SINGAPORE (Jan 13): CIMB is keeping its “overweight” call on Singapore developers on the back of attractive valuations and growth opportunities as the supply overhang passes.

The research house believes there is “little downside risk” as the sector is trading at a 40% discount to revalued net asset valuation (RNAV), close to 1 standard deviation below the mean.

“With low gearing and deep capacity for reinvestment, we think that developers are well paced to tap into new opportunities,” says CIMB lead analyst Lock Mun Yee in a Wednesday report.

“We think potential key catalysts that would spur share prices are landbanking for growth, the office sector declining to trough and M&A opportunities,” she adds.

Here are CIMB’s top 3 Singapore developer picks as the light at the end of the property tunnel beckons.

UOL Group

Trading at a 36% discount to RNAV, UOL is CIMB’s top pick among developers.

CIMB has an “add” rating on UOL with a target price of S$7.96.

“UOL has a high recurring income base, underpinned by rentals, hotel operations and investment holdings,” says Lock.

In addition, Lock adds that potential corporate exercises as UOL raises its total deemed stake in associate UIC to 49.63% could boost value and narrow its discount to RNAV.

As at 3.30pm, UOL is trading 5 Singapore cents higher at S$6.29.

City Developments

While City Dev’s Singapore residential earnings has slowed down, CIMB believes an acceleration in overseas contributions from China and the UK could spur earnings growth.

CIMB has an “add” rating on City Developments with a target price of S$10.40.

“In addition, City Developments’ active capital recycling and low gearing would enable the group to tap into new investment opportunities,” says Lock.

As at 3.40pm, City Developments is trading 13 Singapore cents higher at S$8.86.

CapitaLand

CIMB believes CapitaLand’s ROE-boosting capital recycling activities should boost its RNAV in the medium term. The stock is currently trading at 40% discount to RNAV, and

CIMB has an “add” rating on CapitaLand with a target price of S$4.17.

“CapitaLand has a four-pronged strategy in place to drive growth by strengthening its core businesses, evolving its business model to real estate investment and operating platform, expanding AUM and fee income, as well as staying relevant in the real estate of the future,” says Lock.

As at 3.48pm, CapitaLand is trading 3 Singapore cents higher at S$3.16. — theedgemarkets.com.sg

TOP PICKS BY EDGEPROP

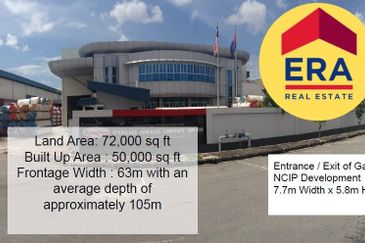

Nusa Cemerlang Industrial Park

Gelang Patah, Johor

Dorset Place @ Taman Lapangan Setia

Ipoh, Perak

Damansara City Residency

Damansara Heights, Kuala Lumpur

Damansara City Residency

Damansara Heights, Kuala Lumpur

Residensi Zamrud (Zamrud Residensi)

Kajang, Selangor