KUALA LUMPUR (Nov 12): Malaysia's economy contracted 4.5% year-on-year (y-o-y) in the third quarter of 2021 (3Q21), amid the strict Covid-19 containment measures in July under Phase 1 of the National Recovery Plan, which weighed on consumption and investment activities.

Department of Statistics Malaysia chief statistician Datuk Seri Dr Mohd Uzir Mahidin said the decline in consumption and investment activities had more than offset the continued expansion in public sector consumption spending.

"However, monthly GDP (gross domestic product) estimates show that the impact of the containment measures was tapering as restrictions were eased in a phased manner throughout the quarter," he said during Bank Negara Malaysia's 3Q21 GDP briefing.

On a quarter-on-quarter basis, Malaysia's economy contracted 3.6%, a larger decline versus the 1.9% contraction in the preceding quarter.

All economic sectors registered contraction during the quarter, led by the construction sector due to operating capacity limits.

On the expenditure side, domestic demand declined by 4.1% y-o-y amid the decline in private consumption and investment activities, while continued increase in public sector consumption spending provided support to growth.

"Progressive lifting of containment measures and continued improvements in the labour market will be key to support the recovery going forward," said BNM governor Datuk Nor Shamsiah Mohd Yunus.

Meanwhile, headline inflation moderated to 2.2% during the quarter, mainly due to the dissipation of the base effect from fuel prices, and the implementation of the three-month electricity bill discounts. Core inflation was unchanged at 0.7% during the quarter.

On the foreign exchange rates, the governor said the ringgit depreciated by 0.8% against the US dollar in 3Q21, due to the strengthening of the greenback amid greater clarity from the US Federal Reserve that it would likely begin tapering its asset purchase programme towards the end of 2021.

However, since Oct 1, the ringgit had appreciated by 0.9% as at Nov 9 against the US dollar, in line with the trend in other regional currencies.

"The ringgit was further supported by an improved domestic outlook amid the economic reopening and higher commodity prices.

"Going forward, as uncertainties regarding global liquidity adjustments and developments surrounding the path of the pandemic remain, financial and foreign exchange markets are expected to be subject to periodic bouts of volatility," said Nor Shamsiah.

Net financing to the private sector grew 3.9%, lower than 4.4% in the preceding quarter, due to lower growth in outstanding loans and outstanding corporate bonds.

BNM said outstanding household loan growth moderated to 3.2% amid slower growth across all purposes.

However, loan applications and disbursements improved in September given the relaxation of movement restrictions.

For businesses, outstanding business loans grew at a faster rate of 2.4% compared with 1.3% in 2Q21, supported by higher working capital loan growth, mainly driven by the wholesale and retail trade, restaurants and hotels, and manufacturing sectors, in line with the resumption of business activity.

Looking ahead, the governor said the domestic economy is on track to meet the 3% to 4% forecast growth, supported by increase in economic activities as containment measures are progressively relaxed and continued policy support.

She added that the various relaxation for fully vaccinated individuals, including for interstate travel, would also spur tourism-related activities.

The strength in global demand will also continue to support export growth.

"Malaysia's growth trajectory is expected to improve given resumption of economic activities, further improvement in the labour market, continued policy support and expansion in external demand.

"The progress and efficacy of vaccinations, compliance with standard operating procedures as well as the ability to effectively contain outbreaks from any new Covid-19 variants of concern will be key to the expected recovery," Nor Shamsiah said.

Headline inflation averaged at 2.3% year-to-date, and is projected to average between 2% and 3% for 2021, while underlying inflation is expected to average below 1% for the year.

While core inflation is expected to edge upwards in 2022, the governor said it will remain benign amid the continued spare capacity in the economy and slack in the labour market.

Get the latest news @ www.EdgeProp.my

Subscribe to our Telegram channel for the latest stories and updates

TOP PICKS BY EDGEPROP

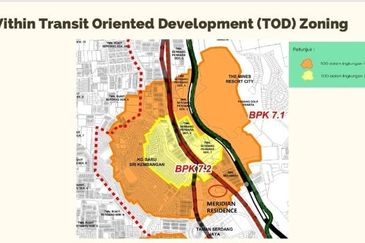

Kampung Baru Seri Kembangan

Seri Kembangan, Selangor

Taman Perindustrian Bukit Serdang

Seri Kembangan, Selangor

Kawasan Perindustrian Nilai

Nilai, Negeri Sembilan

Kawasan Perindustrian Nilai 3

Nilai, Negeri Sembilan

Taman Perindustrian Putra Permai

Seri Kembangan, Selangor