LBS Bina Group Bhd (March 9, RM1.96)

Maintain outperform call with an unchanged target price (TP) of RM2.23: The group announced on Wednesday that its 51.9%-owned subsidiary Biz Bina Development Sdn Bhd has entered into a joint development agreement with YPJ Plantations Sdn Bhd (YPJ) for the proposed development of a 541.4-acre (219ha) plot of leasehold land in Sg Tiram, Johor.

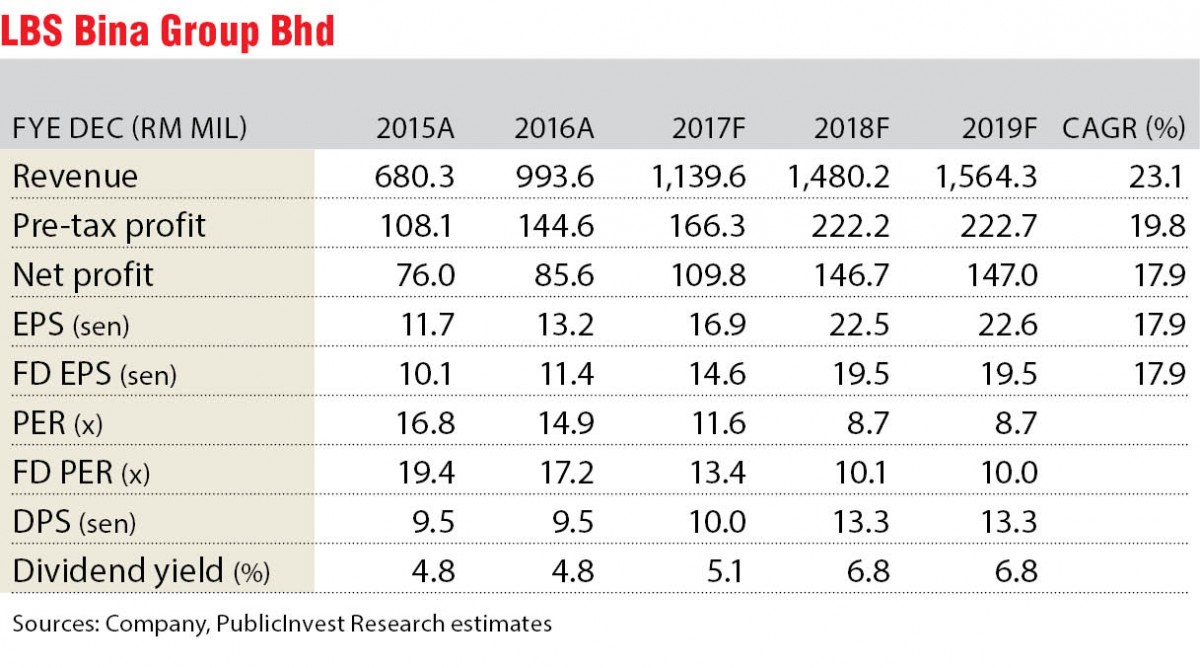

We are positive on this as it further solidifies the group’s long-term prospects in the area of mid-market housing development. Total future land bank is now just over 4,000 acres with a gross development value (GDV) of about RM30 billion.

While it skews total land bank to being slightly Johor-centric again, a large portion of its income remains Klang Valley-based.

With the group currently undertaking 15 ongoing projects against the backdrop of a record-high unbilled sales amount of RM1.41 billion, the company remains primed for sustained growth in the coming few financial years.

The plot of land is situated near the towns of Kulai, Senai, Kota Tinggi and Bandar Tenggara. About 46km from Johor Bahru and 26km from the Senai International Airport, the land is just opposite the Orchard Golf & Country Resort and near Kolej Yayasan Pelajaran Johor.

Based on initial plans, the land will be developed into a mixed township comprising residential and commercial units including Perumahan Rakyat Johor, with an estimated GDV of RM2.6 billion, and to be realised over eight to 10 years.

As landowner, YPJ will be entitled to 7.5% of the GDV, or a minimum guaranteed sum of RM194.9 million.

Management has indicated launches to the tune of RM2.35 billion this year. The sales target of RM1.5 billion, 25% higher than 2016’s RM1.2 billion, will be underpinned by its flagship Bandar Saujana Putra, which will see some RM678 million (29%) worth of properties launched.

Other major contributors are its Alam Perdana project (RM420 million, 18%), CyberSouth Project in Dengkil (RM278 million, 12%), the Langit and Lake project in Bandar Putra Perdana (RM372 million, 16%), Centrum @ Cameron Highlands (RM184 million, 8%) and Bukit Jalil (RM170 million, 7%). — PublicInvest Research, March 9

This article first appeared in The Edge Financial Daily, on March 10, 2017.

For more stories, download TheEdgeproperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Pulau Indah Industrial Area

Pulau Indah (Pulau Lumut), Selangor

Taman Perindustrian Puchong

Puchong, Selangor