AEON Co (M) Bhd (April 12, RM2.40)

Maintain hold with a lowered target price (TP) of RM2.47: Based on our recent meeting with AEON Co (M) Bhd, we gather that AEON will continue to carry out renovations at existing malls and open new malls/stores.

We believe that earnings are likely to recover from their low base in financial year 2016 (FY2016) as the retail segment recovers slowly alongside consumer sentiment and margins improve.

Recent renovation works have given some of AEON’s malls and stores a new style and layout to cater to consumers’ healthy lifestyle demands. The more notable and upcoming large renovation would be at AEON Taman Maluri, which is estimated to be completed in the first quarter of 2019 (1Q2019), and would require an estimated capital expenditure of RM300 million.

In line with its strategy to open at least one mall a year, AEON is planning to open AEON Kempas, Johor Baru in 3Q2017 and AEON Kuching in 2018.

The retail segment is still weak but should have bottomed out. The FY2016 retail revenue grew 4.6% year-on-year (y-o-y) amid the weak consumer sentiment due to contributions from two new shopping malls in FY2016 (AEON Shah Alam in March 2016 and AEON Kota Baru in April 2016).

However, the retail earnings before interest and tax (Ebit) margin fell by 1.3 percentage points (ppts) to 0.1%, reducing retail Ebit by 92.6% to RM3.3 million because of the increased operating expenses due to the initial gestation period for new stores.

Property management provides more stable recurring income. The FY2016 property management segment grew by 9.8% y-o-y, accounting for 98% of FY2016 Ebit, also due to new mall openings.

We gather that the average occupancy rate is at 90%, while rental reversion is somewhat flat in this challenging property market. Nonetheless, this segment provides stable recurring rental income, mimicking characteristics of real estate investment trusts.

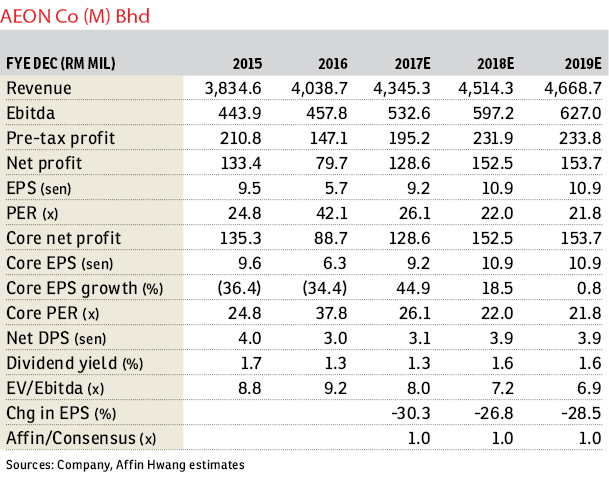

We reduce our earnings forecasts by 27%-30% for FY2017-FY2019 as we forecast higher depreciation charges, higher interest expenses on funding the renovation/expansion works and higher taxes.

While this year continues to be challenging, especially for the retail segment, earnings should see an improvement from their low FY16 base as consumer sentiment gradually improves and fewer stores remain loss-making, which should improve the retail margin. We maintain a “hold” with a lower 12-month TP of RM2.47 (from RM2.65) based on 27 times 2017 earnings per share (EPS) which is in line with its five-year average price-earnings ratio (previously based on 20 times 2017 EPS).

Key risks include: i) higher- or lower-than-expected domestic consumer spending; and ii) lower- or higher-than-expected operating expenses. — Affin Hwang Capital, April 12

This article first appeared in The Edge Financial Daily, on April 13, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Flat Tasek 64, Bandar Baru Seri Alam

Masai, Johor

Seksyen 8, Kota Damansara

Kota Damansara, Selangor

Taman Suria

Jalan Klang Lama (Old Klang Road), Kuala Lumpur

City Garden Palm Villa Condominium

Ampang, Selangor