- In the report, the international real estate consultancy firm also highlighted that the Asia-Pacific office market saw a 1.6% rental decline in 2024, an improvement from the 2.4% drop in 2023. However, 16 out of 23 monitored cities recorded stable or rising rents, particularly in Australia and Japan.

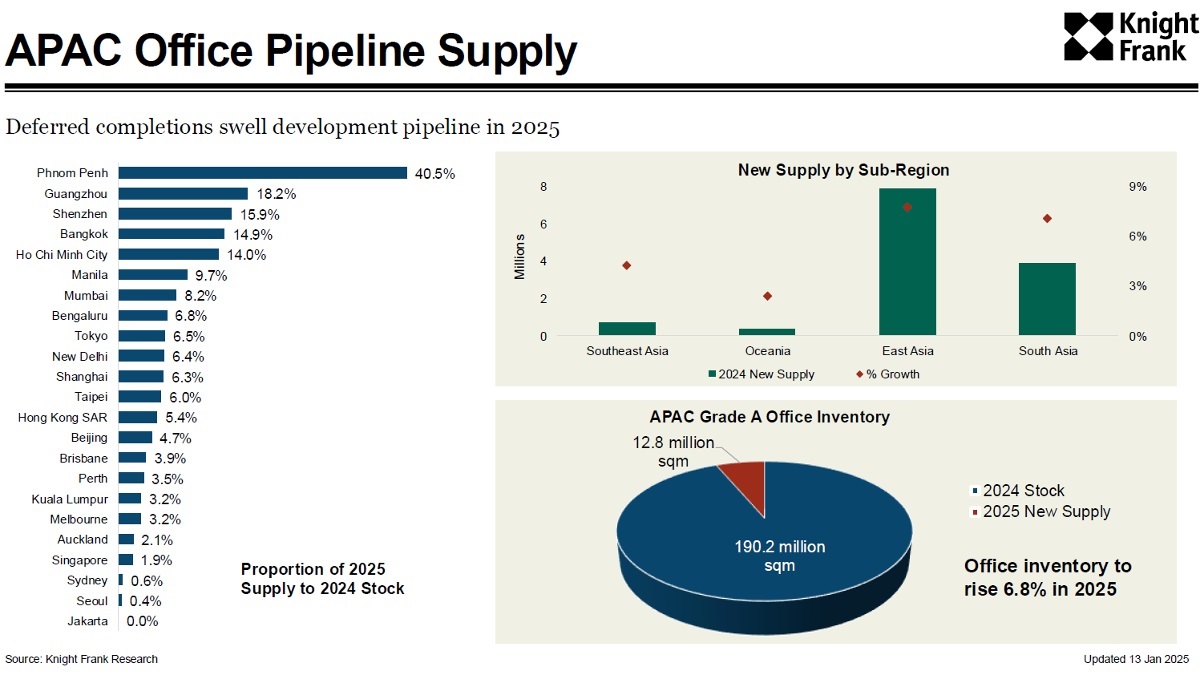

KUALA LUMPUR (Feb 12): Prime Grade A office space in Asia-Pacific is set to increase by 7% in 2025, up from 4% in 2024, with over 40% of new supply concentrated in mainland China, according to the Knight Frank’s Asia-Pacific 4Q2024 Office Highlights report.

In the report, the international real estate consultancy firm also highlighted that the Asia-Pacific office market saw a 1.6% rental decline in 2024, an improvement from the 2.4% drop in 2023. However, 16 out of 23 monitored cities recorded stable or rising rents, particularly in Australia and Japan.

“Although the region’s rent is expected to decline in 2025, much of the weakness is largely concentrated in mainland China. The rest of Asia-Pacific is still expected to see moderate increases of 1% to 2%, with leasing volumes anchored by markets in India and healthy activity in Tokyo,” said Knight Frank’s head of research for Asia-Pacific Christine Li in a press release issued on Feb 11.

In Malaysia, Kuala Lumpur’s prime Grade A offices continue to attract strong occupier demand, driven by the "flight-to-quality" trend as tenants are favouring office spaces with superior amenities and ESG (Environmental, Social and Governance) compliance, helping stabilise occupancy despite an overall subdued rental market.

“Kuala Lumpur’s office market remains dynamic despite a high vacancy rate. This presents a good opportunity for tenants to upgrade or reconfigure their office spaces to align with employment growth, sustainability, and talent retention trends,” said Knight Frank Malaysia senior executive director of office strategy and solutions Teh Young Khean in the statement.

He added that with corporate tenants placing greater emphasis on accessibility, connectivity and employee experience, landlords are upgrading building specifications, enhancing sustainability features, and offering more flexible lease structures.

“The Malaysian office market is undergoing a transformation, with workplace quality and sustainability emerging as top considerations. While landlords face increasing competition, those that invest in improving their buildings and offering greater lease flexibility will remain competitive,” said Knight Frank Malaysia group managing director Keith Ooi.

Despite challenges such as supply overhang and competition from new developments, Malaysia’s office market is expected to remain a focal point for both domestic and international occupiers. With corporate tenants prioritising ESG goals and workplace well-being, the sector is well-positioned to navigate headwinds and unlock new growth opportunities in 2025.

EdgeProp.my is currently on the lookout for writers and contributors to join our team. Please feel free to send your CV to [email protected]

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

TOP PICKS BY EDGEPROP

Novum @ Bangsar South

Pantai Dalam/Kerinchi, Kuala Lumpur

Core Residence @ TRX

Bandar Tun Razak, Kuala Lumpur

Core Residence @ TRX

Bandar Tun Razak, Kuala Lumpur

Core Residence @ TRX

Bandar Tun Razak, Kuala Lumpur