Pavilion Real Estate Investment Trust (Jan 26, RM1.55)

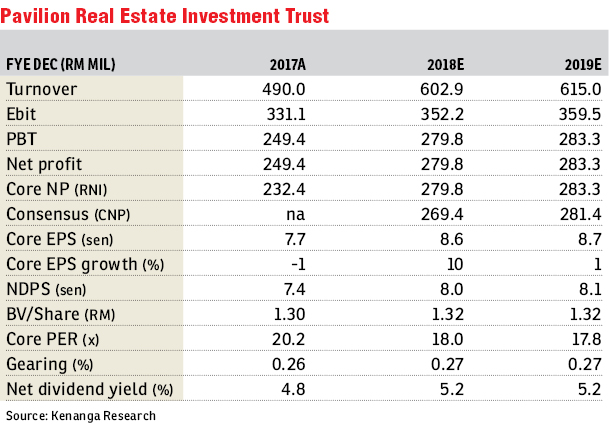

Maintain outperform with an unchanged target price (TP) of RM1.84: Pavilion Real Estate Investment Trust’s (Pavilion REIT) financial year 2017 (FY17) realised net income (RNI) of RM232.4 million came in within our (98%) and consensus (95%) expectations. An interim dividend of 4.28 sen was declared (which includes a 0.13 sen non-taxable portion, bringing FY17 gross dividend per unit to 8.24 sen, which is well within our expectations, making up 101% of our estimated FY17 gross dividend per unit of 8.10 sen.

Year to date, gross rental income was up 7% on the repositioning of tenants at Pavilion KL on the back of positive middle to single-digit rental reversions, full-year contributions from Damen Mall and Intermark Mall (completed in March 2016), and electricity collection fees from Damen Mall. However, RNI declined by 1%, weighed down by higher operating cost (+15%) from maintenance at Pavilion Kuala Lumpur and Intermark Mall, tenancy cost at Damen Mall, provision of doubtful debts, and marketing cost incurred for sponsorship of the 2017 Sea Games, and the increased financing cost (+16%) for the acquisition of new malls.

The trust’s quarter-on-quarter (q-o-q) fourth quarter FY17 (4QFY17) revenue was up by 7% on tenant repositioning at Pavilion KL, higher advertising income as well as fees from Damen’s electricity provider. However, operating cost declined (-6%) as the bulk of the abovementioned costs were incurred in the 2QFY17 to 3QFY17 period, while financing cost remained flattish. This allowed the bottom line to increase by 18%.

The FY18 to FY19 period will see 24%-52% of portfolio net lettable area expiring, on single-digit reversions. Although lease expires in FY19 appear lumpy, we are not overly concerned as the bulk is from Pavilion KL, which should have no issue maintaining full occupancy on decent reversions. The proposed acquisition of Elite Pavilion is expected to be completed in FY18 and will be funded by a combination of borrowings and 7.2% placement. We are positive on this acquisition as it contributes about 8% to FY18 earnings, and 7.6% to dividend per unit (post placement). The Fahrenheit88 acquisition is still on the table, pending the sponsor’s intention to sell, while we believe Pavilion REIT is eyeing cap rates closer to 6.5%. Additionally, as we had previously highlighted, we reckon Pavilion REIT could potentially acquire third party assets from WCT Holdings Bhd (which owns Paradigm Mall and AEON Bukit Tinggi). — Kenanga Research, Jan 26

This article first appeared in The Edge Financial Daily, on Jan 29, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Aira Residence

Damansara Heights, Kuala Lumpur

Aira Residence

Damansara Heights, Kuala Lumpur

DC Residensi (Damansara City)

Damansara Heights, Kuala Lumpur

Bandar Baru Sri Petaling

Bandar Baru Sri Petaling, Kuala Lumpur

PRIMA Residensi Jalan Jubilee

Pudu, Kuala Lumpur