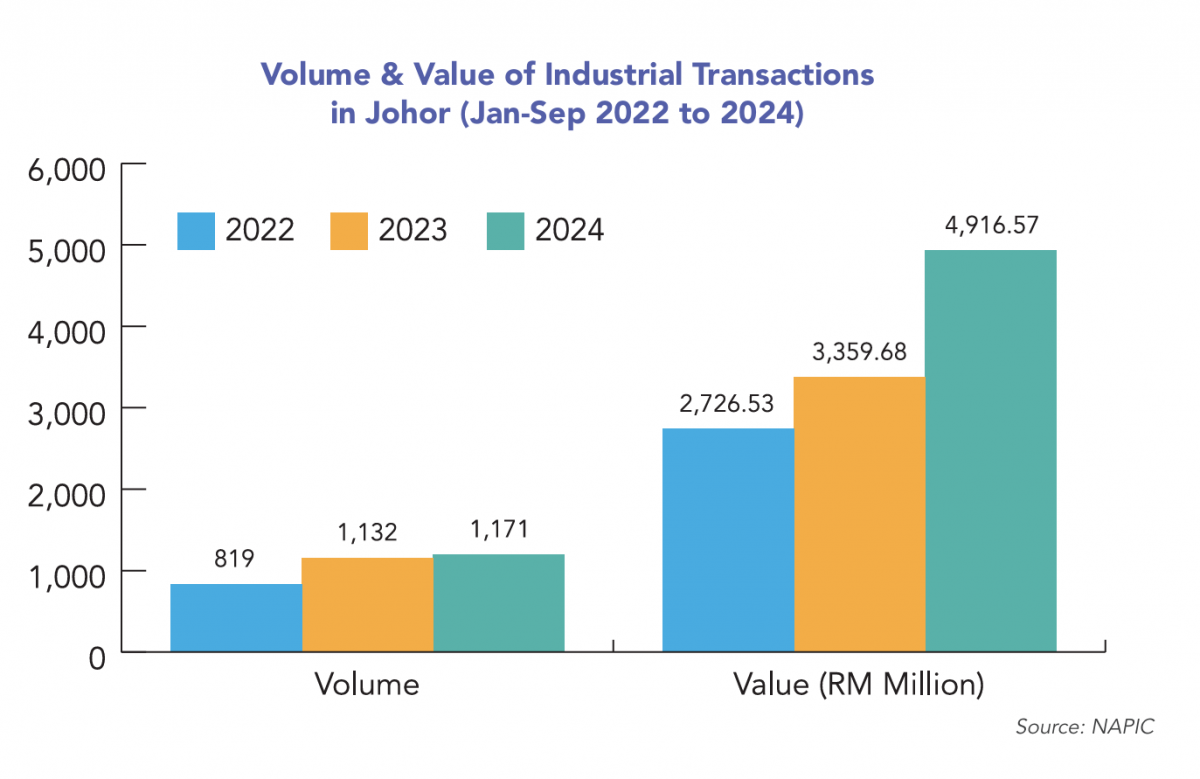

Selangor contributed the most to the national industrial transaction volume, at 33% (2,082 units), followed by Johor, at 18% (1,171 units).

This growth is expected to continue into 2025, with the continued flow of FDIs by large multinational corporations, especially with the upcoming development of more data centres in Johor and Selangor.

“The government has announced that moving forward, it will be focusing a lot on data centres, as well as chip design and manufacturing. So we can expect to see a lot more activity in this sub-sector of the industrial arena,” said Tang.

Infrastructural enhancements across the country will play an increasingly large role in boosting the growth for the industrial sector.

“Improved accessibility between Johor and Singapore through the RTS (Rapid Transit System) link, and the construction of the Mutiara LRT (Light Rail Transit) line to connect Penang island to the mainland, will provide a reason for investors to come in and set up factories in these areas. So, this will provide a boost in demand for industrial spaces,” said Tang.

“The government’s New Industrial Master Plan (NIMP) 2030 as well as the National Energy Transition Roadmap (NETR) will guide the development of the industrial sector moving forward,” added Tang.

Other government programmes and policies that will continue to grow Malaysia’s industrial sector include the Industry4WRD (National Policy on Industry 4.0) nationwide, and Integrated Development Region In South Selangor (IDRISS).

Incoming mega offices raise oversupply concerns

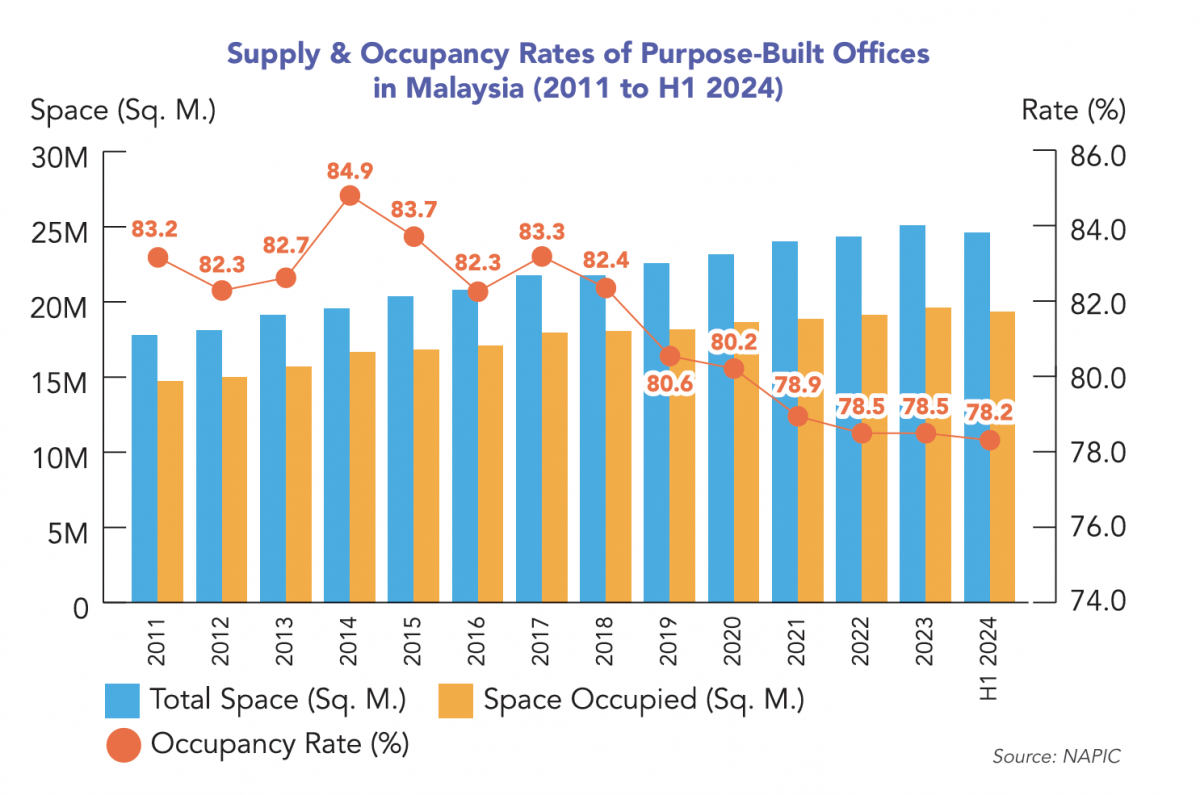

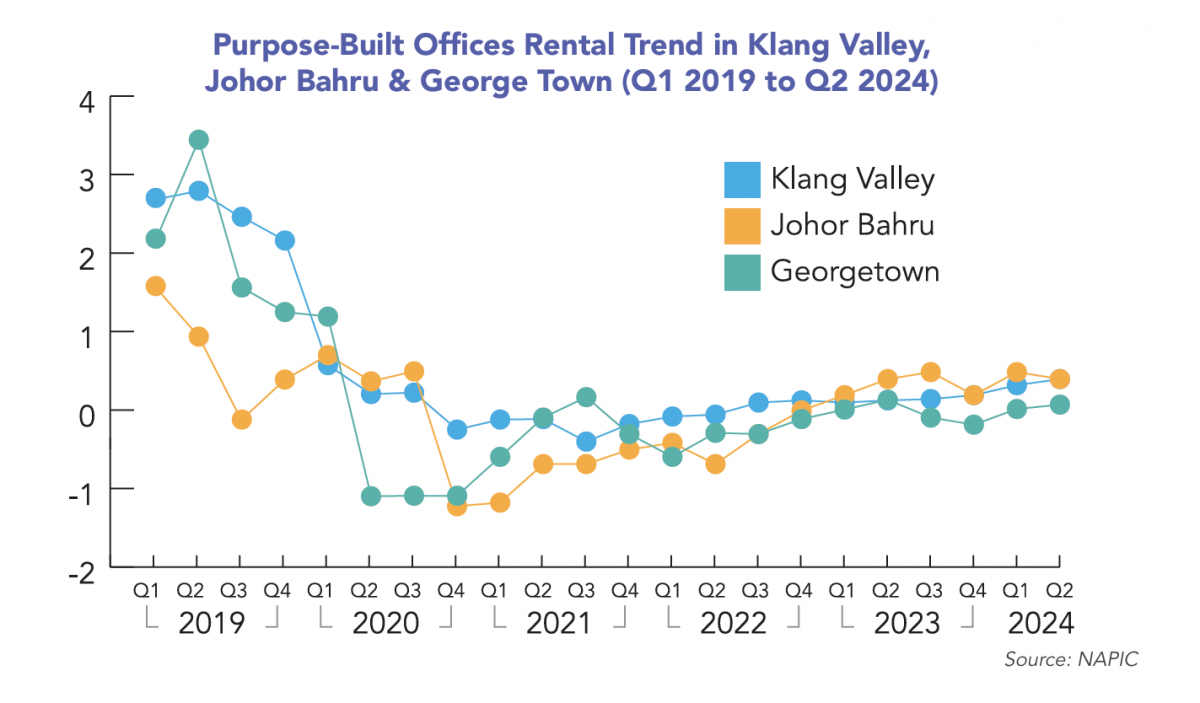

Purpose-built office spaces (PBOs) have seen a slight increase in supply across Malaysia, from 18.39 million sq m to 18.82 million sq m between Q32023 and Q32024. However, occupancy rates have slipped from 72.7% to 71.6% across the same period.

“In terms of supply and demand, there is a lot more variation across states. For example, in Terengganu and Kelantan, where less office spaces are being built, the market is a lot more stable, versus the Klang Valley,” said Tang.

One of the main concerns for the commercial sector is that the increased construction of mega office towers could cause supply issues.

“Office buildings no longer average out with a net built-up area of 300,000 to 500,000 sq ft. Today, we are seeing office buildings of more than a million sq ft being constructed. This has led to concerns about whether there will be an oversupply of office spaces going forward. If you consider all the statistics, this problem could materialise in the next few years,” cautioned Tang.

EdgeProp.my is currently on the lookout for writers and contributors to join our team. Please feel free to send your CV to [email protected]

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!