The tabling of the annual national budget always creates a sense of anticipation, especially amidst a lacklustre economic atmosphere, because therein hangs the hope for a financial plan that can provide the much-needed impetus to push the economy forward.

With Budget 2018 set to be announced by Prime Minister Datuk Seri Najib Razak on Oct 27, EdgeProp.my speaks to various stakeholders from the property sector to find out what they hope is in store.

In a nutshell, many in the industry continue to advocate for stronger affordable housing initiatives and ways that can help make homeownership easier.

Meanwhile, housing prices are not expected to go down as demand remains “robust”; however, prices are expected to remain flattish for the upcoming months.

Top on the Budget 2018 wish list is to:

1 Raise affordability and increase homeownership

The National House Buyers Association (HBA) honorary secretary-general Chang Kim Loong hopes to see the government come up with more proposals to increase the supply for affordable properties.

He suggests that more incentives be given to property developers in the private sector to build more affordable homes, which it defines as capped at RM300,000, with a built-up of between 800 sq ft and 1,000 sq ft (excluding balcony), and at least two to three bedrooms.

Chang also hopes the government could slow down the climb in home prices by increasing the stamp duty rate and Real Property Gains Tax for owners of at least three properties. “This way, it will not affect the majority of the ‘rakyat’ who can only afford one property for own stay and the other one for long-term investment,” he suggests.

Meanwhile, Kenanga Investment Bank Bhd head of equity research Sarah Lim expects Budget 2018 to be government housing scheme-centric. “While emphasis will be on affordable housing supply, we do not foresee any major monetary or fiscal policy changes for the sector,” she says.

Professor of Economics at the Business School of Sunway University Dr Yeah Kim Leng shares the same view. “The budget is expected to boost further the supply of and access to affordable housing. And while there are sporadic voices calling for the property market cooling measures to be eased, it is not likely to be a priority in Budget 2018,” he says.

Yeah adds that to leverage the private sector’s capacity, Budget 2018 may include more incentives as well as public-private partnership schemes for developers to build more homes at the affordable price range.

Institute for Democracy and Economic Affairs (IDEAS) chief executive Wan Saiful Wan Jan, on the other hand, identifies the bumiputera quota policy as one such measure that needs to be re-examined as it “distorts the supply and demand curve because it unnecessarily limits the supply of houses”.

“Of course, there are other factors too, such as the costs of building materials and manpower. New technologies like the Industrialised Building System may help... We should look into simplifying and reducing the costs of employing workers at construction sites, including foreign workers as well.”

2 Ease financing

Malaysian Institute of Estate Agents (MIEA) president Eric Lim believes financing is vital to promote homeownership. “Generally, most financial institutions have been too stringent in their lending. Something must be done [by the government] to relax this. Developer Interest Bearing Schemes should be allowed. It is not a bad thing,” he says.

He adds that banks should come up with more creative and flexible financing.

However, Association of Valuers, Property Managers, Estate Agents and Property Consultants in the Private Sector Malaysia (PEPS) president Foo Gee Jen begs to differ. “Property developers and banks have their own game plans as they need to assess their risks very carefully. The bottom line here is risk assessment, and I would say that so far, banks have been really prudent in assessing risks [in approving housing loans].”

An analyst who declined to be named concurs, pointing out that Malaysia is currently in a situation where balancing affordability with property and banking sectors’ health is becoming tougher. “In such situations, perhaps allowing simple demand and supply forces will result in a healthier sector in the long run. Bank Negara Malaysia is protecting the economy, instead of simply chugging along causing the streets to be full of [loan] defaulters.”

Affin Hwang Capital Research senior associate director for equity research Loong Chee Wei thinks financing assistance should be expanded beyond 1Malaysia People’s Housing (PR1MA) projects.

The Real Estate and Housing Developers’ Association (Rehda) has proposed a Home Ownership Assistance Programme to the Ministry of Urban Wellbeing, Housing and Local Government aimed at first-time or single-property homeowners, where developers will include the interest of the housing loan disbursed during construction into the purchase price.

Meanwhile, Yeah expects the upcoming budget to provide initial financing and subsidies for first-time homebuyers. “The budget may also include measures to promote more innovative rent-to-own schemes to boost homeownership among the low- to middle-income groups,” he adds.

3 Simplify bureaucracy and reduce compliance cost

PEPS’ Foo urges the government to introduce measures to simplify bureaucracy and reduce compliance costs as the current application to approval process is “lengthy and a slight hitch in between would delay delivery time”, inducing higher cost on the developer’s end, which would then be passed on to homebuyers.

“Developers are over-burdened with increasing compliance costs. For instance, developers are responsible for utility provision. There should be cost-sharing [measures] between utility suppliers and developers as utilities are common services complementary to the business needs of both parties,” he proposes.

Rehda agrees, noting that savings in these areas can be passed on to homebuyers. “Rehda would also like to request that GST be waived on construction materials for development of affordable housing priced RM500,000 and below. I’m not asking for zero-rate, but a waiver. This will seriously help developers and encourage more people to build affordable homes,” said its president Datuk Seri FD Iskandar Mohamed Mansor at a recent media luncheon.

Reflecting on Budget 2017

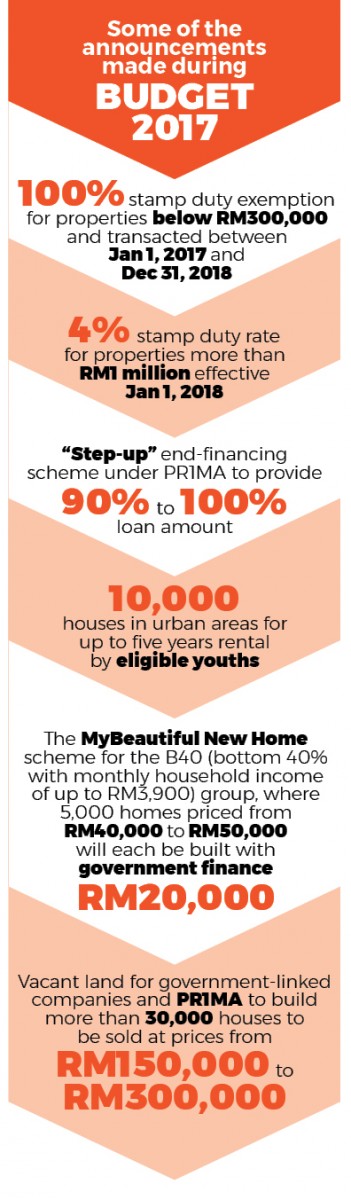

Industry observers are of the view that the measures announced in Budget 2017 (see infographics) have managed to address the needs of the affordable housing segments. However, they were unable to stimulate the general property market.

“Having taken care of the affordable segment, the government should leave it to market forces to determine the general property market. Most properties in major towns are beyond the affordable range so [stamp duty exemption] should be extended to [homes priced up to] RM500,000 to be more effective,” says MIEA’s Eric.

According to Yeah, the measures have stimulated the supply side of the affordable housing market while somewhat easing access to financing for first-time homebuyers. However, they are not enough to offset softer market conditions in general.

“Specifically, the commercial and retail property as well as the upper and high-end residential market segments in a number of locations across the country are facing over-supply and soft demand. Investment demand, meanwhile, is compounded by a slowdown in foreign buying especially those from China, declining yield and smaller upside potential,” he notes.

PEPS’ Foo says that while the policy orientation in affordable housing matter is primarily on price correction, there is a need to reduce the supply-demand mismatch in terms of product offerings and pricing.

“It was observed that new housing developments are increasingly concentrated in the higher price categories and distribution is inadequate. Locational factors often drive developers to offer smaller units to compromise on sale prices, which may not be ideally sized for buyers.

“Alternatively, developers would only be able to launch lower-price properties if the development is undertaken further away from the city centre, which in turn is likely to be unattractive to buyers. Such divergence of expectations between buyers and developers leads to supply-demand mismatch,” he says.

As prices rise on lack of supply, Foo says the solution is to increase supply by releasing state-owned land parcels.

“As land cost is a major component in pricing of a property, releasing state-owned land parcels conditioned for development of affordable housing is a straightforward incentive for private developers to take part.

“On the other hand, for residential properties in the open market, the government could partner with private developers for joint development of residential properties in prime state-owned land to provide housing in locations that appeal to buyers at reasonable prices, especially the middle-income buyers,” he says.

IDEAS’ Wan Saiful calls previous measures to address affordability ineffective, due to a mismatch between the price of what people can afford and what developers are building. “Many people continue to see their salaries and wages being too low relative to the fast rising costs of living and house prices, resulting in them finding it difficult to obtain mortgages. We need to tackle both the supply and demand challenges.”

Foo declares that there were winners and losers in Budget 2017. “On the one hand, property investment activity is likely to be suppressed. On the other, the measures bring in new sources of demand as barriers to the market are lowered, presumably for genuine homebuyers such as first-time homebuyers and young working adults,” he says.

This story first appeared in EdgeProp.my pullout on Oct 6, 2017. Download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

HIJAYU 3A @ BANDAR SRI SENDAYAN

Seremban, Negeri Sembilan

RIMBUN IRAMA @S2 HEIGHTS

Seremban, Negeri Sembilan

Taman Sentosa, Bukit Baru

Melaka Tengah, Melaka