PETALING JAYA (Sept 29): The only way developers can bring property prices down is by cutting their profit margins, said a property industry observer.

“This is the only component of development costs that a developer can control,” they told The Edge Malaysia.

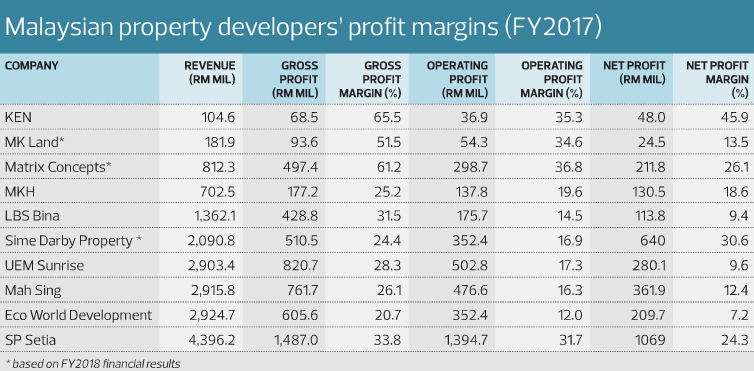

According to the report, many public-listed property developers currently enjoy fat profit margins that exceed even 20% – for instance, KEN Holdings Bhd had achieved a net profit margin of 45.86% in its financial year ended Dec 31, 2017 (FY17) and 47% in the first half of its FY18.

Its net profit almost doubled from 29.9% in FY16 due to the completion of KEN Rimba Condominium 1 in the KEN Rimba township in Seksyen 16, Shah Alam.

A 1,080 sq ft unit excluding parking bays in the development was priced at RM399,000 – exceeding the median house price of RM282,000 deemed affordable by Bank Negara Malaysia’s quarterly bulletin in February.

Finance Minister Lim Guan Eng had urged developers to lower property prices as the Sales and Service Tax as exemptions from the tax on certain building services and materials are expected to reduce property development costs, failing which the waiver may be reviewed.

However, analysts expect the exemption to only result in 3% cost savings – an insufficient amount to mitigate imbalances in the property market.

“Developers are looking at cost savings of 1% to 3% from the tax exemption as some of the items are now taxed at a higher rate than under the previous tax system while others are exempted.

“It [affordability of homes] is a structural issue that cannot be solved just by giving tax exemptions on construction,” said an analyst at a local investment bank who covers property development companies.

TOP PICKS BY EDGEPROP

Taman Taming Indah 2

Bandar Sungai Long, Selangor

Balakong Jaya Industrial Park

Balakong, Selangor

APARTMENT DEWI FASA 2 @ BANDAR PUNCAK ALAM, Ground floor

Bandar Puncak Alam, Selangor

Lorong Az- Zaharah 10/9

Bandar Puncak Alam, Selangor

Lorong Lautan Samudera 9/2A

Bandar Puncak Alam, Selangor

Taman Sri Subang PJS 10

Bandar Sunway, Selangor

The Hills, Horizon Hills

Iskandar Puteri (Nusajaya), Johor