KUALA LUMPUR (July 21): Warrant holders of property developer Yong Tai Bhd have approved the issuance of up to 220.05 million new Irredeemable Convertible Preference Shares (ICPS) at an issue price of 80 sen each.

They gave their approval at a warrant holders’ meeting today, which was adjourned from June 24 due to insufficient quorum.

Yong Tai, in a statement, said 100% of casted votes were in favour of the new issuance of ICPS to facilitate the capital participation of Hong Kong-listed Sino Haijing Holdings Ltd into Yong Tai, as well as to reward the existing shareholders of Yong Tai via a bonus issue.

To recap, Yong Tai had on Feb 4 entered into a subscription agreement with Sino Haijing’s subsidiary, Impression Culture Asia Ltd (Impression Culture), to formalise the parties’ intention and understanding in relation to the proposed corporate exercise.

Under the agreement, Sino Haijing will invest RM280 million in Yong Tai via the subscription of new shares, with Impression Culture subscribing for Yong Tai’s special issue of 150 million new shares amounting to RM120 million.

This represents 34.5% of the enlarged issued and paid-up share capital of Yong Tai, at an issue price of 80 sen per share.

Impression Culture will also subscribe to 200 million new ICPS at an issue price of 80 sen.

As a result, Sino Haijing will emerge as a new substantial shareholder in Yong Tai, holding more than 33% of the voting shares.

Therefore, Sino Haijing will seek an exemption from the authorities from undertaking a mandatory takeover offer for all remaining Yong Tai Shares it does not already own after the proposed special issue and ICPS.

Additionally, to reward the existing shareholders of Yong Tai through further participation in the company, Yong Tai will undertake a bonus issue of up to 20.05 million new ICPS, on the basis of one new ICPS for every 10 Yong Tai shares held by the shareholders.

Under the corporate exercise, Yong Tai has also proposed to undertake a private placement of up to 70 million new shares to independent third party investors.

Meanwhile, Yong Tai and Impression Culture have also entered into an addendum to the subscription agreement to extend the period of fulfilling the conditions precedent of the subscription agreement for another two months, commencing Aug 4 to Oct 3.

Yong Tai shares fell five sen or 4.39% to RM1.09 today, giving the company a market capitalisation of RM176 million.

Year-to-date, the counter has gained 47.3%. — theedgemarkets.com

TOP PICKS BY EDGEPROP

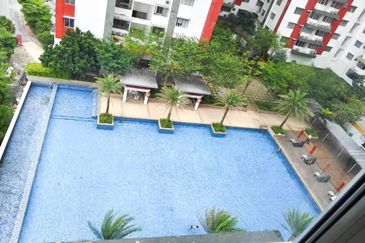

Bandar Baru Sri Petaling

Bandar Baru Sri Petaling, Kuala Lumpur

Bandar Springhill

Port Dickson, Negeri Sembilan

Bandar Springhill

Port Dickson, Negeri Sembilan

Bandar Springhill

Port Dickson, Negeri Sembilan

SAUJANA INDAH @ S2 HEIGHTS

Seremban, Negeri Sembilan