- Cross-border capital flows also rose by 12% to US$171 billion, underscoring the international appetite for real estate.

KUALA LUMPUR (March 5): Malaysia’s commercial real estate (CRE) market saw a strong recovery in 2024, in line with the global resurgence in property investment. According to The Wealth Report by Knight Frank, global CRE investment rebounded to US$806 billion, marking an 8% increase year-on-year, following a sharp contraction in 2023. Cross-border capital flows also rose by 12% to US$171 billion, underscoring the international appetite for real estate.

Malaysia mirrored this trend, with high-net-worth individuals (HNWIs) and institutional investors driving long-term investments. The country’s rising HNWI population reflects increasing wealth accumulation and growing interest in real estate assets.

Knight Frank Malaysia group managing director Keith Ooi remarked: “Malaysia’s commercial real estate market continues to evolve, with investors showing strong interest in prime office and logistics assets. As economic conditions stabilise and financing costs ease, we expect a wave of strategic acquisitions, particularly in key urban centres such as Kuala Lumpur, Penang, and Johor Bahru. Investors are increasingly seeking long-term value, and the resurgence of private capital plays a crucial role in this recovery.”

Private capital and institutional buyers lead growth

Globally, private capital remained dominant in the CRE market in 2024, with institutional investors contributing US$268 billion — 33% of total investments. In Malaysia, private investors were particularly active in the office and industrial sectors, capitalising on demand for high-quality assets. The logistics sector, in particular, continued to attract significant investment due to its strong growth potential.

Knight Frank Malaysia's senior executive director representing land and industrial solutions Allan Sim said: “The rebound in global commercial real estate investment has had a direct impact on Malaysia, where we are seeing increased activity from HNWIs and institutional players. With interest rates expected to ease, we anticipate stronger demand for prime assets, particularly in Kuala Lumpur’s office and logistics sectors.”

HNWIs on the rise

The number of HNWIs globally grew by 4.4% in 2024, reaching 2,341,378 individuals, with North America and Asia leading the expansion. Malaysia has been a key beneficiary of this trend, with more ultra-wealthy individuals diversifying into real estate.

Knight Frank Malaysia executive director from Capital Markets-Investments James Buckley said: “We are witnessing strong demand for luxury residences, particularly in Kuala Lumpur, as well as a heightened interest in commercial properties that offer stable yields. With global investors also returning to real estate, Malaysia stands to benefit from increased capital inflows in the coming years.”

Malaysia’s position in the regional investment landscape

Cross-border investment activity has strengthened worldwide, with London, Sydney and Tokyo ranking among the top real estate investment destinations. In Malaysia, international investor interest remains strong, particularly in Kuala Lumpur’s prime office and hospitality sectors. With a significant pool of capital ready for deployment, 2025 is poised to be a turning point for the country’s real estate market.

Outlook for 2025

Knight Frank head of UK commercial research Will Matthews noted: “Despite the challenges posed by geopolitical uncertainties and uneven regional recoveries, the global CRE market is in recovery mode. 2025 is expected to be a pivotal year, as anticipated interest rate cuts and stabilising property prices create a more favourable investment climate. Private capital will play a critical role in this resurgence, driving renewed momentum across the sector”.

With Malaysia positioned as a key player in Southeast Asia’s investment landscape, both domestic and international investors are expected to leverage emerging opportunities, reinforcing Malaysia’s status as a leading real estate investment destination.

EdgeProp.my is currently on the lookout for writers and contributors to join our team expansion. Please feel free to send your CV to [email protected].

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

TOP PICKS BY EDGEPROP

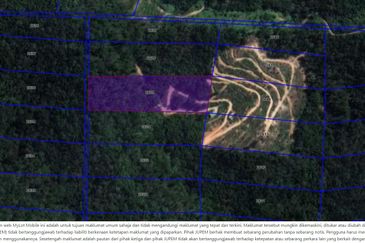

Kuala Terengganu Golf Resort

Kuala Terengganu, Terengganu

Taman Sutera Lama

Port Dickson, Negeri Sembilan

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)