- "We estimate that the investment by Google for Phase 2 could be worth RM4 billion to RM5 billion, as the capacity could be around 200MW to 250MW, based on the land size and the value of total rental."

KUALA LUMPUR (Dec 3): Sime Darby Property Bhd's (KL:SIMEPROP) earnings profile could significantly change in 2026-2027, when its data-centre (DC) projects’ rental earnings kick in, analysts said.

In a note, RHB Research said it expects SimeProp's two data-centre projects, both for Pearl Computing Malaysia, to bring RM380 million in rental income per year, translating to RM170 million to RM180 million in annual net profit.

This is slightly more than 30% of our earnings forecast for FY2024, suggesting that SimeProp’ s earnings from FY2027 onwards may undergo a quantum leap when both DCs contribute at the same time," it said.

"We estimate that the investment by Google for Phase 2 could be worth RM4 billion to RM5 billion, as the capacity could be around 200MW to 250MW, based on the land size and the value of total rental," it added. The research house has "buy" call of RM2.33 on the stock, from RM2.20 previously.

PublicInvest Research, in its note, described the RM5.6 billion data-centre deal announced on Monday (Dec 2) as "a positive surprise", although it said positives are largely baked into its share price.

"Based on the first deal, which we understand costs about RM815 million for construction, completion, testing, and commissioning of a hyperscale data centre, we estimate the second data centre could cost SimeProp about RM3 billion to build," it said, as it maintained "neutral" on the stock with a target price (TP) of RM1.45.

SimeProp said on Monday that it has signed an agreement for a 20-year lease of data-centre facilities to Pearl Computing Malaysia, for up to RM5.6 billion, beginning as early as 2027.

The deal is on top of an estimated RM2 billion data-centre deal in May, also signed with Pearl Computing, a wholly owned unit of Singapore based Raiden APAC Pte Ltd, which is owned by Google.

The build-and-lease agreement comes with options to renew for two additional five-year terms, it said. Similarly, the RM2 billion deal in May is also for a 20-year lease, with options to renew for additional five-year terms.

Analysts largely agree that SimeProp's balance sheet, with net gearing of about 0.2 times, would be able to digest the project costs.

Meanwhile, CGS International expects that the second project could bring in additional revalued net assets value per share of 11 sen, based on broad assumptions of annual leasing revenue of RM280 million, capital expenditure of RM2.5 billion, and an earnings before interest, taxes, depreciation, and amortisation (Ebitda) margin of 80%.

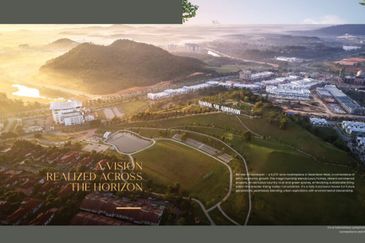

"With this latest development, we think Elmina Business Park is shaping up to be another hotspot for DC operations, allowing SimeProp to capitalise on the rising DC demand," it said, maintaining its "buy" call, with a TP of RM1.94.

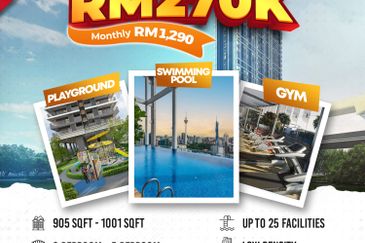

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

TOP PICKS BY EDGEPROP

Skyz Residence @ Bandar Puchong Jaya

Puchong, Selangor

Taman Wawasan, Pusat Bandar Puchong

Puchong, Selangor

Taman Perindustrian Bukit Rahman Putra

Sungai Buloh, Selangor

Setia Marina 2, Setia Eco Glades

Cyberjaya, Selangor