BANGKOK (March 3): Since Thailand Securities and Exchange Commission (SEC) approved the trading of real asset tokens this month, a few Thailand developers and real estate firms are mulling the digital fundraising option by launching their own real estate-backed tokens, Bangkok Post reported.

Amongst the keen industry players, Thailand-listed developer SC Asset will be launching its initial coin offering (ICO) which will be the first of its kind in the country. The deal will also make Thailand the first country in Asia Pacific to launch asset-backed tokens.

The report quoting an anonymous source said real estate firms Sansiri and Ananda Development are also considering the digital fundraising option.

Crypto consulting and investment firm Cryptomind CEO Sajay Popli told the news portal that the company is now working on an ICO deal and is expected to launch by the second quarter of this year.

According to the report, the real estate-backed tokens will serve as a digital version of real estate investment trusts (REITs), backed by real estate development projects that are tangible and traceable.

By doing so, the investment model will be like a “micro” REIT with small amounts of investments; investors could buy and sell at any time as the digital asset exchange will operate all day.

To recap, the SEC on Monday (March 1) approved the trading of real estate-backed ICOs, allowing property developers to raise funds from development projects, which are over 80% of completion, or valued at least 500 million baht (RM67 million).

Get the latest news @ www.EdgeProp.my

Subscribe to our Telegram channel for the latest stories and updates

TOP PICKS BY EDGEPROP

Novum @ Bangsar South

Pantai Dalam/Kerinchi, Kuala Lumpur

4 Acres Industrial Land with Factory and Warehouse facilities

Bidor, Perak

Ayuman Suites Serviced Residence

Gombak, Selangor

Fortune Perdana Lakeside Residences

Kepong, Kuala Lumpur

PJ Transit Oriented Office Building For Sale - Ideal For Corporate Office Headquarters

Petaling Jaya, Selangor

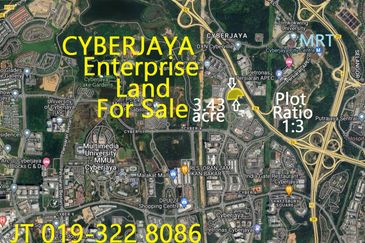

Cyberjaya Enterprise Land 3.43 Acre For Sale - Ideal For Commercial Mixed Property Development

Cyberjaya, Selangor