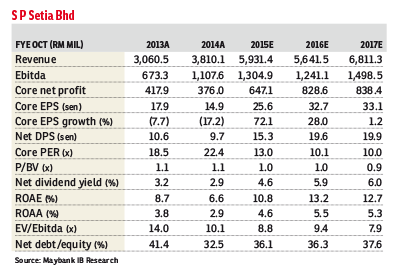

S P Setia Bhd (April 15, RM3.46)

Maintain buy with a target price (TP) of RM4.10: S P Setia is set to enjoy lumpy contributions from its overseas projects (in Australia, Singapore and the United Kingdom) with RM1.5 billion and RM2.3 billion unbilled sales to be recognised progressively in financial year 2015 (FY15) and FY16 respectively.

FY15 will be mainly driven by the RM1.4 billion Fulton Lane project (27% of FY15 property revenue) in Australia which is undergoing staggered handover from December 2014 to May 2015, and is set to boost its upcoming second quarter of FY15 (2QFY15) earnings significantly. Meanwhile, Battersea phase 1’s RM1.5 billion unbilled sales (own 40% portion) will come in by FY16. We raised our FY15 earnings by 9% mainly due to our conservative recognition of progressive billings for some projects slated for completion this year.

The group achieved RM1 billion property sales in the 1QFY15, of which RM737 million is attributed to the Battersea Power Station project in London. This places the company on track to achieve its RM4.6 billion sales target for FY15 (60% from Malaysia). We believe its township products, such as Setia Alam, Setia Eco Hill and Setia Eco Glades, will continue to do well, given the strong demand for lifestyle landed properties with good infrastructure and amenities. Its low land cost will provide strong competitive advantage against its peers.

While it remains a drag on the share price performance, we understand business operation remains intact and property sales continue to be encouraging despite the softer sentiment. We believe the succession plan concern has been overplayed and the solid fundamentals of the group offer strong investment merit. Maintain “buy” with a RM4.10 TP, based on a 30% discount to revalued net asset value. — AllianceDBS Research, April 15

This article first appeared in The Edge Financial Daily, on April 16, 2015.

TOP PICKS BY EDGEPROP

Iskandar Residences Medini

Iskandar Puteri (Nusajaya), Johor

Taman Sri Nibong, Sungai Nibong

Sungai Nibong, Penang

Taman Pinggiran Senawang

Seremban, Negeri Sembilan