Hua Yang Bhd (July 19, 46 sen)

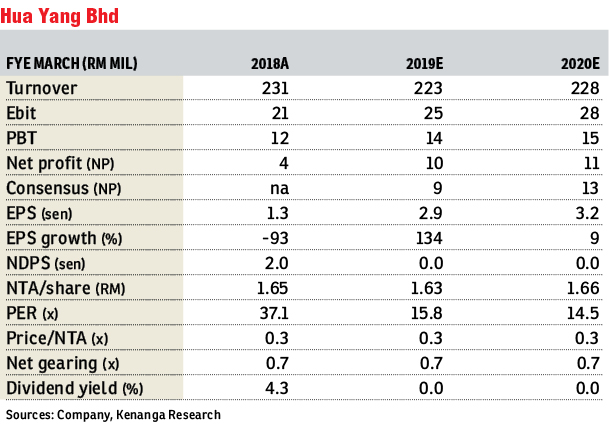

Maintain market perform with an unchanged target price of 46.5 sen: Although only making up 10% and 12% of our and consensus full-year estimates, we deem Hua Yang Bhd’s first quarter ended June 30, 2018 (1QFY19) results to be in line as we are banking on a stronger performance in subsequent quarters, backed by better sales, progressive billings and normalised effective tax rate by the second half of FY19 (2HFY19).

Property sales of RM63.3 million are on track to meet our target of RM249.7 million. No dividend declared as expected.

Hua Yang’s 1QFY19 revenue saw a major improvement of 39% year-on-year but core net profit (CNP) was down by 41%. We believe the revenue growth was backed by better sales from inventories and also ongoing projects, while the sharp drop in CNP was due to a 122% increase in taxes as some of its expenses are non-deductible and higher net interest cost, which rose 420%.

Positively, earnings before interest and tax margins improved by 3.5 percentage points to 9.6% driven by the improvement in revenue. Quarter-on-quarter (q-o-q), both revenue and CNP fell by 23% and 67%, respectively. The drop in revenue was mainly due to the lack of handover of projects for the quarter, which solely relied on property sales and progressive billings.

Notably, we are positive with its inventories from completed projects coming down by 27%, but cash flows remain tight with its net gearing creeping up to 0.8 times from 0.72 times, arising from the completion of the Kajang land acquisition.

Despite the challenging operating landscape in the property sector, we believe that Hua Yang is on the right path to recovery given its focus on clearing inventories. Its unbilled sales in 1QFY19 improved by 12% q-o-q, from RM178.9 million to RM201.4 million with one-year visibility.

Post results, we make no changes to our FY19 estimate (FY19E) and FY20E earnings for now as we are banking on stronger performance in subsequent quarters.

To recap, previously we lowered our revalued net asset value (RNAV) from RM2.84 to RM2.81 as we had lowered our project margin assumptions in our RNAV to better reflect the current margin trend, while maintaining our RNAV discount of 83%.

We believe its profitability would improve, backed by its recent sales performance, which we deem to be encouraging under current market circumstances. — Kenanga Research, July 19

This article first appeared in The Edge Financial Daily, on July 20, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Palm Hill Residence 2 (Residensi Bukit Palma 2)

Cheras, Selangor

Taman Perindustrian Air Hitam Phase 1

Klang, Selangor