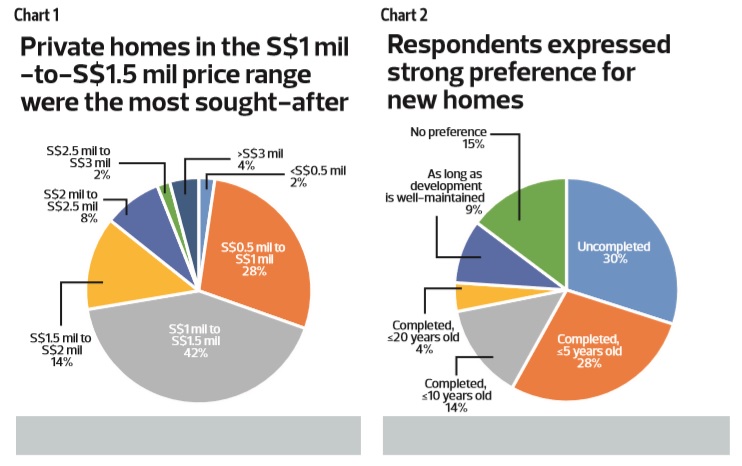

PRIVATE homes priced between S$1 million and S$1.5 million were the most sought-after among the respondents polled in a joint survey by Knight Frank and The Edge Property Singapore. The survey found that 217 of the 500 respondents, or nearly one in two, were on the lookout to purchase a private home in Singapore. Of the 217, 42% were looking to buy a private home in the S$1 million-to-S$1.5 million price range (see Chart 1).

The trend was observed across income bands, including among respondents with a high gross household income of above S$16,000 a month. Properties priced between S$500,000 and S$1 million were the second-most-sought-after, with 28% of respondents indicating this price range as their preferred choice.

Analysis of URA caveats for private non-landed homes somewhat echoes this trend. Condominium units and apartments priced between S$1 million and <S$1.5 million accounted for 37% of the caveats lodged so far this year. Those between S$500,000 and<S$1 million trailed closely, representing some 35% of the caveats lodged.

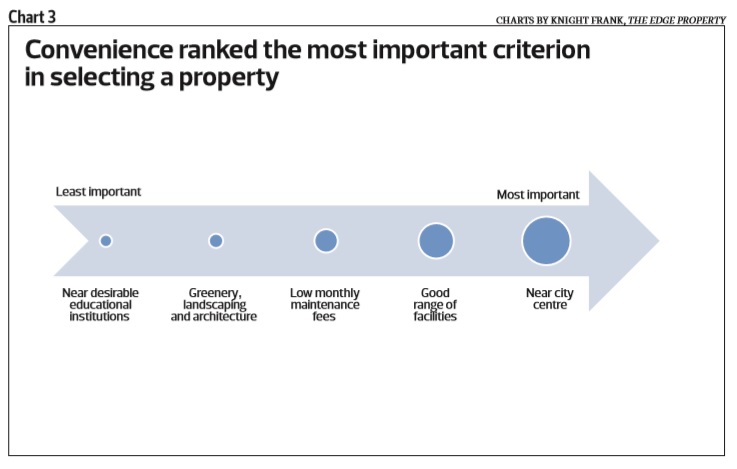

Respondents also expressed a strong preference for new homes. Thirty per cent, or 65 of the 217 respondents, preferred to purchase uncompleted homes. Another 28% of respondents would go for completed homes that are less than five years old (see Chart 2). Only about a quarter of respondents would consider buying a property with a remainder tenure of less than 90 years.

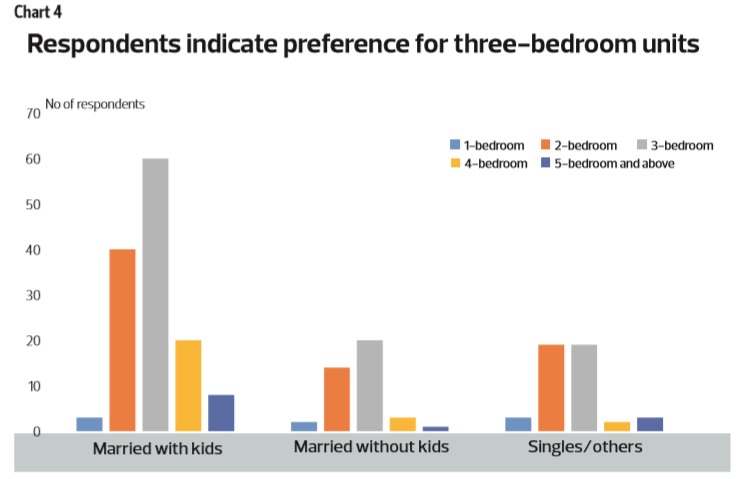

Convenience was the most important criterion in selecting a property. When respondents were asked to rank five criteria that were important to them, proximity to the city centre and a good range of facilities emerged as the two most important criteria (see Chart 3). Proximity to the city centre may also denote the importance of accessibility and commuting time from the city centre by public transport.

Meanwhile, greenery, landscaping, architecture and proximity to desirable schools ranked as the least important criteria. This is understandable, as having a popular school nearby would only be relevant for couples with young children.

The purpose of buying a property was split almost equally between owner-occupation and rental investment.

Compact versus standard three-bedroom units

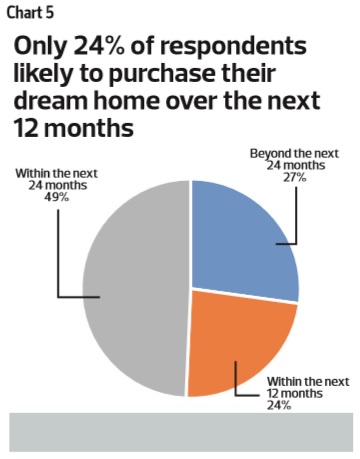

Surprisingly, a majority of respondents showed a preference for three-bedroom units (see Chart 4). The trend was also observed among respondents who were single or married without children. The findings were rather unexpected, considering that sales of large units at new launches tend to lag behind those of smaller ones.

However, there is evidence that three-bedroom units have been well received, particularly in the suburban resale market. The average size of resale suburban condo units and apartments sold this year was 1,266 sq ft, based on 1,839 URA caveats.

However, there is evidence that three-bedroom units have been well received, particularly in the suburban resale market. The average size of resale suburban condo units and apartments sold this year was 1,266 sq ft, based on 1,839 URA caveats.

In the primary market, however, the average size was significantly lower at 845 sq ft. This is partly because new projects carry a price premium, hence smaller units are more affordable.

Still, developers might consider building three-bedroom units that are bigger and have efficient layouts, as opposed to compact ones, to better serve the needs of families and HDB upgraders, which in turn might boost the sales of these units.

For comparison, new HDB four-room flats are at least 90 sq m (969 sq ft), with minimal space dedicated to balcony and air-con ledge. As a result, three-bedroom units at some new launches may be deemed too small for comfort among families or HDB upgraders.

At The Tembusu, a freehold condo in Hougang, three-bedroom units made up around 30% of sales within the first three months of launch. Meanwhile, one-bedroom units in the project accounted for around 20% of sales in the same period. Three-bedroom units at The Tembusu start from 1,044 sq ft.

A handful of suburban projects, such as The Sorrento and The Inflora, were fully or nearly sold out within the first three months of launch. Three-bedroom units start from 1,054 sq ft at The Sorrento and 1,033 sq ft at The Inflora. The Sorrento is a 131-unit freehold condo on West Coast Road, while The Inflora is a 396-unit leasehold condo in Pasir Ris.

The above projects were launched after the introduction of the total debt servicing ratio (TDSR) framework, which has been said to be the reason for the slower take-up of bigger units in new projects. Unless a project is located in a highly coveted address with strong investment potential, the size and efficiency of three-bedroom units offered at new projects could be the decisive factor for potential homebuyers.

Alice Tan, head of consultancy and research at Knight Frank Singapore, says, “As macroeconomic conditions become increasingly challenging, potential homebuyers are increasingly discerning when it comes to their home purchase. Apart from price and location considerations, the preferences for a private home are trending towards greater functionality in terms of size and quality, and mainly for owner-occupation purposes.”

Even city-fringe projects might benefit from offering bigger and more efficient three-

bedroom units to attract aspiring upgraders. At Gem Residences, a city-fringe project in Toa Payoh, there have been 17 new sale caveats for the larger three-bedroom units so far, which range from 980 to 1,055 sq ft. In comparison, there were just nine caveats for the smaller 936 to 947 sq ft, three-bedroom units.

Larger two- and three-bedroom formats with functional layouts and at sweet-spot prices would be likely to receive greater interest from homebuyers, Tan adds.

Homebuyers’ sentiment

The joint survey with Knight Frank was conducted over a one-month period starting from June 10. Part 1 of the survey results was published in the Aug 8 issue of The Edge Property Singapore pullout.

A majority of the 500 respondents (79%) surveyed were Singapore citizens, followed by Singapore permanent residents at 13% and foreigners at 8%.

The top three gross household income ranges among the respondents were S$5,001 to S$8,000 (22%), S$8,001 to S$12,000 (21%) and S$12,001 to S$16,000 (16%). Those with a gross monthly household income above S$20,000 constitute 15% of the group.

Most of the respondents (76%) were married. The proportion is higher than the national statistics, which show 59% of the population aged above 15 in 2015 is married.

While nearly one in two respondents, or 217 of 500, said they were on the lookout to purchase a private home, a weak macroeconomic outlook is deterring them from signing on the dotted line. Only 24%, or 51 of the 217 respondents, said they were likely to purchase their dream home over the next 12 months. Meanwhile, 107 respondents, or 49%, said they might take up to 24 months to commit. The remaining 59 respondents, or 27%, could take longer than 24 months to ink a deal (see Chart 5).

The Ministry of Manpower announced recently that the overall unemployment rate rose from 1.9% in March to 2.1% in June. A total of 4,800 workers were laid off in 2Q2016, the highest redundancies for the second quarter since 2009.

The survey also suggests that the additional buyer’s stamp duty continues to weigh heavily on purchasing decision. About 58%, or 125 of the 217 respondents, would purchase a private home within 12 months if the ABSD is reduced or removed, up from 24% if the ABSD remained the same.

Interestingly, 59% of the 217 respondents who plan to purchase a private home currently own an existing property in Singapore, mainly an HDB flat, while another 21% own more than one property.

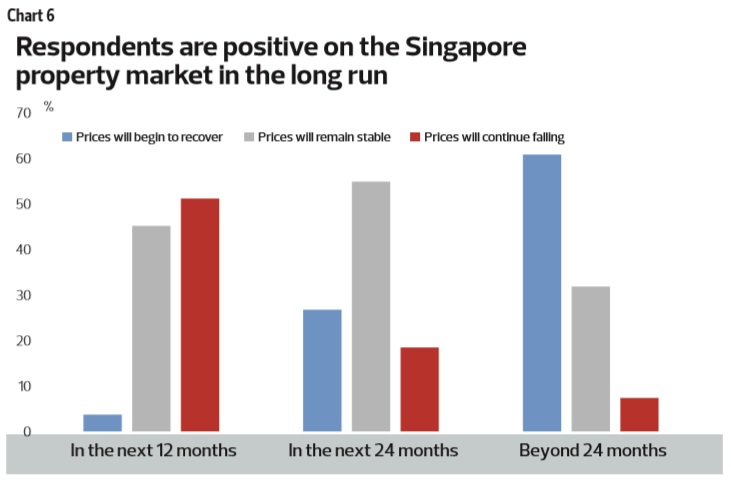

In the long term, respondents remain positive on the Singapore property market. Half of the 217 respondents believe prices will continue to fall over the next 12 months. Beyond the next 24 months, however, 61% of respondents believe prices will begin to recover (see Chart 6).

A vast majority of respondents believe Singapore residential property makes a good investment, citing potential capital appreciation as well as the country’s stability and renowned status as a gateway city and financial hub.

Knight Frank’s Tan says developers could take a more proactive stance to communicate their product offerings and track record to the public, to raise their profile and project awareness as consumers are faced with ample choices in the market.

Feily Sofian is head of research and Esther Hoon is senior analyst at The Edge Property Singapore.

This article first appeared in The Edge Property Singapore, a pullout of The Edge Singapore, on Oct 3, 2016.

TOP PICKS BY EDGEPROP

Taman Bukit Indah @ Iskandar Puteri

Johor Bahru, Johor

[CORNER LOT] TROPICANA ALAM @ Puncak Alam

Bandar Puncak Alam, Selangor

Taman Bukit Indah @ Iskandar Puteri

Johor Bahru, Johor

Taman Bukit Indah @ Iskandar Puteri

Johor Bahru, Johor

Taman Bukit Indah @ Iskandar Puteri

Johor Bahru, Johor

Medan Idaman Business Centre

Setapak, Kuala Lumpur