PUTRAJAYA (July 19): Malaysia's Public Sector Home Financing Board, a statutory body under the public sector Home Financing Board Act 2015, is teaming up with MBSB Bank to provide a joint financial scheme to public sector employees for owning their first homes.

The move was formalised after the board, which is also known as Lembaga Pembiayaan Perumahan Sektor Awam (LPPSA), inked a memorandum of understanding (MoU) with MBSB Bank, today.

The scheme allows spouses or parents and children to apply for a joint loan to purchase a house, provided at least one of the joint applicants is a public sector employee.

Separately, joint applicants who work in the private sector can obtain funding from MBSB Bank.

LPPSA chief executive officer (CEO) Datuk Kamal Mohd Ali said the board always opens up cooperation opportunities to other financial institutions for facilitating and assisting public sector employees to own their own homes.

"This includes allowing joint financing among private sector workers by providing them (the purchaser) space for a more comfortable home purchase.

"In the history of LPPSA's collaboration with a commercial bank like MBSB (Bank), there was no such thing allowed before.

"The scheme will be ready for application by this year," he told reporters at a press conference here, today.

Kamal said the main purpose of the scheme is to assist the borrowers, especially public sector employees, to obtain a higher amount of financing than individual housing loans.

Additionally, this joint financing scheme can help public sector employees to reduce their monthly funding commitments, as repayments financing is shared between the joint borrowers.

Under the MoU, LPPSA and MBSB Bank will offer two loan categories for the scheme — financing for completed houses and houses under construction.

"The facilities offered by MBSB Bank are to finance the differential amount between the amount of funding approved by LPPSA and the balance of house prices.

"We will allocate about RM500 million for this scheme for three years. In time, we will increase the amount depending on the growth of the (LPPSA) portfolio," said MBSB Bank president and CEO Datuk Seri Ahmad Zaini Othman.

"Financing offered by MBSB Bank is in the form of Shariah-compliant product called Tawarruq," he added.

Ahmad Zaini said MBSB Bank is the first bank to sign the MoU with LPPSA for this scheme.

"Combined household is much better compared to single household. We (MBSB Bank) are here to assist in acquisition of their asset," Ahmad Zaini added. — theedgemarkets.com

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

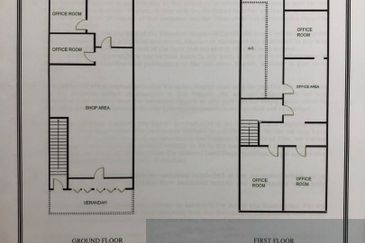

Medan Idaman Business Centre

Setapak, Kuala Lumpur

Taman Sri Putra, Sungai Buloh

Sungai Buloh, Selangor

HiCom-Glenmarie Industrial Park

Shah Alam, Selangor

Kawasan Perindustrian Taman Johor

Johor Bahru, Johor

Taman Ria Jaya ( Industrial )

Sungai Petani, Kedah