- Explaining the diversification move, Classita said it expects to improve its financial performance and condition by tapping onto the growing demand within the property industry.

KUALA LUMPUR (Nov 22): Loss-making Classita Holdings Bhd (KL:CLASSITA) is mulling diversifying into the property investment business as it foresees growing demand.

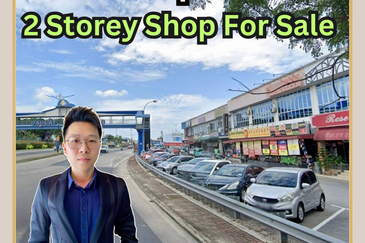

The diversification proposal follows the Perak-based lingerie maker’s move to acquire 18 retail shop lots in Kajang for RM17 million from property developer Paris Dynasty Land Sdn Bhd initiated back in May this year, according to its bourse filing on Friday.

Explaining the diversification move, Classita said it expects to improve its financial performance and condition by tapping onto the growing demand within the property industry.

“In view that Classita intends to venture into the property investment business, the board expects it may contribute more than 25% of the group’s net profits or cause a diversion of more than 25% of net assets moving forward,” it said.

The group currently operates an undergarment manufacturing business which has seen its revenue decline, and a loss-making property development and construction business. It intends to maintain its existing businesses post-diversification.

Classita's diversification proposal only listed the Kajang retail shoplots as the proposed business’ investment properties. The shoplots are currently being developed by Paris Dynasty Land and are expected to be completed by the first quarter of 2025, according to the group.

Paris Dynasty Land is wholly owned by Goh Eugene via Hera Trading Sdn Bhd. No further details pertaining to Goh were disclosed.

According to its filing announcing the proposed acquisition of the property, Classita deemed the RM17 million selling price — RM526 per sq ft — offered by Paris Dynasty Land as a “favourable entry price” based on its valuation assessment conducted internally which ascribed an indicative price of RM450 per sq ft to RM850 sq ft to similar properties.

Internally generated funds are to cover RM4 million of the purchase price, while the bulk RM13 million is to come from proceeds raised from the group’s RM88.05 million rights issue completed back in July 2023.

Shares in Classita ended unchanged at 6.5 sen on Friday, valuing the company at RM74.41 million.

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

TOP PICKS BY EDGEPROP

Royal Strand @ Country Garden Danga Bay

Johor Bahru, Johor

SL 10, Bandar Sungai Long

Bandar Sungai Long, Selangor

Petaling Jaya Commercial City

Petaling Jaya, Selangor