I-Bhd (July 25, 53.5 sen)

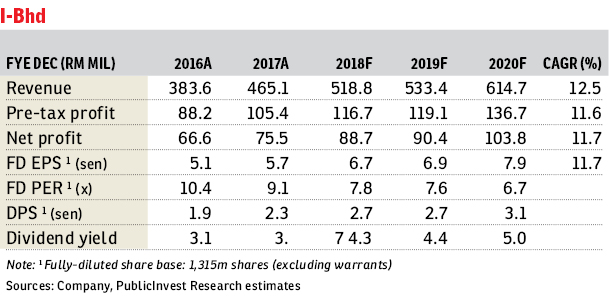

Affirm outperform with an unchanged target price of 91 sen: I-Bhd’s property development contributions continued to drive earnings growth. Divisional pre-tax profit of RM28.4 million for the second quarter of financial year 2018 (2QFY18) was 18.1% higher compared with the immediate preceding quarter’s RM24.1 million, though a touch lower (-0.2% year-on-year) versus the previous corresponding period’s RM28.5 million. Margins have improved, owing to a better sales mix and cost adjustments. The group’s longer-term earnings visibility is secure and will be underpinned by its current unbilled sales of RM305 million and increasing contributions from the 8 Kia Peng project in downtown Kuala Lumpur.

Its property investment portfolio, while still seeing negligible contributions in 2QFY18, with pre-tax losses of RM736,000 (1QFY18: RM373,000), is poised to see a marked turnaround in fortunes in the coming financial year with the imminent opening of the mall by year end.

While the group’s cash holding has fallen a fair bit quarter-on-quarter, a bit of which has gone into the rapidly-concluding mall construction, the overall current ratio remains a healthy and relatively liquid 2.4 times with zero borrowings, apart from the liability components of the unconverted irredeemable convertible unsecured loan stocks and redeemable convertible unsecured loan stocks.

The second half of the year will be a busy time for the group. The three-themed Liberty, Parisien and Hyde Towers with a total of 1,217 units will be handed over to purchasers this financial quarter (90% sold on average), while the RM850 million mall will also be opened in November to add another level of vibrancy to the township and augment property investment-related income. With no planned launches for this year, the company’s focus will still be on clearing its existing stock in i-City and 8 Kia Peng, the latter being its sole development project out of Shah Alam, Selangor, which continues to see encouraging sales done contrary to the reportedly lacklustre market environment for higher-end properties, particularly in downtown Kuala Lumpur. — PublicInvest Research, July 25

This article first appeared in The Edge Financial Daily, on July 26, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Taman Sri Putra, Sungai Buloh

Sungai Buloh, Selangor

Melati Apartment, Taman Bukit Subang

Bukit Subang, Selangor