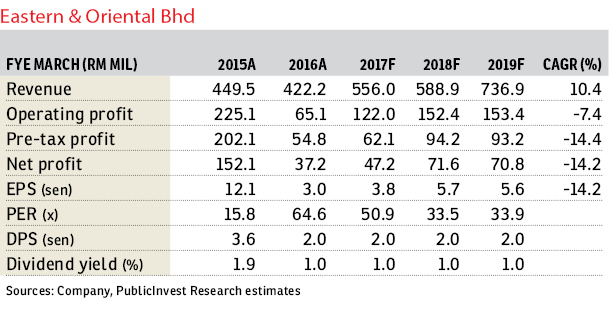

Eastern & Oriental Bhd (May 3, RM1.89)

Maintain neutral with a higher target price (TP) of RM2: A recent meeting with management revealed that Eastern & Oriental Bhd (E&O) is working on disposing of more non-core assets to lighten its debt load despite the recent announcement that it has successfully roped in Kumpulan Wang Persaraan (Diperbadankan) (KWAP) as its strategic partner for Seri Tanjung Pinang Phase 2A (STP2A), which is estimated to raise RM900 million for E&O via RM130 million in restricted issue stocks and RM766 million for its 20% stake in STP2A.

To recap, its total capital commitment for STP2A is estimated at RM1.8 billion (including infrastructure costs) and it still has 507 acres (205ha) remaining to be reclaimed in other phases. The assets that could be disposed of, among others, include its hotels (such as Straits Quay and Lone Pine) and certain land banks that could collectively be sold for more than RM400 million.

Also, it could also dispose of its overseas landbank that was purchased for more than RM450 million a few years back. This is important, in our view, to manage its gearing (currently at about 0.74 times) and liquidity.

As for STP2A, while the emergence of KWAP as its strategic partner is positive, the key issue is still selling the properties with the average selling price (ASP) said to be around RM1,300 per sq ft (psf) for the proposed new projects.

To recap, sales for Andaman Condominium are still slow with only about 50% sold so far (Block 1G and 1H were launched back in 2012 and 2013 respectively at RM1,300-RM1,400 psf ASP). Maintain “neutral” but TP is nudged higher at RM2 (from RM1.80 previously), pegged at 50% discount to revalued net asset value.

E&O is working on disposing of certain assets such as Straits Quay Retail (270,000 sq ft net lettable area, RM233 million book value), Lone Pine Hotel (90 rooms, RM69 million book value) and certain non-strategic land banks such as its 0.9-acre piece of land at Jalan Liew Weng Chee (off Jalan Yap Kwan Seng) that has a market value of RM55 million.

If the price is right, it will also offload its overseas undeveloped land bank, that is Hammersmith and Esca, which were purchased for a total of RM450 million. Hence, the potential proceeds from the resource conversion are estimated to be about RM900 million.

Together with KWAP’s investment, the total capital of RM1.8 billion will be handy for its capital expenditure and focus on generating cash and strengthening balance sheets.

While positive with the emergence of KWAP as its 20% equity partner for STP2A, we believe that the group still needs to scour for partners that could open more new markets for its mammoth development in STP2.

Sales for Andaman Condominium are still slow with the ASP of RM1,300-RM1,400 psf, which are incidentally also the touted selling prices for STP2A. Hence, we reckon that unless the group starts selling in new markets, it will be challenging for STP2 to reap in sales, given the currently tough trading environment.

As for progress, Phase 2A works have commenced and are on track to be completed by June 2018. — PublicInvest Research, May 3

This article first appeared in The Edge Financial Daily, on May 4, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Pulau Indah Industrial Area

Pulau Indah (Pulau Lumut), Selangor

Taman Perindustrian Puchong

Puchong, Selangor