- A vast majority of Malaysian households, about 7 million of them (88.5%), make less than RM15,000 a month. So, how would they be affected if mortgage rates went up by a mere 0.5%?

KUALA LUMPUR (March 14): Bank Negara Malaysia (BNM) has opted to keep the Overnight Policy Rate (OPR) stable at 3%, in contrast to some of our neighbouring countries such as the Philippines, Indonesia and Thailand, which have been increasing their rates for the past months. In fact, the announcement last week marked a period of 10 months since BNM last increased the rate in May 2023 by 25 basis points.

Most of us would have heaved a sigh of relief over this news, because it means not having to cut down on yet more daily expenses (considering the rug has just been pulled from under our feet by the sudden expansion of service tax) to make up for increased home instalments.

It’s also good news for those who want to buy homes. After all, it's not just about the price tag; but also about being able to qualify for a loan and pay the monthly mortgages.

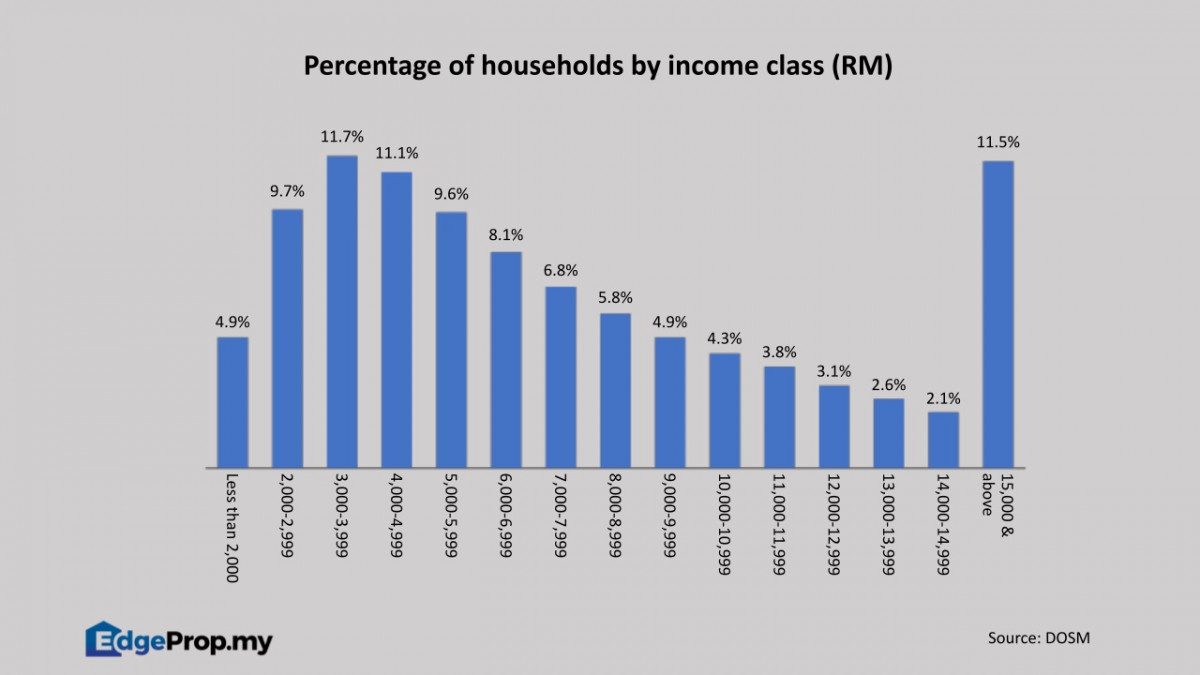

Yes, homebuying is a big deal for most Malaysian families. Referencing the Department of Statistics Malaysia (DOSM) Household Income Report 2022, a vast majority of households in Malaysia, about 7 million of them (88.5%), make less than RM15,000 a month.

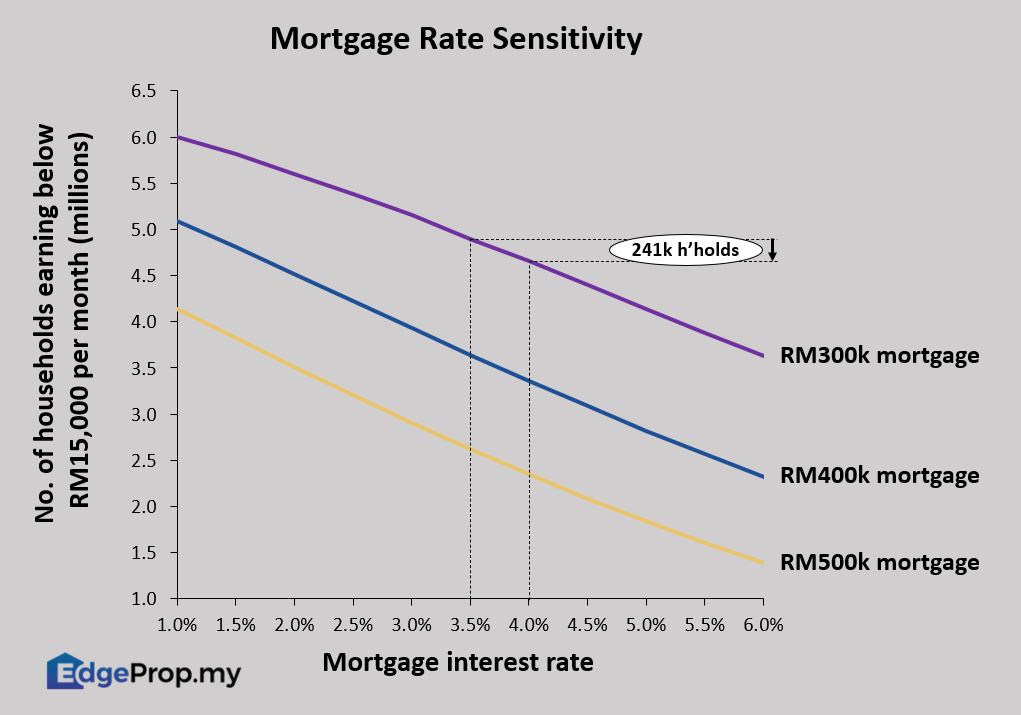

Recognising this, we looked into how changes in mortgage rates might impact these households, especially if they want to secure loans of RM300,000, RM400,000 or RM500,000.

Our research revealed an interesting insight: Assuming a maximum debt service ratio (DSR) of 30%, a mere 0.5% increase in mortgage rates — ie from 3.5% to 4% — can potentially box out 241,000 households (about 3%) earning below RM15,000 from qualifying for a RM300,000 loan.

Yes, you can hardly find a decent family home with a RM300,000 loan, but that is how much the regular household could be impacted if the OPR went on an upward tangent.

So, what does it mean? Simply put, BNM's steadfast approach in maintaining the OPR is a lifeline for numerous Malaysian families, keeping the dream of homeownership alive and attainable.

Looking to buy a home? Discover exclusive rewards and vouchers for your dream home when you sign in to EdgeProp START.

TOP PICKS BY EDGEPROP

OUG Parklane

Jalan Klang Lama (Old Klang Road), Kuala Lumpur

Razak City Residences

Salak Selatan, Kuala Lumpur

Bandar Mahkota Banting (Brooklands)

Banting, Selangor

Bandar Mahkota Banting (Brooklands)

Banting, Selangor

Bandar Mahkota Banting (Brooklands)

Banting, Selangor

Citizen 2

Jalan Klang Lama (Old Klang Road), Kuala Lumpur