THE capital of Sabah, Kota Kinabalu, still boasts the remnants of fresh markets and fishing jetties, although a number of shopping malls and high-rise developments laid claim to the city centre and its surroundings.

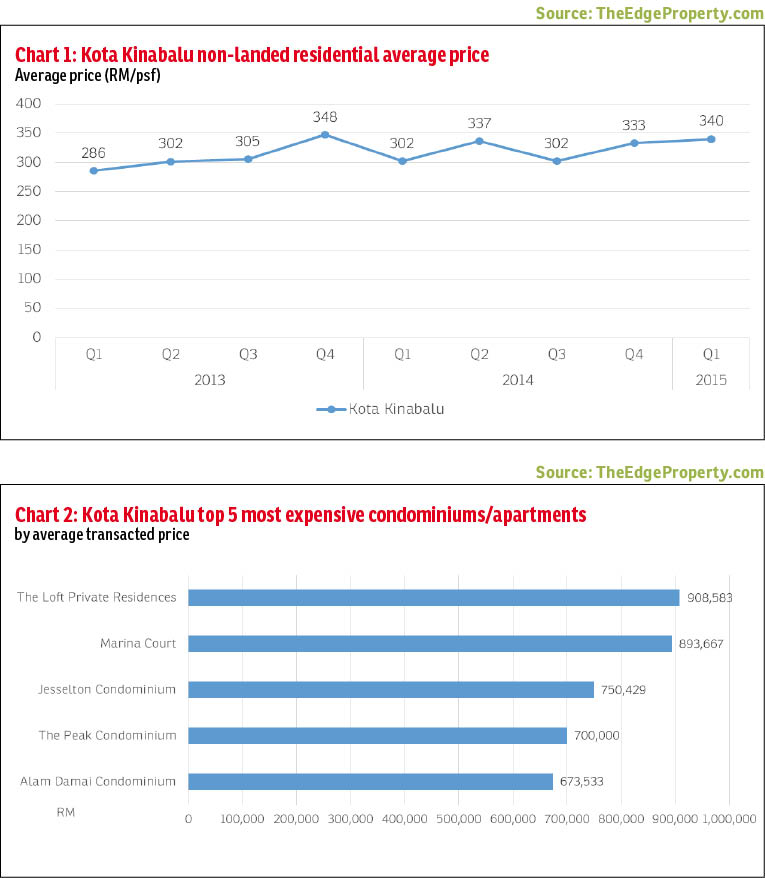

TheEdgeProperty.com’s analysis of non-landed residences on the Kota Kinabalu secondary market covers areas from the Kota Kinabalu International Airport to the south, Sepanggar ports to the north, as well as popular areas such as Lido, Likas, Luyang and Jalan Lintas. It shows that the average transacted price of non-landed properties here has been fairly steady since mid-2013.

The average transacted price reached RM340 psf in 1Q2015, rising 12.7% y-o-y from RM302 psf in 1Q2014, following a 5.7% y-o-y growth the previous year.

Meanwhile, transaction volume for the 12 months to 1Q2015 fell 13.8% to 579 units from 672 units.

Knight Frank Malaysia (Sabah branch) research executive Welton Chin (pictured, right) says non-landed residential properties, especially high-end condominiums, have performed consistently over the past year, with a steady rate of supply.

Knight Frank Malaysia (Sabah branch) research executive Welton Chin (pictured, right) says non-landed residential properties, especially high-end condominiums, have performed consistently over the past year, with a steady rate of supply.

Based on Knight Frank’s research, a total 1,318 units of high-end condominiums will be completed in the next three years. The majority of developments under construction comprises high-end condos priced above RM700 psf. They have recorded an average take-up rate of 86%.

Some recently or soon-to-be completed projects are Harrington Suites, The Loft Private Residences at Imago Mall, The Residences at Sutera Avenue, Jesselton Residences, Jesselton View, Oceanus Mall, Pelagos Designer Suites, and the Riverson mixed-use development (which includes Gleneagles private hospital).

Many ongoing landmark projects are integrated developments that are expected to boost the city’s liveability. These are the RM1.8 billion Jesselton Quay waterfront development by SBC Corporation Bhd, the RM1.4 billion KK Convention City by Mah Sing Group Bhd, and S P Setia Bhd’s RM1.8 billion worth of projects planned at Aeropod, Tanjung Aru.

Due to scarcity of land in the city, developments in Kota Kinabalu city centre comprise mainly high-rises while landed properties are located on the city fringes. New developments are increasingly upmarket while secondary market properties still cater for the mass market segment.

Based on TheEdgeProperty.com’s analysis of non-landed residential transactions in the 12 months to 1Q2015, the average transacted price per unit was RM428,000. Properties in the RM100,001 to RM200,000 price range accounted for 25.5% of total volume, while 27.1% fell in the RM200,001 to RM300,000 price range. Properties below RM500,000 made up 83.4% of total transactions.

Metro Homes Sdn Bhd senior group manager Richard Tokuzip (pictured, left) notes that homebuyers mainly go for mid-range condominiums with an absolute price per unit of RM350,000 to RM500,000. Most purchasers are first-time homebuyers.

Metro Homes Sdn Bhd senior group manager Richard Tokuzip (pictured, left) notes that homebuyers mainly go for mid-range condominiums with an absolute price per unit of RM350,000 to RM500,000. Most purchasers are first-time homebuyers.

“Units at Ashton Tower Condominium in Kolombong were snapped up within a few months after it was launched in 4Q2014 as the location was reasonably close to the mature township of Kolombong and Inanam. The average price tag of RM462 psf was reasonable for units starting at 870 sq ft,” he says.

TheEdgeProperty.com’s analysis of transactions in the 12 months to 1Q2015 found that the priciest non-landed home by average price per unit was at The Loft Private Residences in KK Times Square, a development by Asian Pac Holdings Bhd. Being part of the KK Times Square development, the serviced apartment is one of the first high-end mixed-use developments in the city. While it has an average price per unit of RM909,000, prices vary according to unit type. Transactions ranged from RM400,000 for a 603 sq ft unit to RM1.23 million for a 1,755 sq ft unit during the period reviewed.

Marina Court Resort Condominium recorded the second-highest average price per unit of RM894,000 in the same period. Located on Tun Fuad Stephens Road, the condominium is opposite the new Oceanus Mall. Its average price was raised by the sale of three penthouse units at RM1 million, RM1.25 million and RM1.4 million, respectively. A typical 3-bedroom unit of 1,200 sq ft in size went for between RM700,000 to RM778,000.

Nonetheless, the most expensive unit sold during the review period was a penthouse in Puteri Damai Condominium. Although the development is a decade old, the 2,314 sq ft unit was sold for RM1.65 million in January last year.

Based on average per square foot values, the most expensive condominium was The Loft Private Residences at Imago Mall at RM722 psf followed by The Peak Soho, which has an average price of RM609 psf. Developed by SBC Corporation Bhd, The Peak SoHo is part of The Peak Vista Collection, which also includes The Peak Condominium, The Peak Suites and The Peak Vista. These luxury projects are located on the exclusive Signal Hill in Likas and boast panoramic views of the South China Sea.

The least expensive projects were low-cost flats away from the city centre, led by Banbangan Apartment (RM177 psf), Seraya Apartment and Agathis Apartment (RM184 psf).

Gaining momentum

Chin believes Kota Kinabalu will gain development and growth momentum.

“We expect developments that were put on hold in 2015 due to the overall market slowdown to hit the market in 2016. However, we maintain that lending conditions need to improve in order for developers to achieve strong take-up rates,” he says.

Chin adds that values are expected to remain stable across all sectors on the secondary market supported by a rise in primary market launch prices. Prices of new condo launches have reached as high as RM1,200 psf.

He cautions that it is not possible for developers to lower their margins as land costs continue to increase, coupled with the Goods and Services Tax, minimum wage hikes, a weak ringgit and inflationary pressures.

In the longer term, however, he notes with concern the rising number of mid to high-end condominiums being constructed and nearing completion that will fill up the market all at once.

Tokuzip too believes Kota Kinabalu’s property market is picking up, as observed from the good response to recent launches such as Kingfisher Putatan.

As Kota Kinabalu city centre remains Sabah’s commercial hub, demand for housing within and around the city is most sought after.

“We foresee strong demand for some of the planned large mixed-use developments in the central business district and at the old Kota Kinabalu port area by major developers such as Mah Sing, S P Setia Bhd and Gabungan AQRS Bhd. They have plans to incorporate high-end residential developments as a key component of their integrated developments,” Chin says.

He also notes that the supply of high-end condominiums is mainly focused on areas outside the city centre but with easy access to it.

Hotspots in the capital include Likas Bay, Damai, Luyang, Likas, and the fringes of the CBD. The highest number of units is in the Likas area, followed by Luyang and Damai, says Chin.

Both Chin and Tokuzip concur that these areas are strongly favoured by homebuyers due to their strategic location, accessibility, and abundant facilities and amenities such as schools, medical centres, commercial areas, and banks. Most importantly, Tokuzip adds, these areas offer high capital growth and demand.

Chin believes there is growing acceptance of high-end condominiums in selected locations in Kota Kinabalu due to changing lifestyle trends, as evident from the success of condos such as The Peak Collection and Bay 21. These projects have the advantage of being located on Likas Bay, providing tenants unobstructed views. Other new condo projects that were well-received were Harrington Suites, Bay

Residences, Maya Likas, and Jesselton Residences.

“There is pent-up demand for newer and better quality condominiums from discerning purchasers,” says Chin.

Elsewhere, affordable and mid-range properties predominate, such as in satellite areas with a growing population. These

include Inanam, Kolombong, Penampang and Putatan, which are becoming more sought after, Chin says.

Notable developments in such areas are Kingfisher Inanam, Kingfisher Putatan (both by Hap Seng Properties), Bukit Bantayan Residences (Gamuda Land), and Ashton Tower (SCP Group). Nonetheless, Chin notes that amenities and infrastructure in these areas will take some time to mature.

He expects the luxury residential sector to maintain its strong performance in the near future because Kota Kinabalu has a sizeable expatriate population due to the presence of multinational companies in the oil and gas sector. The city also has a reputation as a retirement and holiday destination.

Rental yields

Analysis by TheEdgeProperty.com shows that the project with the highest relative price growth was University Condo Apartment 1 on Jalan Sulaman Highway. Developed by the W Group, the apartment enjoyed average price growth of 25.4% y-o-y to RM334 psf in 1Q2015. The project is targeted at the population of nearby educational institutions such as Universiti Malaysia Sabah (UMS), Mara University Technology Malaysia and Kota Kinabalu Polytechnic. The developer has similar projects in its portfolio such as University Apartments, University Prime Condominium, and the upcoming University Utama Condominium.

The highest absolute growth can be seen at Alam Damai Condominium, where average prices have risen by RM75 psf or 19% y-o-y to RM561 psf. The recently completed condominium is located at the edge of Keramat Hill in Damai and was developed by Wah Mie Group.

Asking rents observed in June 2015 were below RM2 psf for mass market projects and over RM3 psf for luxury properties. Rental yields are decent, at between 4.1% and 7.1% while the state-wide average annual rental yield was 5.6%.

The highest indicative annual rental was seen at YYK 1Borneo Condominium, where rental demand is buoyed by its strategic location at the edge of the UMS campus. It also sits atop the 1Borneo Hypermall.

According to Chin, the impending completion of new projects is expected to heighten competition in the rental market.

“Although there might be some price resistance from the domestic market, we firmly believe that good projects will be well received by foreign investors given their strategic location, excellent views and accessibility to major landmarks.”

Chin is hopeful that cooling measures, stringent lending conditions and the weak ringgit can be dealt with by the government, adding that prime residential projects in particular, will be the focus of marketing campaigns targeting foreign investors and expatriates.

Tokuzip too believes that the property market in Kota Kinabalu can be improved with better loan approval rates and more high quality developments to cater for the higher end sector.

“There would also be increasing demand for Grade A offices upon the completion of the new oil and gas platform and Sabah Ammonia Urea (Samur) at Sipitang Oil and Gas Industrial Park (Sogip). Currently, expatriates working in Labuan live in Kuala Lumpur, although Kota Kinabalu could be a better alternative due to its proximity to Labuan,” he notes.

Meanwhile, Chin highlights that the serviced apartment sector in Kota Kinabalu remains largely unexplored but is rising in popularity because investors are now able to invest in units, possibly with a leaseback guarantee, as an alternative to hotels.

“Existing established serviced apartments are mostly aged establishments, which are less regulated and can be readdressed internally and externally. Two serviced apartments with the most supply — The Mercure and Sutera Avenue Residences have shown positive movements. The opportunity for a brand new serviced apartment equipped with modern facilities, proper management, and completed with architecturally designed features, will bring a fresh outlook to a long dormant market sector,” he explains.

Overall, Tokuzip says “the property market in Kota Kinabalu for the medium to long term is still healthy with steady growth particularly in hotspots as well as upcoming areas along the new Pan Borneo Highway.”

He cites for example areas along Tuaran Bypass and Jalan Sulaman, which saw steady growth in both the volume and value of transactions upon the completion of some infrastructure works in recent years. He believes that areas from Penampang to Kinarut will similarly benefit from the upcoming 2,239km Pan Borneo Highway which is expected to begin construction this year.

Related stories:

PROPERTY SNAPSHOT 1: Kota Kinabalu property prices remain stable

PROPERTY SNAPSHOT 2: What's affordable in Kota Kinabalu?

PROPERTY SNAPSHOT 3: What are prices like in Kota Kinabalu?

PROPERTY SNAPSHOT 4: What's hot in Kota Kinabalu?

Plenty of trending activity at The Peak Vista here

This story first appeared in The Edge Property pullout on Feb 12, 2016, which comes with The Edge Financial Daily every Friday. Download The Edge Property here for free.

TOP PICKS BY EDGEPROP

Victory Suites (The Face 2), KLCC

KL City, Kuala Lumpur

Suadamai, Bandar Tun Hussein Onn

Cheras, Selangor

Jalan Suasana, Bandar Tun Hussein Onn

Batu 9th Cheras, Selangor

Rumbia Residence @ ARI PERMAISURI

Cheras, Kuala Lumpur

Kawasan Perindustrian Nilai 3

Nilai, Negeri Sembilan

Bandar Kinrara 5

Bandar Kinrara Puchong, Selangor