- “Continued observations of preferences for more flexible tenancy contracts and hybrid work arrangements suggest adjustments in supply still have some way to go.”

KUALA LUMPUR (March 25): Concerns over persistently high vacancy rates in the office space segment remain as new supply continues to outstrip demand, said Bank Negara Malaysia (BNM).

Total office space stock in the Klang Valley expanded further to 121.7 million sq ft in the fourth quarter of 2024 (4Q2024), up from 121 million sq ft as at the end of 2Q2024, the central bank said in its Financial Stability Review for the second half of 2024.

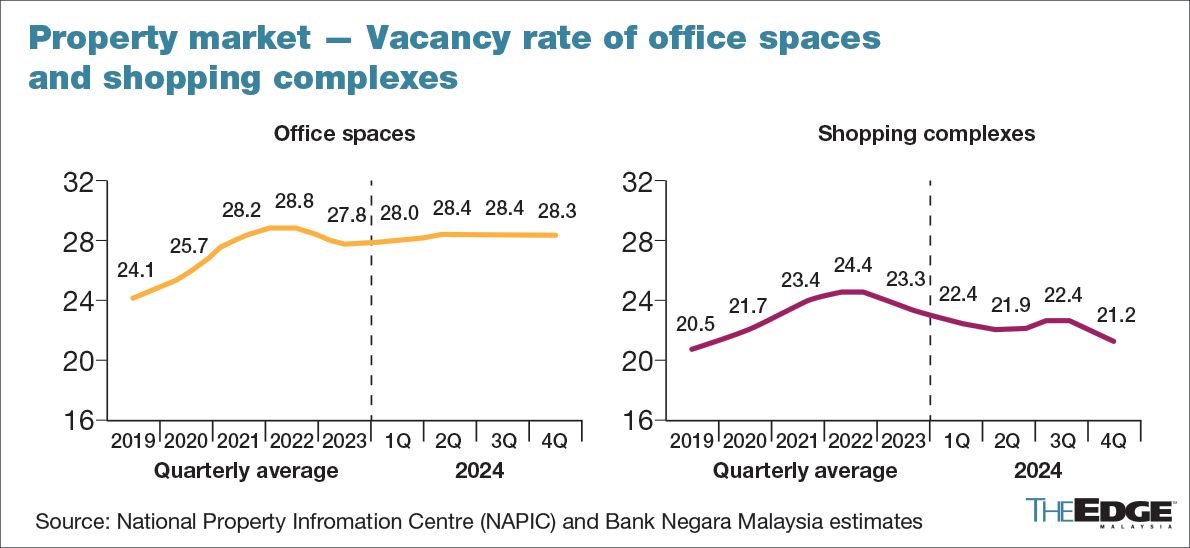

It, however, pointed out that demand had failed to keep pace with the increasing supply, leading to an elevated vacancy rate of 28.3% as at end-2024, compared with 28.4% in both the third and second quarters.

“Continued observations of preferences for more flexible tenancy contracts and hybrid work arrangements suggest adjustments in supply still have some way to go,” BNM said in the report released on Monday.

Despite these challenges, the central bank maintained that risks in the overall non-residential property sector remained contained.

Meanwhile, the shopping complex segment showed some improvement, with a marginal decline in vacancy rates amid higher footfall and improved demand conditions.

The vacancy rate of shopping complexes went down to 21.2% in 4Q2024, from 22.4% in 3Q2024 and 21.9% in 2Q2024.

Want to have a more personalised and easier house hunting experience? Get the EdgeProp Malaysia App now.

TOP PICKS BY EDGEPROP

Hexa Commercial Centre

Desa Petaling, Kuala Lumpur