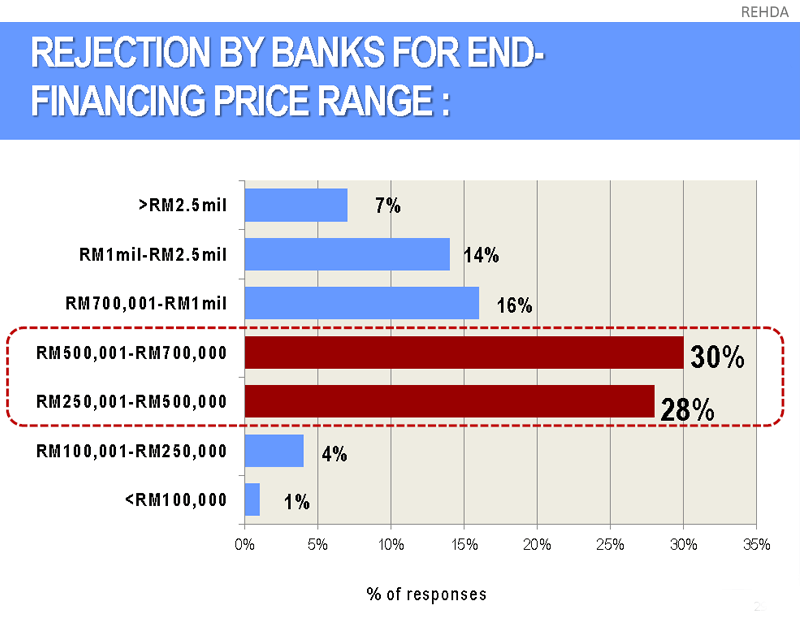

PETALING JAYA (March 9): Properties priced from RM500,001 to RM700,000 are the most vulnerable to loan rejection, according to almost a third of 159 respondents to the Real Estate Housing Developers Association of Malaysia (Rehda) property industry survey 2H2015.

About 30% of respondents agreed that properties priced from RM500,001 to RM700,000 faced the highest rejection rates, while 28% of respondents said properties priced from RM250,001 to RM500,000 faced the highest rejection rates, whereas 16% of respondents said properties from RM700,001 to RM1 million were most likely to experience financing issues.

“Currently, the RM200,001-RM500,000 priced residential houses are still the most launched in the market for six states in 2H2015 – Kedah, Kelantan, Pahang, Perak, Melaka and Terengganu. Subsequently, the most launched houses priced in the RM500,001-RM1 million segment for 2H2015 are for the states of Negeri Sembilan, Selangor, Penang, Johor and Wilayah Perseketuan,” said Rehda president Datuk Seri Fateh Iskandar Mohamed Mansor who presented the survey findings to the media this morning.

According to him, the high loan rejection rate will really impact aspiring homebuyers, especially those who are buying for the first time.

“We note that first-time homebuyers have increased from 36% in 1H2015 to 47% in 2H2015 while investors have decreased from 23% in 1H2015 to 13% in 2H2015. The survey also noted that 62% of buyers say they buy for their own stay, so most of the buyers are really purchasing for self-dwelling and not for speculation,” he noted.

The survey – held from July to December last year – was carried out by Rehda to assess the property market performance for 2H2015, the property market outlook for 1H2016 and the sentiment of developers on 2H2016.

He said there is no denying that there are speculators, but their numbers are very minimal.

“The figures are really insignificant and they do not impact the property market at all,” he said.

Commenting on whether the high household debt is the reason for the rejection, he noted that approximately 30% of it comprise mortgages, 20% automobile loans and while the rest is made up of credit cards and personal loans.

“As compared to other countries such as Australia, their current household debt is standing at approximately 82%, with mortgages constituting almost 70%, so our country’s figure is little as compared to theirs,” he noted.

He cited that Malaysia’s household debt currently stands at 86.6% of gross domestic product (GDP) according to Bank Negara Malaysia’s figures.

According to the survey, 62% of the respondents agreed that the developers interest bearing scheme (DIBS) should be reinstated for properties below RM500,000 for first-time homebuyers, with 65% of them expressing that DIBS will help to improve their sales performance.

“We are not asking for DIBS to be given to all homebuyers, but for those who genuinely want to own their own house for the first time. This will ensure that there is no speculation in property prices, yet the right people will benefit from them,” he said.

TOP PICKS BY EDGEPROP

Country Heights Kajang

Country Heights, Selangor

Almyra Residences @ Bandar Puteri Bangi

Bangi, Selangor

Kuala Terengganu Golf Resort

Kuala Terengganu, Terengganu

Rumah Rakyat Lubok China

Linggi, Negeri Sembilan