HO CHI MINH CITY: The Vietnam high-end condominium segment made a comeback for first quarter of 2015 (1Q2015) as market sentiment returned, riding on the stable country’s economy, according to CB Richard Ellis’ “Vietnam Market Insights 1Q2015” report.

“The comeback of the high-end segment is attributed to better economic conditions, with higher gross domestic product growth, expanding foreign direct investment, stronger industrial production, more attractive home loan schemes, improved market sentiment, … higher rental yield, and interesting products being launched,” said managing director of CBRE (Vietnam) Co, Ltd, Mark Townsend in the press release.

The market report noted there were new condo launches of 4,880 units in Hanoi and 5,150 units in Ho Chi Minh City during the quarter under review. This is compared with 2,600 and 1,959 new units in Hanoi and Ho Chi Minh City respectively, year-on-year.

New launches were supported by stronger sales of 3,080 (Hanoi) and 6,484 units (Ho Chi Minh City) in 1Q2014 compared with 1,500 and 2,724 units during the same quarter last year for the respective cities.

For Hanoi, a larger chunk of the new launches is made up of mid-end apartments, while Ho Chi Minh City saw largely affordable and high-end apartments in the period under review.

CBRE expects a strong supply of condos for the year, with 13,000 and 22,000 units in Hanoi and Ho Chi Minh City, respectively.

The report also stated that infrastructure improvements such as the widening of roads have been highly appreciated by real estate developers.

Other infrastructure improvements include the Hai Phong highway in Hanoi, which is due for completion in 4Q2014, as well as Cai Bi International Airport, that will be completed in 2Q2016.

Meanwhile, Vietnam’s office market has seen a decline in vacancy rates for Grade A and B offices in both Hanoi and Ho Chi Minh City.

“The Hanoi and Ho Chi Minh City office market remained stable in the review quarter, both for the central business district and in decentralised districts. Demand from the market keeps increasing due to improvements in the global and Vietnamese economy. This was compounded by [the] limited supply, which helped to reduce the vacancy rate.”

The report stated that Grade A vacancy rate showed a slower level of improvement compared with Grade B.

In 1Q2015, the Grade A vacancy rate decreased by 0.3% versus 2.2% in Grade B. Compared with 1Q2014, the Grade A and B vacancy rates in 1Q2015 decreased by 1.9% and 3.8% respectively.

Grade A and Grade B rental rates saw small changes compared with 4Q2014, with a decrease of 3.4% in Grade A and a marginal increase of 0.4% for Grade B.

“In the Grade A segment, as new supply arrives in the next quarter, landlords softened their rents slightly in an effort to fill up buildings. In the Grade B segment, most buildings managed to maintain their rent. Rent increases were also witnessed in some new and good-quality buildings,” said Townsend.

CBRE Vietnam foresees sales for condos to remain strong with the resurgence of top-tier projects and developers. It, however, remained cautious as the condo market may be over-hyped.

The office market is expected to be positive as it will be supported by Vietnam’s economic recovery and expansion of international companies.

CBRE expects rent to be a deciding factor rather than then location of the offices.

TOP PICKS BY EDGEPROP

Taman Sri Nibong, Sungai Nibong

Sungai Nibong, Penang

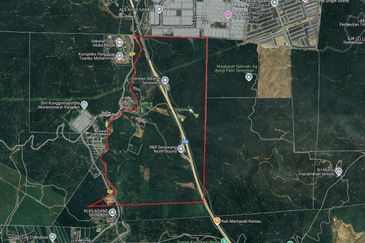

Taman Pinggiran Senawang

Seremban, Negeri Sembilan