• Today, we look at price growth and indicative asking rental yields for non-landed homes in Setapak, Kuala Lumpur. From analysis of transactions by TheEdgeProperty.com, the average transacted price for non-landed homes in the secondary market was RM363 per square foot (psf) in 1Q2015, up 14.2% y-o-y, primarily due to the advent of newer, modern condominiums.

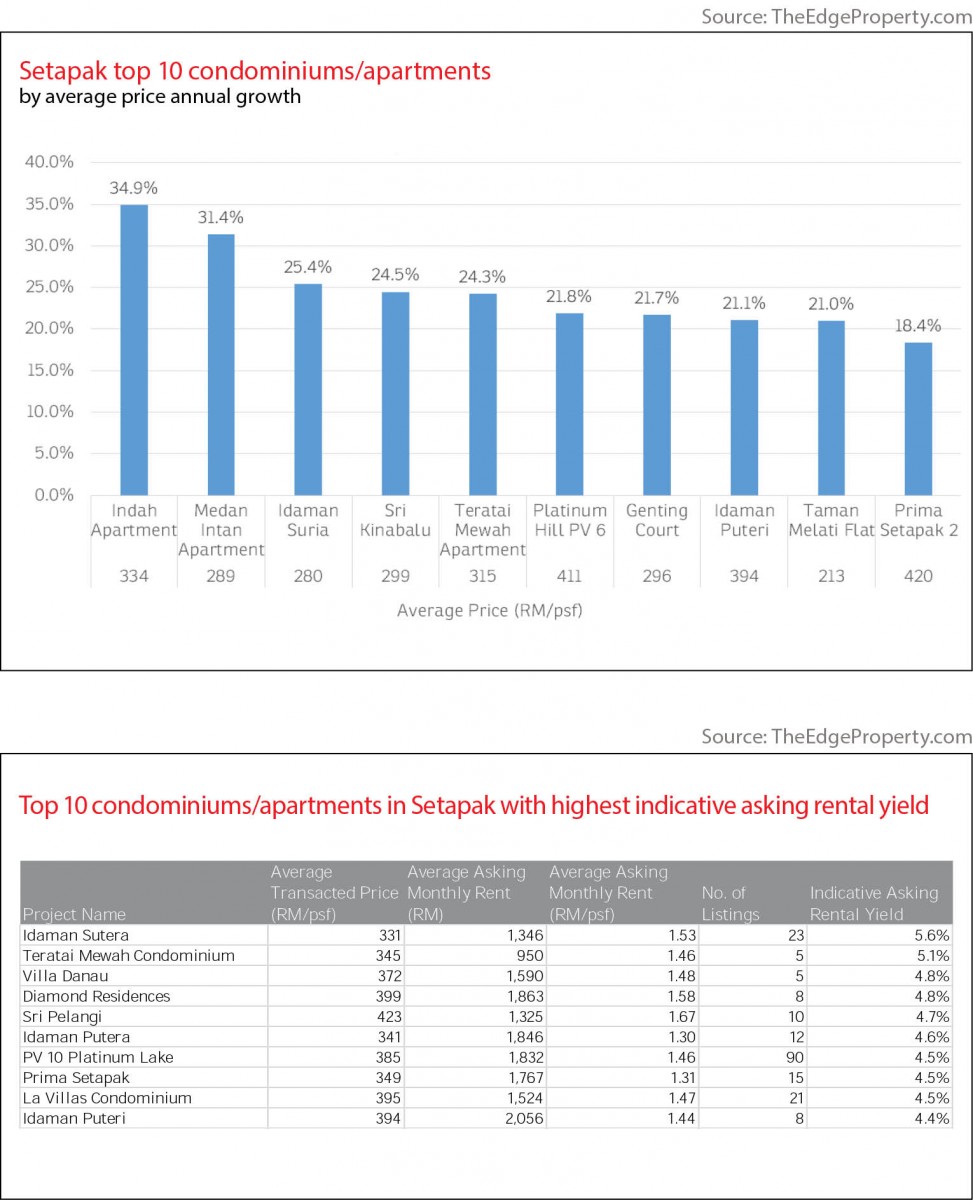

• Average prices have grown modestly across the market. The highest relative price growths were among the affordable properties, in part due to their lower capital bases. The top three performers were Indah Apartment, Medan Intan Apartment and Idaman Suria, with prices up 34.9%, 31.4% and 25.4% respectively.

• Within the mid-market segment, the highest price growth can be found at Platinum Hill PV 6. The average price here grew 21.8% y-o-y to RM411 psf in the 12 months to 1Q2015. Average prices at the Platinum Hill projects range between RM386 psf at Platinum Hill PV 5 and RM467 at Platinum Hill PV 2.

• The rental market is sustained primarily by the Tunku Abdul Rahman University College. The university offers several bus shuttle services servicing the neighbourhood. Typical 3-bedroom units generally command rents between RM1,500 – RM1,800 a month.

• Annual indicative yields are fairly decent, ranging from 3.7% to 5.6% per annum. The highest indicative annual yields can be found at Idaman Sutera where rents are fairly average but the rental yield is elevated due to the small unit sizes.

Click here to check out the price trends at Indah Apartment.

The Analytics are based on the data available at the date of publication and may be subject to revision as and when more data becomes available.

TOP PICKS BY EDGEPROP

Liu Li Garden, Setia Eco Glades

Cyberjaya, Selangor

Isle of Botanica, Setia Eco Glades

Cyberjaya, Selangor

Setia Marina 3, Setia Eco Glades

Cyberjaya, Selangor

Charms of Nusantara, Setia Eco Glades

Cyberjaya, Selangor

Lepironia Gardens, Setia Eco Glades

Cyberjaya, Selangor

Liu Li Garden, Setia Eco Glades

Cyberjaya, Selangor

Charms of Nusantara, Setia Eco Glades

Cyberjaya, Selangor

Setia Marina 2, Setia Eco Glades

Cyberjaya, Selangor

Bandar Baru Sri Petaling

Bandar Baru Sri Petaling, Kuala Lumpur

Taman Perindustrian Subang USJ 1

Subang, Selangor

Cipta Industrial Park @ Serenia City

Sepang, Selangor

Medan Idaman Business Centre

Setapak, Kuala Lumpur

Hampton Damansara

Country Heights Damansara, Kuala Lumpur

Hampton Damansara

Country Heights Damansara, Kuala Lumpur

Hampton Damansara

Country Heights Damansara, Kuala Lumpur