- It said these incentives, which aim to establish Forest City as a hub for family offices, are projected to attract local and international investments, fuelling demand for property and creating job opportunities over the long term.

KUALA LUMPUR (Sept 23): The recently announced incentives for Forest City’s Special Financial Zone (SFZ) are expected to uplift the real estate sector, particularly in the Iskandar Malaysia region.

"The incentive package for Forest City (FC) SFZ is significant and should have a positive spillover effect on Iskandar Malaysia in the longer run, ie demand for property, commercial and retail activities," said RHB in a note on Monday.

Meanwhile, the research house noted developers including UEM Sunrise (KL:UEMS), Sunway Bhd (KL:SUNWAY) and Eco World Development Group Bhd (KL:ECOWLD) are poised to gain from this uptick in activity.

It said these incentives, which aim to establish Forest City as a hub for family offices, are projected to attract local and international investments, fuelling demand for property and creating job opportunities over the long term.

“If the ecosystem (regulations and infrastructure) is well established, the push for family offices makes sense as FC [is] situated next to Singapore, which has been a hub for family offices in the region,” said RHB in a note on Monday.

Forest City’s proximity to Singapore, a key financial hub in the region, positions it as a strategic location for asset management companies, financial institutions and high-net-worth individuals.

Besides, several Singapore-based institutions have already shown interest in the SFZ, pending official guidelines from the Securities Commission Malaysia (SC).

While the incentives are expected to lure high-net-worth individuals to Forest City, they may not appeal as strongly to the ultra-wealthy segment.

To further incentivise property investments, the incentive package includes a harmonised 0% real property gains tax for foreign buyers after five years and a 50% stamp duty exemption on property transfers.

“Although the incentives are mainly centred around the FC, as more job opportunities are created, we will likely see more business activities in nearby areas like Nusajaya and Medini, benefitting the retail, entertainment and F&B sectors,” the note added.

RHB maintained its “overweight” call on the real estate sector, citing a favourable macroeconomic environment with stable interest rates, improving economic growth, and stronger investment inflows.

Revival of Kuala Lumpur-Singapore high-speed rail

In addition to these developments, the research house said the potential revival of the Kuala Lumpur-Singapore high-speed rail (KL-SG HSR) project could serve as a major catalyst for the property market.

“If this mega infrastructure project is revived, this will be a major re-rating catalyst for the overall property sector, as not only the developers in Iskandar Malaysia (especially in the Nusajaya area) will benefit, developers that have landbank exposure along the alignment area from Singapore to Kuala Lumpur should also have better development prospects going forward,” it added.

The bank’s top picks in the sector include Sime Darby Property Bhd (KL:SIMEPROP) (target price (TP): RM2.00), Mah Sing Group Bhd (KL:MAHSING) (TP:RM2.26), UEM Sunrise (TP: RM1.60), and Sunway (TP: RM5.00), all rated with “buy” calls.

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

TOP PICKS BY EDGEPROP

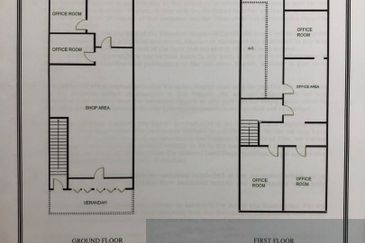

Medan Idaman Business Centre

Setapak, Kuala Lumpur

Taman Sri Putra, Sungai Buloh

Sungai Buloh, Selangor

HiCom-Glenmarie Industrial Park

Shah Alam, Selangor

Bandar Damai Perdana

Bandar Damai Perdana, Selangor

Megan Phoenix Business Centre

Cheras, Kuala Lumpur

Seksyen 1, Petaling Jaya

Petaling Jaya, Selangor