Sunway Construction Group Bhd (Sept 27, RM1.62)

Upgrade to buy with a higher target price (TP) of RM1.85: Sunway Construction Group Bhd (SunCon) has accepted a letter of intent from MMC Gamuda KVMRT (PDP SSP) Sdn Bhd for the advanced construction works of a viaduct guideway and other associated works between Kampung Muhibbah and Serdang Raya, for a total contract sum of RM52.5 million, to be completed by September 2017.

The package involves the construction of 19 nos of pile caps, 122 nos of bored piles, realignment of Sungai Midah and temporary decking. The location of this stretch is in the vicinity of the Sungai Besi-Ulu Klang Expressway, KTM double track and Kuala Lumpur-Seremban Highway of approximately 0.68km in length.

Separately, SunCon has received letters of intent from Sunway Iskandar Sdn Bhd for the following projects:

i) Construction of 88 units of office shoplots, one block of management office and a mosque, one block of garbage storage, two Tenaga Nasional Bhd substations and relevant facilities on Lot PTD 200672 in Medini Zone F24, for a contract sum of RM56.5 million. The project is to be completed over a 20-month construction period adopting precast components. The project shall start on Oct 1, 2016 and to be completed by April 30, 2018.

ii) Earthworks and main building works for the design and build of the proposed commercial development for Plot F19 and F20 Sunway Iskandar on the land held under PTD 200695 and 200696, in Medini Zone F. The contract sum is RM100 million and the project is scheduled to commence on Oct 1, 2016, to be completed within 13 months, by Oct 30, 2017.

With these job wins, SunCon has secured RM2.6 billion worth of new construction jobs year to date, and exceeded management’s full-year target and our assumption of RM2.5 billion for 2016. The group’s outstanding construction order book currently stands at RM5 billion.

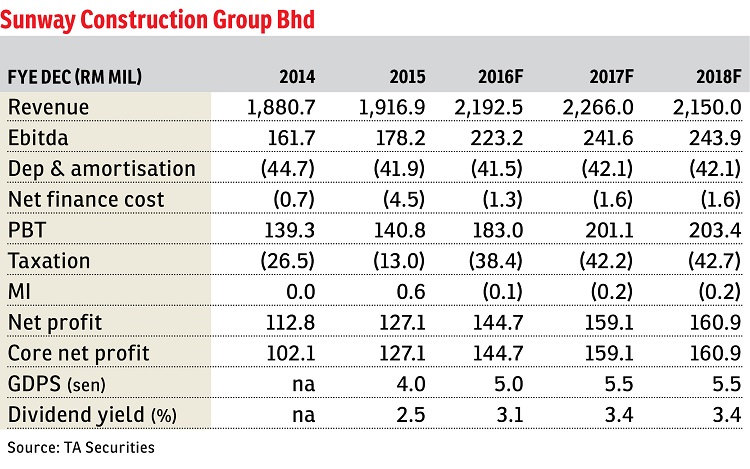

We revise our financial year 2016 (FY16) order book replenishment assumption higher to RM2.6 billion and raise FY17 and FY18 earnings forecasts by 2.4% and 1.6% respectively. Following the earnings revision, we raise SunCon’s TP from RM1.80 to RM1.85, based on an unchanged 15 times calendar year 2017 earnings per share. We upgrade SunCon to “buy”. — TA Securities, Sept 27

Try out one of our super tools, the rental yield calculator, here.

This article first appeared in The Edge Financial Daily, on Sept 28, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Menara HLX (formerly Menara HLA)

KL City Centre, Kuala Lumpur

Mutiara Upper East @ Desa Pandan

Desa Pandan, Kuala Lumpur

Seri Hening Residence

Ampang Hilir, Kuala Lumpur

St Regis The Residences

KL City, Kuala Lumpur

Parkside Residence @ Setia Federal Hill

KL City, Kuala Lumpur

Parkside Residence @ Setia Federal Hill

KL City, Kuala Lumpur

Solarvest Suites Bangsar South

Bangsar South, Kuala Lumpur

Solarvest Suites Bangsar South

Bangsar South, Kuala Lumpur

Section 5, Petaling Jaya

Petaling Jaya, Selangor

Section 22, Petaling Jaya

Petaling Jaya, Selangor

Seksyen 5, Petaling Jaya

Petaling Jaya, Selangor