- As we anticipate the formalisation of the JS-SEZ next year, how has the real estate market responded so far? Using EdgeProp research and the EPIQ platform, we track the residential market transactions in Johor to help you make your next property move.

KUALA LUMPUR (Dec 19): The Johor-Singapore Special Economic Zone (JS-SEZ) is set to be signed in January 2025. This bold initiative has sparked renewed optimism in Johor’s property market, fostering cross-border economic opportunities. Positioned as a strategic initiative to enhance regional collaboration and economic growth, the JS-SEZ is envisioned to boost investors’ confidence in the region’s future potential.

Market watchers have been keeping tabs following its initial discussions in early 2023, and the official announcement in July 2023. Since then, has the JS-SEZ factor managed to reshape market dynamics in the southern region?

Based on EdgeProp research and the EPIQ platform, we give you the data on the residential market in Johor to help you make the next investment move.

JS-SEZ: A visionary project to boost economic potential

According to the Malaysian Ministry of Finance’s 2025 Economic Outlook report, the official launch of the JS-SEZ was marked by a memorandum of understanding (MOU) signed in Jan 2024. This ambitious project aims to foster economic growth, streamline the cross-border movement of people and goods, and strengthen the overall business environment between Malaysia and Singapore.

Inspired by successful models like Shenzhen SEZ and Dubai International Financial Centre, the JS-SEZ is envisioned as a dynamic commerce hub, driven by a vibrant sector of businesses across the world.

It seeks to elevate the economic potential of both nations, offering special incentives and regulations to 16 key sectors, including electronics, manufacturing, aviation and healthcare. The zone is also poised to become a regional hub for data centres.

JS-SEZ: A strategic location spanning 3,505 sq km

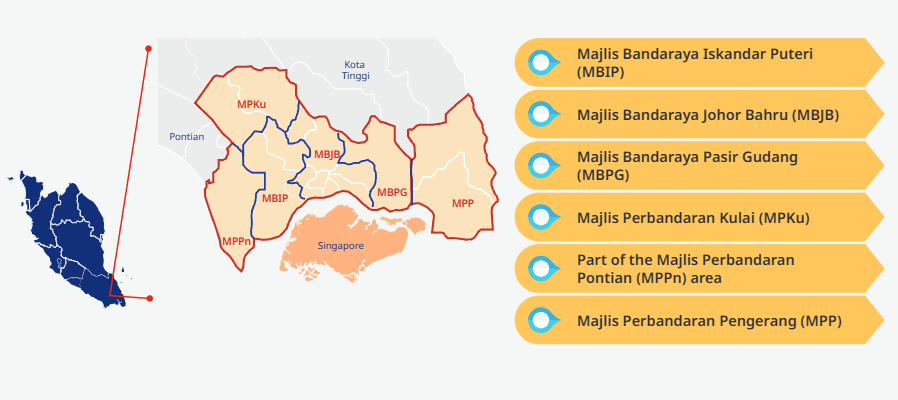

The JS-SEZ marks a significant step forward in the ongoing economic cooperation between Malaysia and Singapore. By leveraging the unique strengths and complementary nature of both economies, the initiative aims to deliver substantial benefits to both nations.

This proposed SEZ covers a designated area of over 3,505 sq km and involves six local authorities in Johor: Iskandar Puteri City Council, JB City Council, Pasir Gudang City Council, Kulai Municipal Council, parts of the Pontian Municipal Council area, and Pengerang Municipal Council. The zone spans four districts in Johor: JB, Kota Tinggi, Kulai and Pontian.

The 4km Rapid Transit System (RTS) Link, a light rail connection between Woodlands, Singapore, and Bukit Chagar, JB, is currently under construction. This rail link is projected to start operations in 2027.

According to the joint press release of the Ministry of Economy, Malaysia and the Ministry of Trade and Industry, Singapore, both governments have announced several initiatives to support the JS-SEZ, including:

- One-stop business/investment service centre: A dedicated centre in Johor to streamline the application process for Singaporean businesses setting up in Johor

- Digitised cargo clearance: Adoption of digital processes to expedite cargo clearance at land checkpoints

- QR code clearance system: Implementation of a passport-free QR code system to facilitate faster clearance of people at land checkpoints

- Investor forum: Co-organising a forum to gather feedback from Singaporean and Malaysian businesses on the JS-SEZ

- Renewable energy cooperation: Facilitating joint initiatives in renewable energy between Malaysia and Singapore within the JS-SEZ

- Talent development: Curating training and work-based learning programmes to address talent and skill gaps in relevant industries

- Joint promotional events: Organising joint events to promote trade and investment in the JS-SEZ

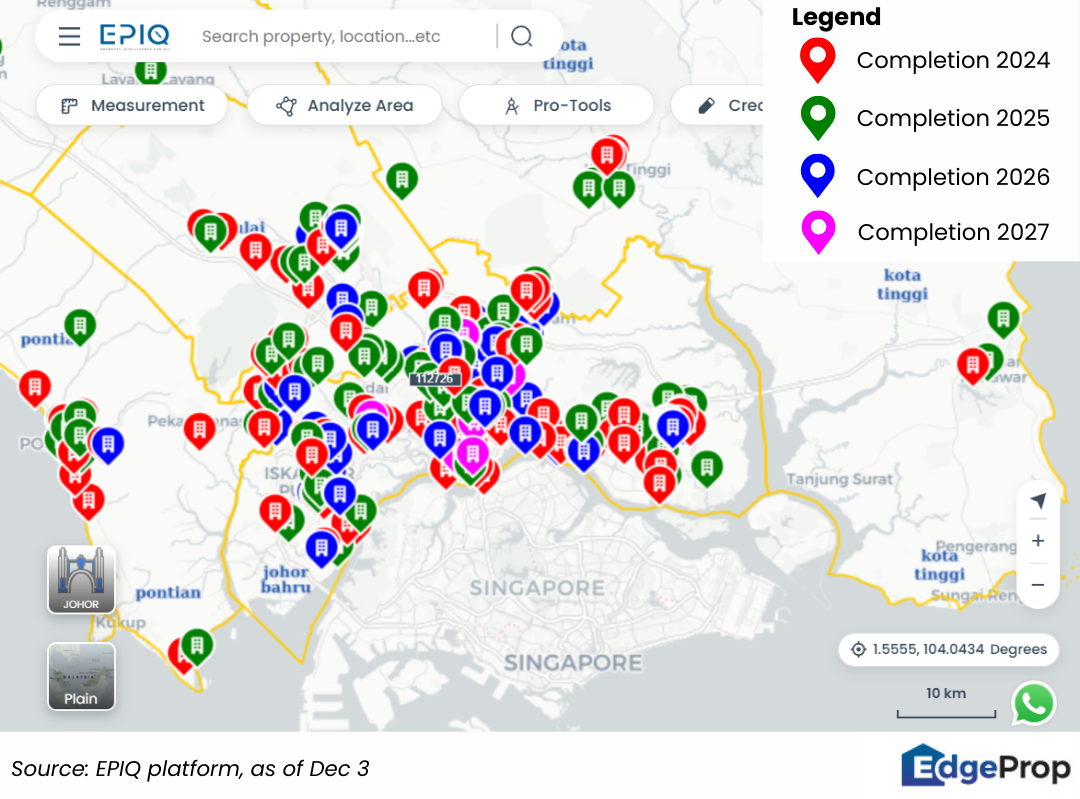

Landed homes dominate upcoming supply in JS-SEZ’s key districts

To understand the property market landscape of the four key districts in the JS-SEZ, we have conducted a comprehensive analysis using the EPIQ platform and EdgeProp Research. This research provides valuable insights into upcoming projects and market performance, informing the strategic planning for the JS-SEZ.

Our EPIQ platform data reveals a vast number of landed homes available in the upcoming residential market, especially in JB, compared to other districts. By examining the JS-SEZ in the four districts of JB, Kulai, Pontian and Kota Tinggi, we can see that in 2025, a significant portion of new launches will be landed homes (132 projects) compared to high-rises (16 projects).

This trend continues in 2026, with upcoming projects of 122 landed homes and seven high-rises. For 2027, while the data is less comprehensive, we anticipate a small supply of upcoming projects with 26 landed homes and six high-rises.

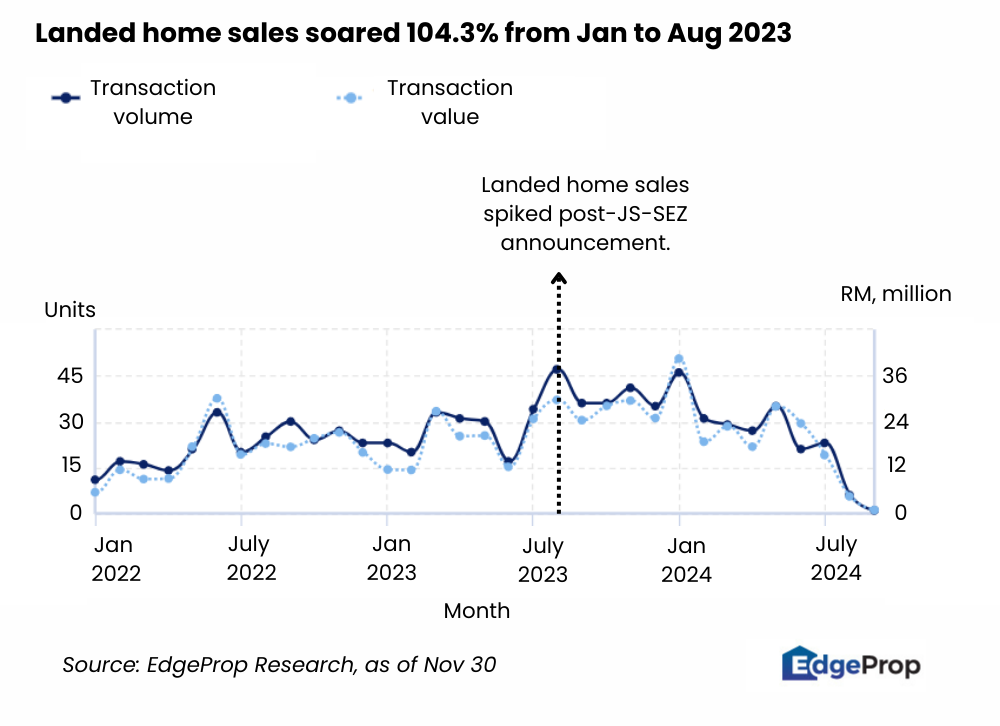

JS-SEZ announcement sparked market surge

JB has significantly outperformed other districts within the JS-SEZ, solidifying its position as the region's most active property market. From January to November 2024, JB recorded a staggering 8,967 transactions valued at RM4.83 billion. In comparison, Kota Tinggi saw 1,259 transactions (worth RM560.1 million), Kulai recorded 520 transactions (worth RM156.3 million), and Pontian saw 205 transactions (worth RM72.5 million).

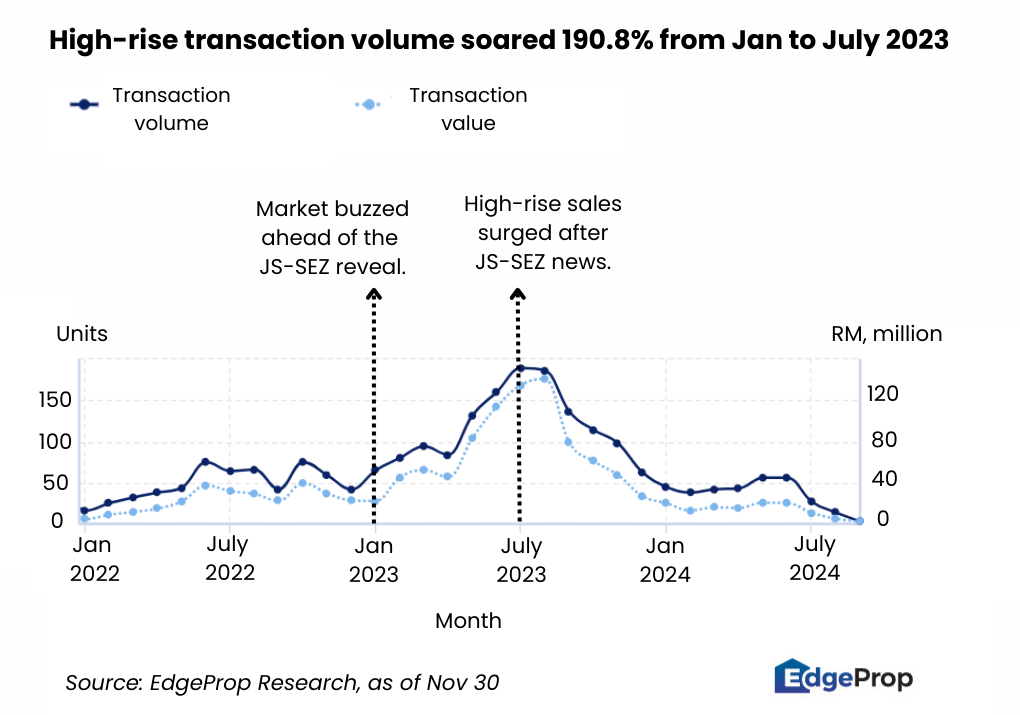

The connection between the progress of JS-SEZ and market performance is marked by a notable surge in property transactions starting in 2023. It indicated an early sign of anticipation as stakeholders awaited government disclosures.

The official announcement of the JS-SEZ during the Joint Ministerial Committee for Iskandar Malaysia meeting in July 2023 generated significant excitement for both sides of the border, further driving market performance.

By August 2023, transaction volume for landed homes had risen by 104.3% compared to Jan 2023, increasing from 23 units to 47 units. Transaction values also climbed significantly, reaching RM30 million (RM254 psf) in Aug 2023, up from RM11 million (RM195 psf) in Jan 2023, an impressive growth of 172.7%.

The performance of high-rise properties in JB was even more notable. Transaction volumes surged by 190.8%, growing from 65 units in Jan 2023 to 189 units in July 2023. Meanwhile, transaction values skyrocketed by 513.6%, jumping from RM22 million (RM637 psf) to RM135 million (RM692 psf).

However, this trend did not sustain following the initial excitement surrounding the announcements. Although the SEZ was highlighted again during the leaders’ retreat in Singapore in Oct 2023, and an MOU was signed between both countries in January 2024, the declining activities since the first fervour indicates that the market is adopting a wait-and-see approach, anticipating more concrete policies.

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

TOP PICKS BY EDGEPROP

Sunway Square Corporate Tower

Bandar Sunway, Selangor

Monet Springtime @ Sunsuria City

Dengkil, Selangor

Liu Li Garden, Setia Eco Glades

Cyberjaya, Selangor

Isle of Botanica, Setia Eco Glades

Cyberjaya, Selangor