Al-Salam Real Estate Investment Trust (REIT) (Oct 27, RM1.01)

Initiate buy with a target price (TP) of RM1.07: Al-Salam Real Estate Investment Trust (REIT), Malaysia’s fourth Islamic REIT, was listed on Sept 29 this year. Al-Salam REIT has a well-diversified asset portfolio worth RM903 million in investment properties. Its assets include the strategically located Komtar JBCC shopping mall and Menara Komtar, right opposite Johor Bahru’s Customs, Immigration and Quarantine Complex.

The portfolio also comprises strong recurring income-producing assets such as @Mart Kempas (similar to a hypermarket), KFCH International College and properties from QSR Brands (M) Holdings Sdn Bhd (KFC or Pizza Hut outlets and industrial premises). The trust’s sponsor, Johor Corp (JCorp), is the largest unitholder with 56.5% in Al-Salam REIT.

Al-Salam REIT has a good combination of young and stable assets such as QSR Properties and KFCH International College (under triple net and step-up long leases) anchoring the earnings base, while newly refurbished Komtar JBCC provides much room for rental to play catch-up.

Its average rental of RM5.63 per sq ft (psf) is less than half that of next-door neighbour, JB City Square shopping mall’s RM19 psf to RM20 psf. Al-Salam REIT also stands to benefit from the upcoming Johor Bahru-Singapore rapid transit system (RTS), a strong catalyst to Komtar JBCC’s and Menara Komtar’s capital values and provides a bargaining power for positive rental reversions.

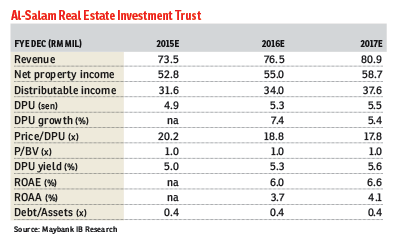

In the near future, Al-Salam REIT targets to secure the first rights of refusal to purchase five assets, including a retail mall, office towers, and food and beverages outlets from JCorp. We initiate coverage with a “buy” rating and a discounted cash flow-based TP of RM1.07 (weighted average cost of capital: 7.2%, terminal yield: 7%). The expected total return is 13.4%, inclusive of financial year ending Dec 31, 2016, net yield potential of 5.3%. — Maybank IB Research, Oct 27

This article first appeared in The Edge Financial Daily, on Oct 28, 2015. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Emerald Bay @ Puteri harbour

Johor Bahru, Johor

Happy Garden (Taman Gembira)

Kuchai Lama, Kuala Lumpur

Pearl Villa Townhouse

Bandar Saujana Putra, Selangor

Taman Sri Putra, Sungai Buloh

Sungai Buloh, Selangor

Medan Idaman Business Centre

Setapak, Kuala Lumpur

HiCom-Glenmarie Industrial Park

Shah Alam, Selangor