- The consortium also proposed a 100% industrial plan rather than having 10% of the site earmarked for mixed use purpose as mandated, citing the site's potential and "evolving demand of investors".

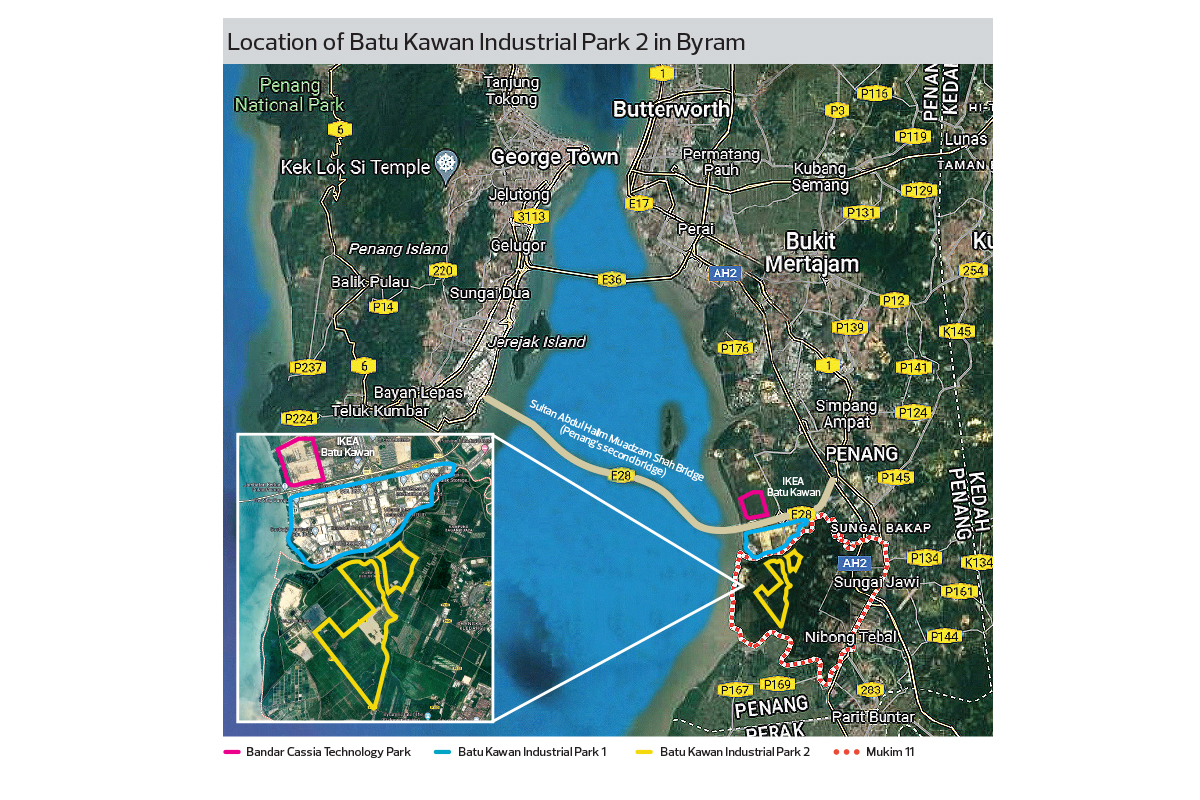

KUALA LUMPUR (Dec 3): The tripartite consortium involving IJM Properties Sdn Bhd said it will continue to explore pathways forward with the Penang government to develop Batu Kawan Industrial Park 2 (BKIP2) after its initial proposal was rejected.

In a statement, the consortium, whose other shareholders are Aspen Vision All Sdn Bhd and Mettiz Capital Sdn Bhd, came out to explain the variation of its proposal compared to certain requirements underlined by the state in its request for proposal (RFP) were "best explained and clarified in a face-to-face meeting".

However, the consortium said such an opportunity was not granted.

IJM Properties is a unit of IJM Corp Bhd (KL:IJM), while Aspen Vision All is a unit of Aspen (Group) Holdings Ltd.

The consortium reportedly saw its proposal rejected last month by Penang state agency Penang Development Corp (PDC), which is also the project's master developer.

For one, the consortium said it proposed to have quarry operations on site "to support efficient landfilling needs for the project, and reduce overall costs "while providing additional commercial returns" for PDC.

It also requested first right of refusal for adjacent parcels should PDC decide to develop them for industrial purposes.

"This approach ensures continuity in industrial development planning and execution while aligning with past and present practices. Granting this right would not disadvantage PDC in any way," it opined.

Additionally, the consortium, which provided a RM818 million offer for PDC's 99-year leasehold requirement — the reserve price for the land was reportedly RM780 million — said it never mandated freehold status, although it did propose converting the 99-year leasehold site to freehold and is willing to pay a premium for the conversion.

On a proposal to be given "flexibility" in the consortium's equity restructuring among the consortium's three shareholders, the consortium denied this equates to "flipping" the project to external parties.

Rather, this was proposed to "optimise organisational efficiency while ensuring accountability", it claimed.

Any external changes or inclusion of new partners would still require PDC's approval, it said.

The consortium also proposed a 100% industrial plan rather than having 10% of the site earmarked for mixed use purpose as mandated, citing the site's potential and "evolving demand of investors".

Despite the difference, it said a fully industrial plan featuring a 400-acre solar farm "would better align with Penang's ESG priorities", and "complements existing mixed-use elements in BKIP1”, it said.

Meanwhile, the consortium said it is committed to have the model where landowner PDC retains initial ownership before subsequent transfer, although it did suggest direct alienation of the land "where such practices have facilitated streamlined execution".

"We regret that the decision to reject our proposal was made without engagement or an opportunity for clarification," the consortium said.

"A summary rejection, without allowing the consortium to present and explain its solutions, is not consistent with the objectives of an RFP process," it said

"Open dialogue would have allowed us to address concerns, align expectations and demonstrate the proposal’s alignment with the state's strategic priorities," it added.

"Despite this outcome, we remain committed to constructive engagement with PDC and other stakeholders to resolve outstanding concerns and explore pathways forward," the consortium said.

It was reported that the IJM-led consortium was the only one who submitted a bid out of seven shortlisted parties.

A second RFP would be called, Penang Chief Minister and PDC chairman Chow Kon Yeow reportedly said, citing how the earlier bids did not meet five of nine requirements.

PDC last year signed a joint development agreement with Umech Land Sdn Bhd to develop the RM3.5 billion industrial project. Umech Land was supposed to pay RM646.02 million to PDC as the proprietor of the land.

However, it was highlighted that Sunway Bhd (KL:SUNWAY) emerged as 70% shareholder of Umech Land two days before the JDA signing on Sept 27, 2023.

The last-minute shareholding change and criticism over the price tag, which some deem as undervalued, prompted public scrutiny and the deal was eventually called off before an RFP was issued.

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!