Scientex Bhd (June 14, RM6.55)

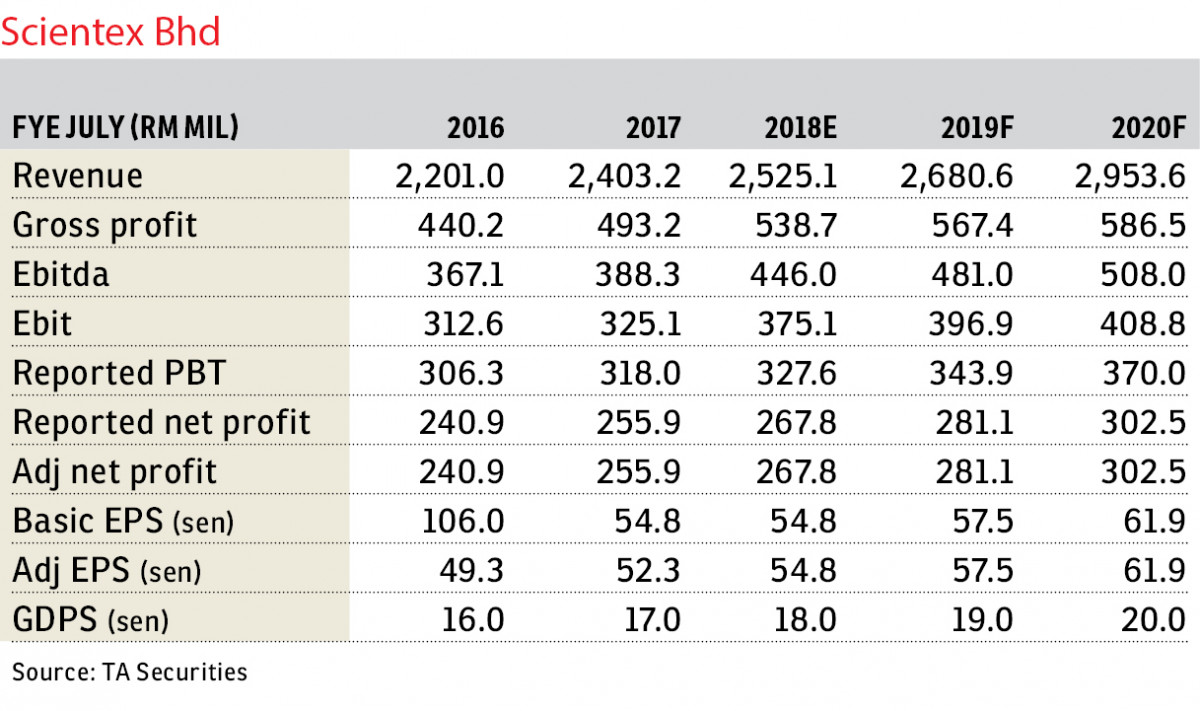

Downgrade to hold with a lower target price (TP) of RM7: We project Scientex Bhd to report a net profit of RM60 million to RM70 million for the third quarter of the financial year ended April 30, 2018 (3QFY18), a decline from 9.8% and an increase of 5.3% year-on-year. Factors affecting its 3QFY18 results performance include: i) the recent rally in global crude oil prices may increase production costs; and ii) resilient demand for affordable housing. We reduce our earnings forecasts by 18.8% and 27.6% for the financial year ending July 31, 2018 (FY18) and FY19 respectively.

Fossil fuel resins make up for more than 50% of production cost for the group’s manufacturing division. Although Scientex uses various types of polymers in its plastic packaging manufacturing division, we often use the price of global low-density polyethylene (LDPE) to analyse the price trend of raw material cost. We find that LDPE resin’s global price moved in line with the movement of global crude oil prices until end-2017. Industry experts believe the LDPE price will continue to increase in line with increasing global demand and increasing crude oil prices. The Brent crude oil price has increased by about 9.8% year-to-date, surpassing the US$70 (RM278.60) per barrel (bbl) mark in May, then coming back to US$65/bbl level currently. We reduce Scientex’s FY18 and FY19 earnings projections by 18.8% and 27.6% respectively after revising our FY18 in-house crude oil price assumption to US$70/bbl from US$60/bbl previously. In our sensitivity analysis, every US$5/bbl increase in crude oil prices would reduce our earnings forecast by 18.5% for FY18, ceteris paribus.

Scientex’s property division is expected to chalk up a resilient 3QFY18. The group will continue to focus on affordable housing as the take-up rate has been healthy between 90% and 100% in the past’s project launches. In our forecast, we project the company to rake in property sales of RM794 million for FY18 and RM814 million for FY19.

Scientex has a total of 2,200 workers and of this, about 30% are foreign workers. Most of the workers work within the manufacturing segment and account for about 6.5% of manufacturing-segment sales. We do not foresee a big impact from an increase in minimum wage following the general election. Management also guided previously that the implementation of foreign worker levies in January 2018 would have no material impact on Scientex’s earnings. — TA Securities, June 14

This article first appeared in The Edge Financial Daily, on June 18, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

TAMAN MEDANG (MANTIN)

Seremban, Negeri Sembilan

TAMAN SEREMBAN FOREST HEIGHTS

Jelebu, Negeri Sembilan

Pekan Nanas Industrial

Pekan Nanas (Pekan Nenas), Johor