- Batu district, well known for affluent neighbourhoods such as Mont’Kiara and Desa Park City, emerged as a top performer, particularly within the serviced apartment segment.

- “In Johor, we are witnessing a remarkable market performance.”

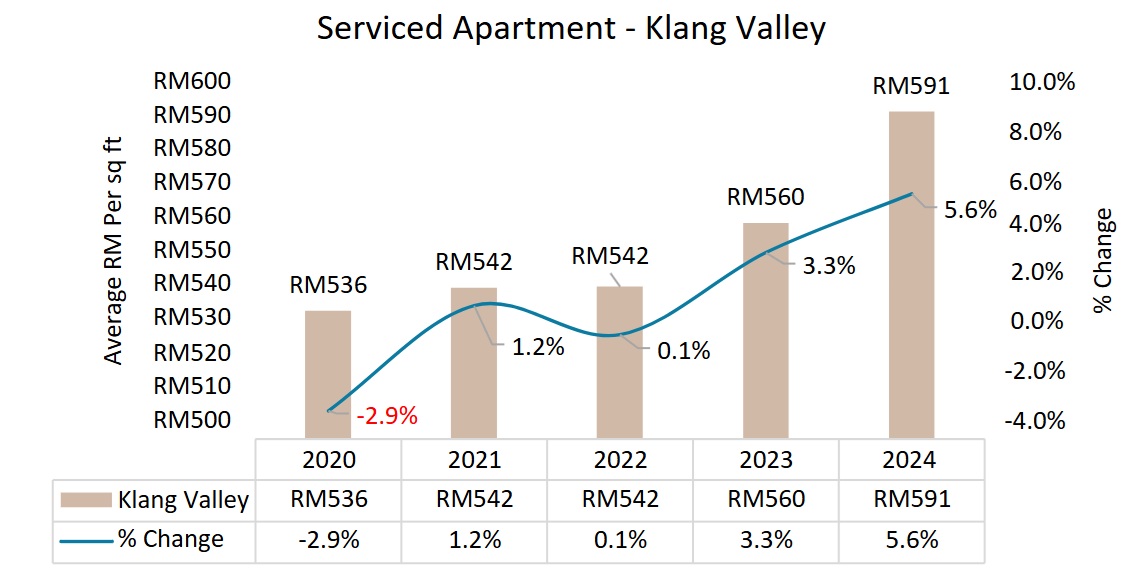

KUALA LUMPUR (Feb 3): The Klang Valley property market experienced an upward trend in 2024, with prices appreciating by more than 3% year-on-year (y-o-y). Batu district, home to prestigious neighbourhoods like Mont’Kiara and Desa ParkCity, emerged as a top performer, with serviced apartments witnessing an impressive price surge of almost 20%.

These findings were disclosed by global real estate services firm JLL Malaysia at a recent press conference on the 1Q2025 property market outlook.

According to JLL Malaysia managing director Jamie Tan, prices appreciated across major regions in the city by an average of 3.2% compared to the previous year. Although this positive trajectory was primarily driven by strong demand, escalating construction costs were also a pushing factor.

The serviced apartment sector recorded a notable 5.6% increase in average prices (RM591 psf). Batu district, well known for affluent neighbourhoods such as Mont’Kiara and Desa ParkCity, emerged as a top performer, particularly within the serviced apartment segment, which witnessed a significant 18% price jump to RM664 psf.

Two-storey terrace houses in Batu district and Kuala Lumpur Town Centre district (encompassing KL city centre (KLCC), Bukit Bintang and Chow Kit), also experienced substantial growth, with prices appreciating by approximately 12% in both locations, with average prices of RM581psf and RM639 psf respectively.

“The 2025 outlook for prime residential properties is positive. Serviced apartments are leading this trend, outperforming condominiums and apartments because of their superior facilities, amenities, and higher rental growth potential,” Tan said.

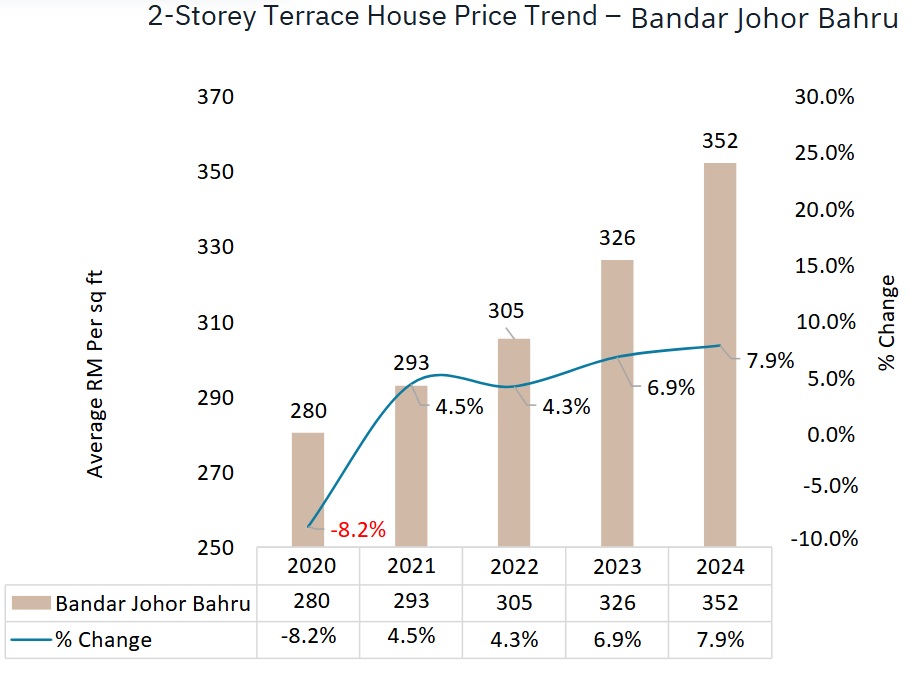

Johor showing unprecedented growth

In Johor Bahru, the price of 2-storey terrace houses saw a 7.9% increase, reaching RM352 psf. Meanwhile, high-rises such as serviced apartments experienced a 2.7% price increase, reaching RM589 psf. Apartments and condominiums also appreciated, with prices rising by 4.3% to RM330 psf.

“In Johor, we are witnessing a remarkable market performance. The market is exhibiting unprecedented growth, experiencing consistent y-o-y growth. Johor is undoubtedly a state to closely monitor,” Tan added.

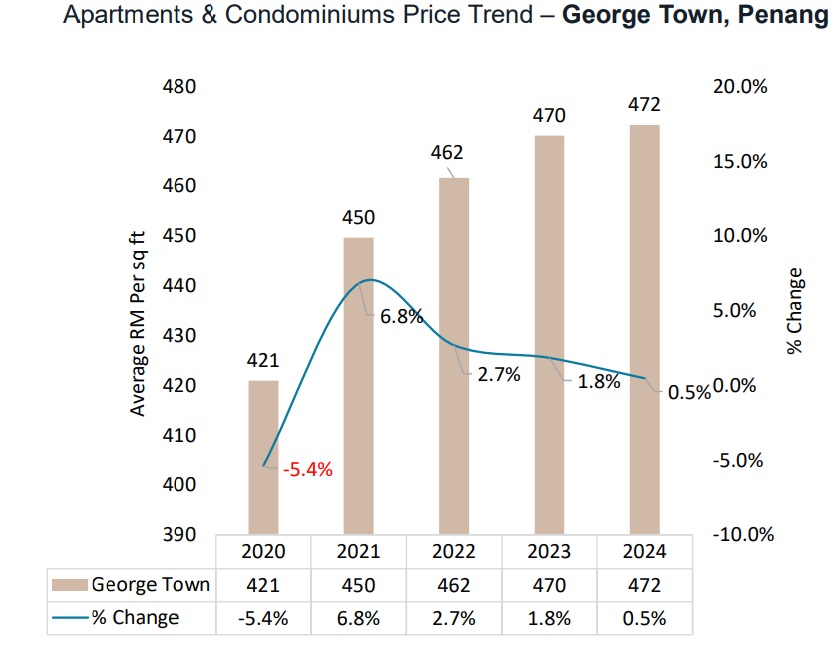

Modest price increase in Penang

In George Town, Penang, growth has been steadily cooling down. Apartments and condominiums saw a modest 0.5% price increase in 2024, reaching RM472 psf, compared to 2023. Serviced apartments experienced a 4.3% increase, reaching RM695 psf. The price of 2-storey terrace houses increased by a slight 0.3% to RM608 psf in 2024.

Overhang at controlled levels

The residential overhang issue, particularly in first-tier regions like Selangor, KL and Johor is gradually improving.

"A significant overhang existed during 2020 and 2021 due to the pandemic. This overhang peaked at 48% to 63% across all three cities. However, it has decreased dramatically, with current levels at 21% for Selangor, 32% for KL, and 28% for Johor. These are considered healthy levels,” Tan said.

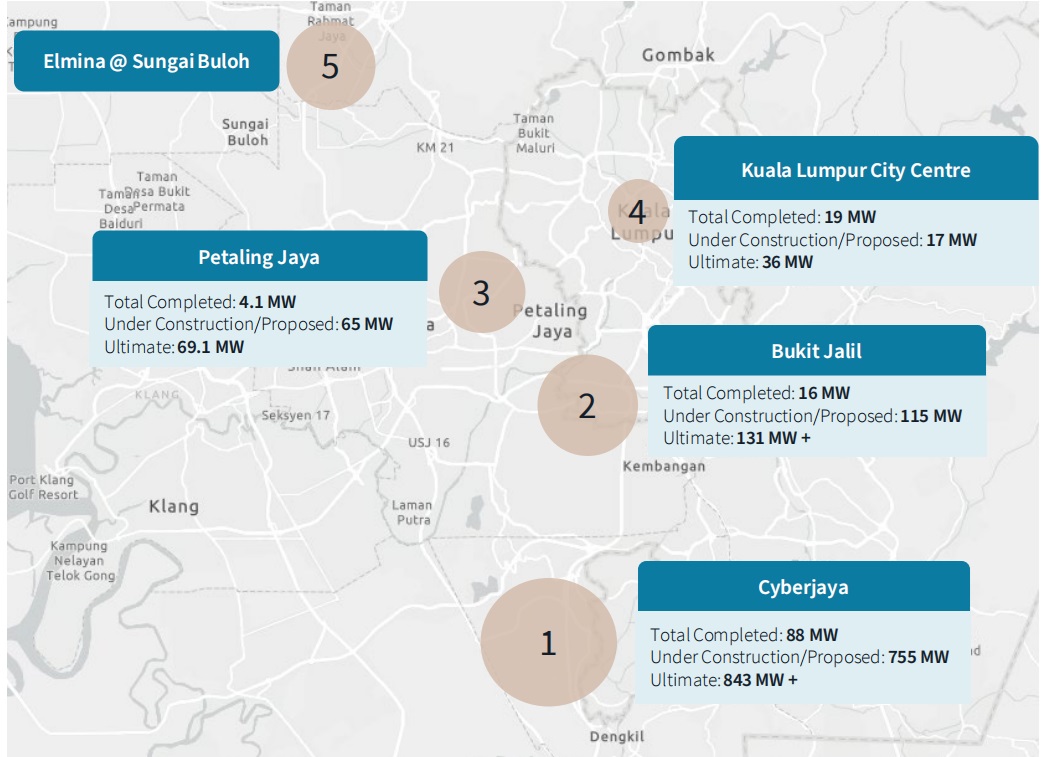

Data centre boom in Malaysia: Power capacity to triple by 2025

“Malaysia's data centre (DC) growth rate has increased remarkably, at the end of 2024, the power capacity of DCs has reached 530 MW, and it is expected to experience triple growth by the end of next year to 1.5 GW.

“DCs were the flavour of 2024. It contributed significantly to the gross domestic product (GDP). It was at the forefront of our economic development,” JLL Malaysia capital markets senior director KL Eng stated.

He indicated that DC locations in Greater KL: Cyberjaya, TPIM/ MRANTI @ Bukit Jalil, Petaling Jaya, and KLCC are the established destinations. However, due to the overwhelming demand, there were restrained utilities and a lack of ready land in these established DC locations. Hence, DC investments have flowed into new industrial areas in Sungai Buloh and Nilai, Negeri Sembilan.

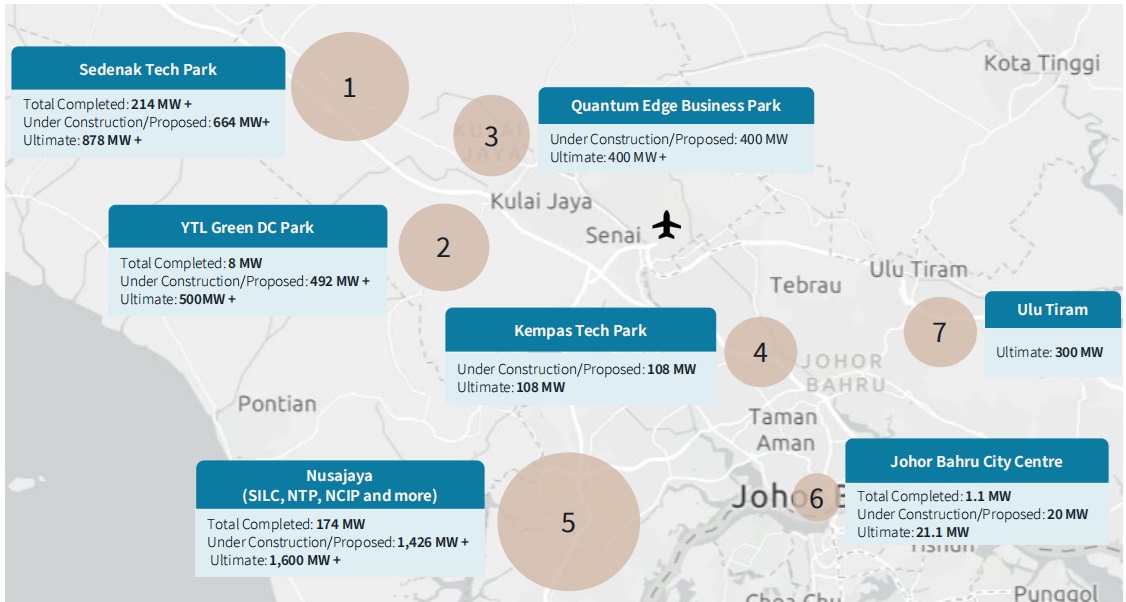

"Johor has been the sweet spot for DCs, primarily because of its proximity to Singapore. In Johor, industrial parks in Nusajaya and Sedenak Tech Park are the established DC destinations. The overwhelming demand has resulted in the flow of DC investments into new industrial areas in Kulai, Ulu Tiram and Iskandar Puteri," Eng added.

Positive outlook for Malaysian real estate: Strong GDP and FDI growth

Looking ahead, JLL Malaysia's head of research and consultancy Yulia Nikulicheva stated that the macroeconomic outlook for the real estate market is expected to be positive. GDP growth is projected to remain strong, inflation is anticipated to be moderate, and foreign direct investments (FDIs) are expected to continue flowing into the country.

“Malaysia is set to maintain its role as an emerging global hub in the DC industry. The expected macroeconomic dynamics suggest that the real estate market will benefit from the current positive momentum.

“However, we should remain cautious of market risks and recognise that across all segments, tenants and buyers are increasingly demanding efficiency and quality in spaces. Well-planned, technologically advanced projects in prime locations are likely to perform better in today’s highly competitive environment,” Nikulicheva said.

EdgeProp.my is currently on the lookout for writers and contributors to join our team. Please feel free to send your CV to [email protected]

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

TOP PICKS BY EDGEPROP

Bayan Lepas Industrial Park

Bayan Lepas, Penang

USJ Avenue @ USJ Heights

Subang Jaya, Selangor