KUALA LUMPUR (June 16): Mah Sing Group Bhd plans to increase its Klang Valley land bank from the current 65% to 75% in the next two to three years as it continues with its strategy of developing affordable housing projects.

“We believe that demand for property will continue to be strong in the Klang Valley as the value and volume of property transactions in the area are by far the highest in the country in terms of economic dominance,” said managing director Tan Sri Leong Hoy Kum.

So far this year, Mah Sing has acquired two pieces of land in the Klang Valley — an 8.5-acre (3.43ha) plot in Sentul and a 3.56-acre plot which fronts the Titiwangsa Lake Garden, he told reporters after the group’s annual general meeting (AGM) yesterday.

The two plots have a combined potential gross development value (GDV) of about RM1.95 billion, while Mah Sing’s remaining prime land bank currently stands at 2,255 acres, with total remaining GDV and unbilled sales of RM31.5 billion.

Leong said Mah Sing has a minimum sales target of RM1.8 billion for this year, and as of March 31, it had achieved sales of about RM410 million.

The group is targeting 73% of its sales for this year to be from residential properties priced below RM700,000. Sales for such properties for 2016 and 2015 accounted for 50% and 44% respectively.

Leong said the group will be launching six projects with a total estimated GDV of RM1.9 billion this year.

Two projects in Rawang and Sungai Buloh, with units priced between RM500,000 and RM700,000, will be launched in the third quarter.

One project in Penang and three in Johor will be launched in September and July, all featuring units priced below RM500,000.

“Our focus will be on mixed developments in Klang Valley. More on residential [developments] as the demand for residential [developments] will be greater,” said Leong.

“The market is still undergoing consolidation. With Morgan Stanley forecasting [Malaysia’s] gross domestic product growth to be 5% [for 2017 and 2018], I think it’s a good sign and the ‘worst is over’ for the property market,” said Leong, commenting on the market outlook.

At the AGM, Mah Sing updated shareholders on its strong financial track record where the group saw 14% return on equity and 49% asset turnover over a five-year average, compared with peer average of 9% and 24% respectively.

“Furthermore, the group had a strong balance sheet with a low net gearing of 0.02 times as at March 31,” it said in a statement. “2017 also marks the 11th consecutive year for the group to pay a minimum 40% of net profit as dividend.”

Shares in Mah Sing closed unchanged at RM1.58 yesterday, giving it a market capitalisation RM3.8 billion.

This article first appeared in The Edge Financial Daily, on June 16, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Taman Sri Putra, Sungai Buloh

Sungai Buloh, Selangor

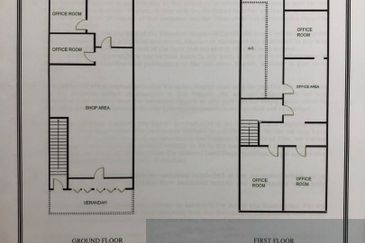

Medan Idaman Business Centre

Setapak, Kuala Lumpur

HiCom-Glenmarie Industrial Park

Shah Alam, Selangor

Glory Beach Resort Apartment

Port Dickson, Negeri Sembilan