PETALING JAYA (Feb 24): About 33% of London’s West End homes were sold for above £2,250 psf in the final quarter last year (4Q2015), compared with 10% of the market a year ago, said international property services firm CB Richard Ellis (CBRE) senior director Jamie Gunning in the firm’s report on the area’s residential market.

Meanwhile, average prices in the midtown market rose to a record £2,026 – 12% higher than in 3Q2015 and 13% higher than in 4Q2014, said the firm.

CBRE found that home sales in the West End for 4Q2015 totalled £59.34 million, 15% higher than the total value sold a year ago.

This brings the total value of residential sales for 2015 to £248.43 million, 24% higher than 2014’s figure.

Transaction volume also rose 29% from 2014, with 67% of them being new launches.

New builds achieved a premium of 92% on average capital value and 19% on psf over properties on the subsale market, highlighting the high quality requirements of buyers, said CBRE.

This year CBRE expects to draw more investors as a number of schemes will be completed in 1Q, positively affecting sales.

“There is something about being able to actually see and feel the finishes within these unique buildings that clinches the deal,” said the report.

CBRE noted that the opening of Tottenham Court Road station along the Crossrail at the end of 2015 will improve the accessibility of the area, thus pushing values up at a higher rate than other prime central London areas as investors recognise the opportunity for sustainable growth.

“With the opening of Tottenham Court Road Station due at the end of 2015, activity within the West End is expected to soar as buyers seek properties in close proximity to this key transport hub,” Gunning added.

Meanwhile, average rental values were 22% higher in 4Q2015 than the same period in 2014 as the student segment of the market remained buoyant from September, with 59% of tenancies being let to students.

“As predicted, 4Q was our second busiest quarter of the year – only beaten by 3Q – and was a result of the overflow from the sheer demand of students seeking accommodation before the start of the academic year,” CBRE noted.

Vacancies across 2015 were 20% lower than 2014, with vacancies lasting an average 16 days, showing that tenants were more likely to stay in the same property.

“Refurbished properties are particularly successful in retaining tenants as they tend to present fewer maintenance problems, resulting in higher rents, lower void periods and longer tenancies.

“In line with this, refurbished units experienced the highest uplift in rents in 4Q, attracting on average 16% higher rental values than non-refurbished units,” it said.

TOP PICKS BY EDGEPROP

Taman Taming Indah 2

Bandar Sungai Long, Selangor

Balakong Jaya Industrial Park

Balakong, Selangor

Kawasan Industri Rawang Perdana

Rawang, Selangor

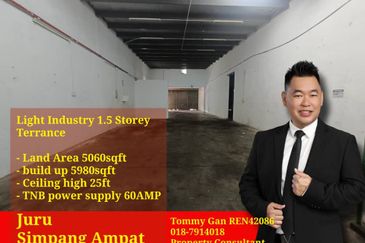

Taman Perindustrian Ringan Juru @ IKS Juru

Simpang Ampat, Penang