- Record sales of RM4.07 billion achieved and six sen total dividends declared

KUALA LUMPUR (Dec 12): Eco World Development Group Bhd (EcoWorld Malaysia) recorded profit after tax (PAT) for FY2024 (after taking into account Eco World International’s loss and a RM38 million impairment of investment in 4Q 2024) of RM303.5 million which is 60.3% higher than FY2023.

EcoWorld Malaysia also achieved RM4.07 billion sales in FY2024, the group’s highest ever, exceeding its RM3.5 billion sales target by 16%, according to its media release today.

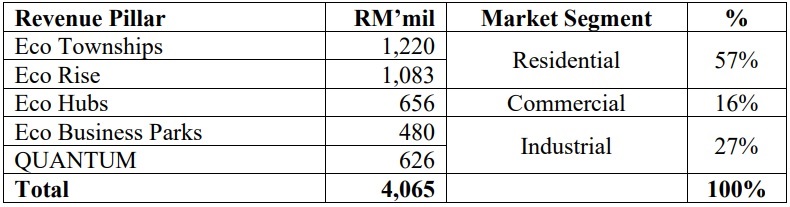

A breakdown of the FY2024 sales achieved by revenue pillars is set out below:

Revenue and gross profit for FY2024 increased by 1.4% and 13.3%, respectively, compared to FY2023. Gross profit margin improved from 24.2% FY2023 to 27.0% in FY2024.

The group’s Malaysian operations contributed PAT of RM343.1 million. This is a record high for EcoWorld Malaysia, mainly due to improvement in gross profit margins of its subsidiaries.

Net cash generated from operating activities in FY2024 amounted to RM890 million. This is 56% higher compared to FY2023 and close to three times the Group’s FY2024 PAT.

Gross and net gearing ratios as at Oct 31, 2024 further reduced to 0.46 times and 0.19 times, respectively, from 0.53 times and 0.25 times as at Oct 31, 2023.

Cash balances (including deposits and short-term funds) remained high at RM1.36 billion.

The Board of Directors also declared a final dividend of two sen per share, bringing total dividends declared for FY2024 to six sen per share.

“FY2024 has been a phenomenal year for EcoWorld Malaysia. Total sales breached the RM4 billion mark and our Malaysian operations recorded PAT of RM343.1 million, both record highs for the group,” said EcoWorld Malaysia president & CEO, Datuk Chang Khim Wah.

“Our projects are also well placed geographically within all three property hotspots of the Klang Valley, Iskandar Malaysia and Penang. In FY2024, our projects in Iskandar Malaysia contributed 57% (RM2.33 billion) of the Group’s sales, followed by 31% (RM1.27 billion) from the Klang Valley and 12% (RM470 million) from Penang.

“Landed residential homes under our Eco Townships pillar made up 30% of total sales with RM1.22 billion recorded. 82% of homes sold under this pillar were priced above RM650,000, demonstrating sustained demand for our upgrader products across all three regions,” said Chang.

“Sales under the Eco Rise pillar recorded the highest growth in FY2024 with RM1.08 billion achieved, more than double the RM509 million recorded in FY2023. This is testament to the success of our duduk apartments in capturing the hearts and minds of a cross-generational group of urban homebuyers in the Klang Valley, Iskandar Malaysia and Penang,” he said.

“Our industrial pillars, namely Eco Business Parks and QUANTUM, achieved total sales of RM1.11 billion, 6% higher than the previous record high achieved in FY2023. This was bolstered by strong data centre demand with two parcels of industrial land at our first QUANTUM Edge park being sold to Microsoft Payments (Malaysia) Sdn Bhd and Princeton Digital Group for a combined sales value of RM626 million,” he added.

“Thanks to our strong balance sheet, we are well positioned to expand our landbank to broaden and deepen our market share and increase future pipelines of growth,” Chang revealed.

He daid that “acquisitions will strengthen our Eco Townships, Eco Rise and Eco Hubs pillars. Furthermore, the location of the lands, which are all situated adjacent to our existing matured townships, will enable us to enjoy economies of scale and benefit from the established brand presence and customer following that we have cultivated in the immediate vicinity.”

“We are also targeting to acquire more landbank to enable us to serve the continued high demand for industrial products from local, regional and global industrialists,” Chang said.

“Apart from exploring opportunities to increase our landbank for development, we also aim to build up a strategic portfolio of investment properties to be held for recurring income.

“Accordingly, in 4Q 2024, we acquired 108 strata office units at The Stride (now renamed Menara EcoWorld) at Bukit Bintang City Centre (BBCC). Apart from generating rental income, we are confident that these units will appreciate in value, based on the steady increase in both rents and occupancy rates experienced at Menara EcoWorld over the past year,” added Chang.

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

TOP PICKS BY EDGEPROP

Medan Idaman Business Centre

Setapak, Kuala Lumpur

Taman Sri Putra, Sungai Buloh

Sungai Buloh, Selangor

HiCom-Glenmarie Industrial Park

Shah Alam, Selangor

Victory Suites (The Face 2), KLCC

KL City, Kuala Lumpur

Bandar Puncak Alam

Bandar Puncak Alam, Selangor

Luxura Residence @ twentyfive.7

Kota Kemuning, Selangor