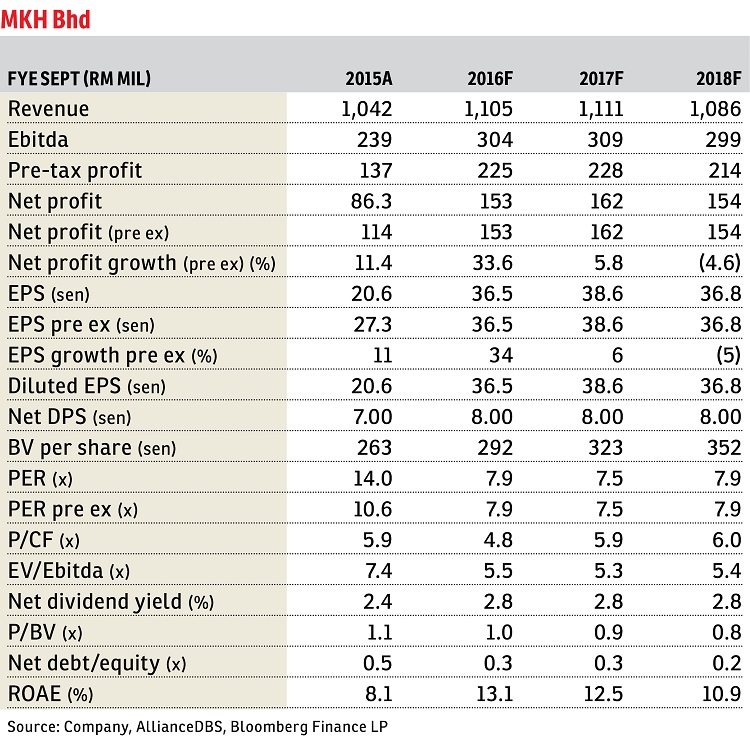

MKH Bhd (Aug 22, RM2.95)

Maintain buy with an unchanged target price of RM3.20: MKH Bhd announced that it had entered into a joint venture (JV) agreement with Sim See Hua Brothers Sdn Bhd, which owns 39.12 acres (15.83ha) of land in Kajang, to undertake property development with an estimated gross development value (GDV) of RM228 million.

The landowner’s entitlement of RM61 million will be progressively paid over seven years, implying RM36 per sq ft (psf) consideration for the 39-acre land which constitutes 27% of total GDV.

We are positive on the JV as the land is adjacent to MKH’s existing 270-acre Kajang 2 which will be linked to a KTM commuter station.

Also, the staggered payment for the entitlement bodes well for MKH, allowing it to focus on the delivery of RM828 million unbilled sales as at March.

Note that this is MKH’s second JV with Sim See Hua Group after the first JV agreement for 130 acres of land next to Kajang 2 in August 2015.

MKH has not launched any projects in Kajang 2 in recent years as management believes the value of the entire township will be enhanced with the completion of the MRT in 2017.

We believe more launches in Kajang 2 will be rolled out in financial year 2017, riding on the healthy demand for affordably priced landed properties in Kajang and Semenyih.

Reiterate our “buy” rating for MKH given its undemanding valuation as well as clear earnings visibility anchored by twin drivers — property and plantations. — AllianceDBS Research, Aug 22

Want to know the price trends of a development? Click here.

This article first appeared in The Edge Financial Daily, on Aug 23, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

JALAN TAMBUN (JALAN RAJA DIHILIR)

Kinta, Perak

KL Gateway Residences

Bangsar South, Kuala Lumpur

Kenny Hills (Bukit Tunku)

Kenny Hills (Bukit Tunku), Kuala Lumpur

HiCom-Glenmarie Industrial Park

Shah Alam, Selangor

Medan Idaman Business Centre

Setapak, Kuala Lumpur