IOI Properties Group Bhd (June 13, RM2.10)

Maintain buy with a target price of RM2.57: IOI Properties Group Bhd has announced that it entered into a memorandum of agreement with Hongkong Land International Holdings Ltd (HKLI) to jointly own and undertake the development and management of the land parcel that IOI Properties successfully tendered for in November last year.

HKLI is a wholly-owned subsidiary of Hongkong Land Holdings Ltd. Recall that IOI Properties won the tender for a 2.7-acre (1.1ha) parcel of leasehold land in Central Boulevard from Singapore’s Urban Redevelopment Authority (URA) with an aggressive winning bid of S$2.57 billion, translating into S$1,689 per sq ft per plot ratio. The development would comprise two office towers with 1.26 million sq ft net lettable area and a small retail podium measuring 30,000 sq ft.

The formalisation of the joint venture (JV) agreement is subject to approval from URA (due to the change in shareholding structure), as well as Bank Negara Malaysia (due to the change in the corporate guarantee relating to the bridging loan and novation of shareholder loan). According to the announcement, the land would be transacted at S$2.84 billion (RM8.66 billion) for the JV, which is also inclusive of goods and services tax and stamp duty incurred apart from the original land cost. With a JV stake of 67% for IOI Properties and 33% for HKLI, the latter would contribute S$940 million to the JV, and the proceeds would be used to reduce IOI Properties’ existing bridging loan and some corporate guarantees. The proposed JV is expected to be completed by the first quarter of 2018.

Rising net gearing and significant funding requirements needed to develop the Central Boulevard land on its own have been investors’ key concerns over IOI Properties since the company successfully won the tender at the end of last year. With this JV, we believe that the participation of HKLI would help ease the cash flow burden over IOI Properties. In the meantime, we believe HKLI would also enhance the value of the properties, as it currently manages both One Raffles Quay and Marina Bay Financial Centre — Central Boulevard is located between these two properties. Thus, we think there would be seamless connectivity between these buildings as they share the same asset manager in HKLI.

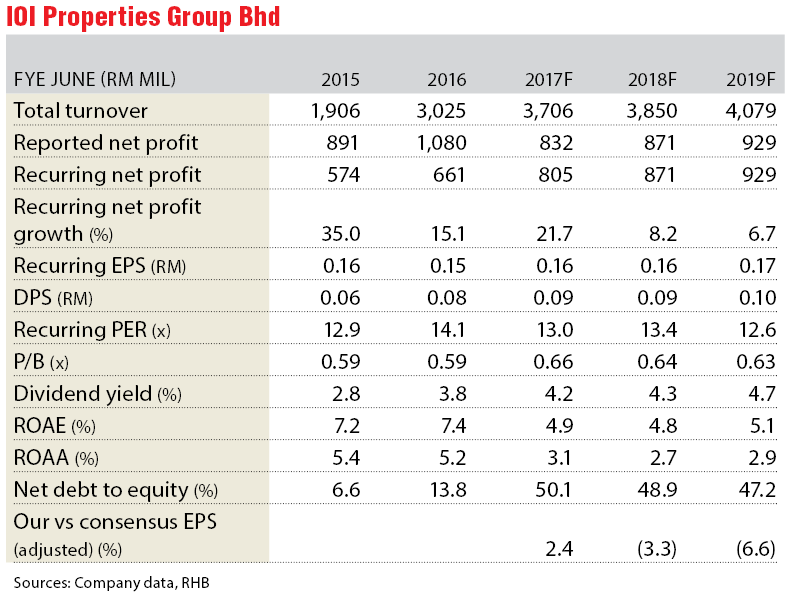

As the funding structure for the construction loan has yet to be finalised, we keep our net gearing projections unchanged for now. Nevertheless, we believe this latest JV would make funding requirement more manageable for IOI Properties and hence cash flow would be less affected by the Central Boulevard project. — RHB Research, June 13

This article first appeared in The Edge Financial Daily, on June 14, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Suadamai, Bandar Tun Hussein Onn

Cheras, Selangor

Taman Nusa Sentral

Iskandar Puteri (Nusajaya), Johor

The Tropika Bukit Jalil

Bukit Jalil, Kuala Lumpur

Suadamai, Bandar Tun Hussein Onn

Cheras, Selangor