YTL Corp Bhd (Oct 25, 1.05)

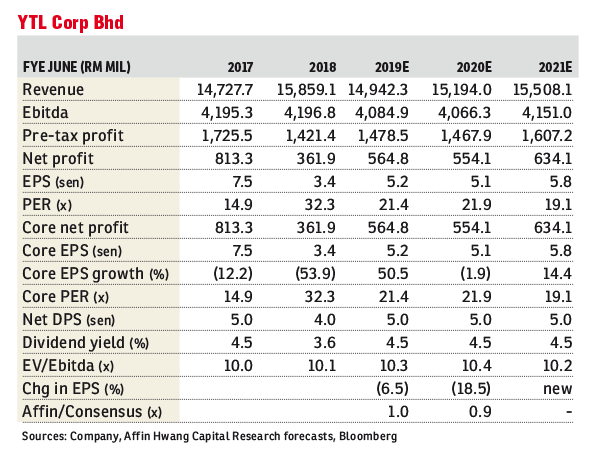

Downgrade to sell with a lower target price (TP) of 90 sen: We believe that the operating environment for the cement segment will remain challenging and expect its profit margin to narrow further, due to rising operating costs.

As the industry’s overcapacity situation remains unchanged, stiff pricing competition among cement manufacturers is still ongoing, as they continue to compete for market share. Although YTL Corp Bhd has a cost advantage against its peers, it is still challenging for YTL to grow its profit for the segment, and the segment’s profit contribution is still on a declining trend since four years ago.

Its profit before tax (PBT) contribution has declined by more than two-thirds from RM664 million in financial year 2014 (FY14) to less than RM200 million in FY18.

Although the government cancelled, delayed and renegotiated multiple big infrastructure projects, the RM8.9 billlion Gemas-JB Electrified Double Tracking (EDT), of which YTL is one of the two main sub-contractors, remains intact. However, the KL-Singapore HSR project, for which YTL was bidding, has now officially been put on hold. We believe that as the current government focuses on reducing the financial burden of the country, there is still the possibility that the EDT could be reviewed. Any large-scale infrastructure projects are only likely to be available for tendering by second half (2HFY19).

We downgrade our call to “sell” from “hold”, as we lower our sum-of-parts-based TP to 90 sen, on the back of 6.5%-18.5% earnings per share cuts after lowering the expected contribution from both the cement and construction operations. Upside risks to our call lie in major contract wins and a stronger-than-expected recovery for cement demand. — Affin Hwang Capital Research, Oct 25

This article first appeared in The Edge Financial Daily, on Oct 26, 2018.

TOP PICKS BY EDGEPROP

Taman Sri Putra, Sungai Buloh

Sungai Buloh, Selangor

Melati Apartment, Taman Bukit Subang

Bukit Subang, Selangor