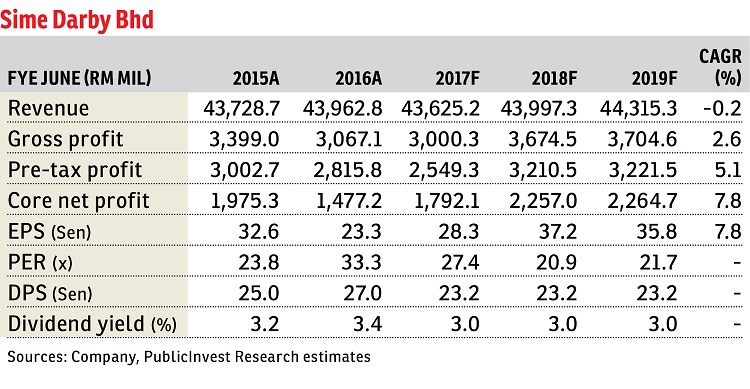

Sime Darby Bhd (Oct 11, RM7.83)

Maintain neutral call with a target price of RM7.15: Sime Darby Bhd has entered into an implementation agreement with Japan Residential Assets Manager, the manager of Saizen Real Estate Investment Trust (Saizen REIT), to acquire at least 25% of the enlarged Saizen REIT through a reverse takeover (RTO) after the expiry of a framework agreement last week.

There are some slight changes with regard to the shareholding and agreed prices compared to the previous agreement. The estimated market capitalisation of Saizen REIT was also revised up from RM900 million to RM1.1 billion. At this juncture, we maintain our “neutral” call and TP pending the completion of recent proposed private placement and more guidance from management on the outlook of its plantation and industrial arms.

Saizen REIT is a Singapore-based REIT established since 2007 with the objective of investing into Japanese residential real estate assets. The company has a market capitalisation of S$34.7 million (RM104 million) as of yesterday. It used to manage 136 properties with a total value of S$509 million over 14 Japanese cities.

Under the new agreement, Sime Darby’s indirect wholly-owned subsidiaries, Hasting Deering (Australia) Ltd and Austchrome Pty Ltd will dispose 20 industrial properties in Australia’s Queensland and the Northern Territory to Saizen REIT for a total consideration of A$355.8 million (RM1.12 billion). Subsequently, those properties will be master leased back to Sime Darby’s Australian subsidiaries for a total period of 16.7 years.

Sime Darby’s other indirect wholly-owned subsidiary, Sime Darby Property Singapore Ltd (SDPSL) will be issued new units at S$0.03604 per unit (RM0.11) in Saizen REIT and promissory note as part of Sime Darby’s TO of Saizen REIT, which in turn will own at least a 25% stake in the Singapore-listed REIT. In addition, Japan Residential Assets Manager will also sell an 80% interest in the Saizen REIT manager to SDPSL.

Following the completion of the disposal of Saizen REIT’s entire portfolio of real assets to Triangle TMK on March 4, 2016, Saizen REIT ceased to have any operating business and currently exists as a cash trust. Most of the proceeds from the disposal were paid out to unitholders via a special distribution. Its current cash level stands at about S$0.099 per unit.

It is believed that the properties to be injected are the assets drawn from Sime Darby’s industrial arm, which markets and distributes Caterpillar equipment across Australia. There are a total of 20 industrial properties across Australia with a total book value of more than RM1.1 billion. — PublicInvest Research, Oct 11

This article first appeared in The Edge Financial Daily, on Oct 12, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Taman Sri Putra, Sungai Buloh

Sungai Buloh, Selangor

Medan Idaman Business Centre

Setapak, Kuala Lumpur

HiCom-Glenmarie Industrial Park

Shah Alam, Selangor

Aurora Residence @ Lake Side City

Puchong, Selangor

Bandar Springhill

Port Dickson, Negeri Sembilan