- Axis REIT said the latest placement involves issuing up to 100 million new units, representing up to 6.09% of the REIT's total issued units, to be placed out to investors to be identified later.

KUALA LUMPUR (Nov 15): Axis Real Estate Investment Trust (REIT) has proposed to raise up to RM178 million via a private placement to repay bank financing.

This is the REIT's second cash call in less than a year after it completed a private placement on Dec 20, 2021, which raised gross proceeds of RM334.72 million, also for repayment of bank financing.

In a filing with Bursa Malaysia on Monday (Nov 14), Axis REIT said the latest placement involves issuing up to 100 million new units, representing up to 6.09% of the REIT's total issued units, to be placed out to investors to be identified later.

The placement will be determined later and will be priced at a discount of not more than 10% to the five-day volume weighted average market price (VWAMP) of the units, immediately before the price fixing date.

For illustration purposes, assuming the maximum number of placement units are issued at an issue price of RM1.78 per unit, it would represent a discount of about 3.42% to the VWAMP of the units for the five market days up to and including the latest practicable date of Nov 3 of RM1.8430, said the REIT.

Maybank Investment Bank has been appointed as principal adviser to the manager for the proposed placement, which is expected to be completed by the second quarter next year.

TOP PICKS BY EDGEPROP

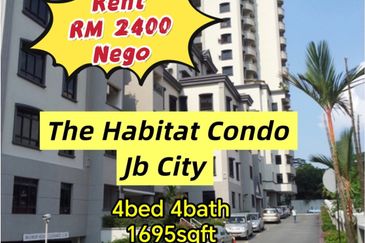

Fair View, Bandar Baru Permas Jaya

Permas Jaya/Senibong, Johor

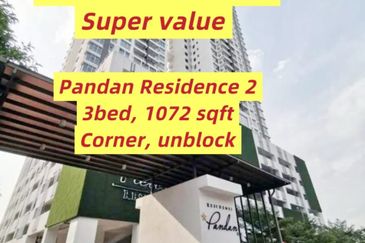

Imperial Jade Residenz @ Bandar Seri Alam

Masai, Johor

Taman Bukit Indah @ Iskandar Puteri

Johor Bahru, Johor