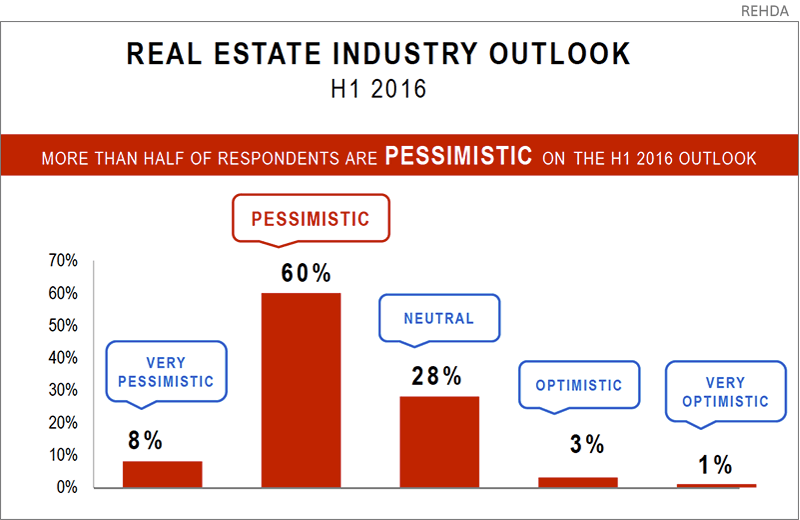

PETALING JAYA (March 9): Almost 70% of 159 respondents to the Real Estate Housing Developers Association of Malaysia (Rehda) property industry survey 2H2015 remained pessimistic on the property market for 1H2016.

PETALING JAYA (March 9): Almost 70% of 159 respondents to the Real Estate Housing Developers Association of Malaysia (Rehda) property industry survey 2H2015 remained pessimistic on the property market for 1H2016.

The survey – held from July to December last year – was carried out by Rehda to assess the property market performance for 2H2015, the property market outlook for 1H2016 and the sentiment of developers about 2H2016.

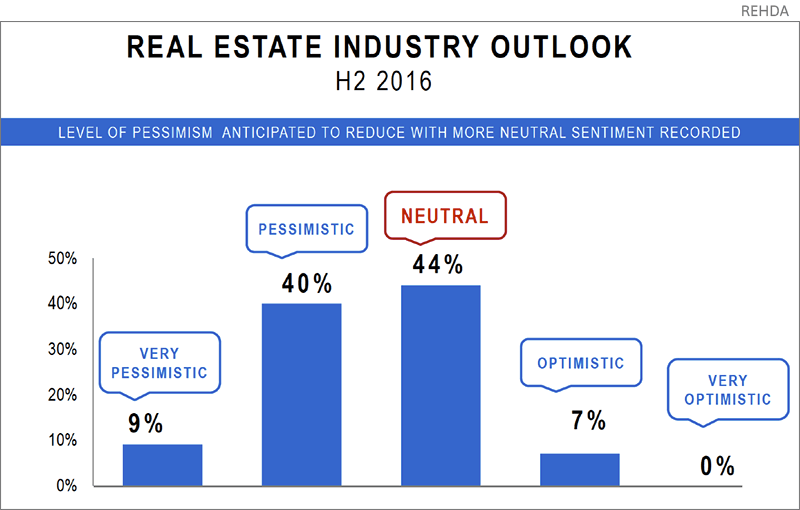

“However, we note that the level of pessimism is anticipated to decrease with more neutral sentiment recorded at 44% for 2H2016 as compared to 28% for 1H2016,” said Rehda president Datuk Seri Fateh Iskandar Mohamed Mansor (pictured, right), who presented the survey findings to the media this morning.

He also noted that fewer developers had a gloomy outlook for the property market in 2H2016 – about 50% of developers said they were pessimistic about the state of the market during the period, compared with 68% who said they were pessimistic about the market in 1H2016.

However, more developers may change their views, depending on certain factors in the market, he said.

“It depends a lot on the market condition this 1H2016. Factors such as the response from the public and the take-up rate of properties will play a role. If they show positive figures, the negative outlook from the developers may be reduced even further,” he added.

“Some of the reasons for the negative outlook include the rejection by banks for end-financing and the increasing construction cost that the developers have to bear,” he explained.

According to FD, prices of some construction materials such as steel had stabilised but prices of other materials such as sand have doubled from RM21 to RM42 from January 2013 to December 2015.

“Another issue related to construction cost is the high labour cost. We at Rehda understand that the government has to set proper rules and ensure that proper licencing is obtained for foreign workers. However, at the same time, we hope that foreign workers who have worked here for the past two to three years and gained proper training are able to get their licence extended or approved instead of being sent back. If not, we have to hire new workers and start the training process again, which will raise the cost,” he explained.

According to the survey, only 42% of the respondents said they launched projects in 2H2015, a 6% drop from 1H2015.

Moreover, the number of units launched fell by 891 to 9,938 units for 2H2015 from 10,829 units in 1H2015.

However, the survey did note that there was an increase in sales performance from 40% in 1H2015 to 52% in 2H2015.

“For 1H2016, we see that almost 80% of respondents are anticipating sales of below 50%. Part of the reason is that the sales conversion takes time, from the time the booking is done all the way to the approval stage,” he said.

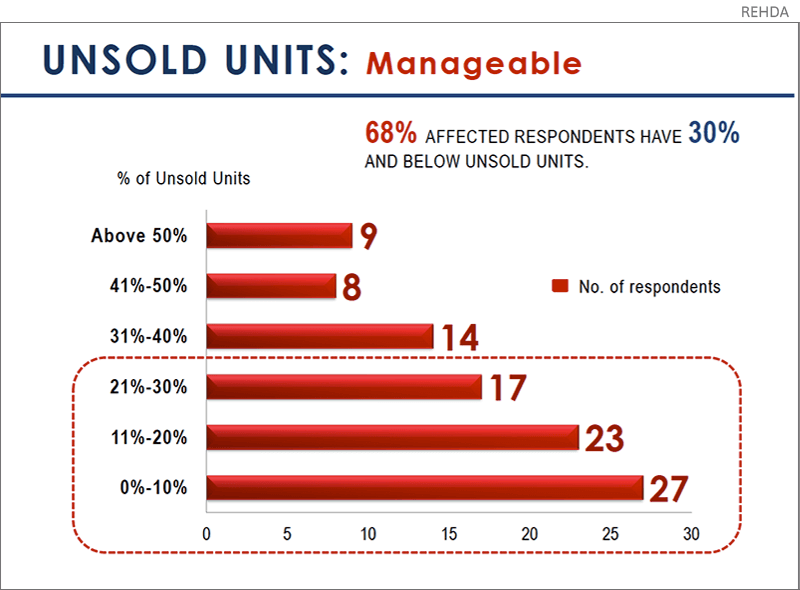

In 2H2015, 62% of respondents said they had unsold stock – mainly from Selangor, Johor and Pahang – compared with 78% in 1H2015.

Meanwhile, almost two-third of the affected respondents feel that their unsold units are still at a manageable level, with up to 30% of units remaining unsold on their hands.

The number of first-time buyers in 2H2015 also rose to 47% from 36% in the previous period, while investors only accounted for 13% of buyers, down from 23% in 1H2015.

TOP PICKS BY EDGEPROP

D'Pristine Medini

Iskandar Puteri (Nusajaya), Johor

Medan Idaman Business Centre

Setapak, Kuala Lumpur

Kundang Industrial Park (Kawasan Perindustrian Kundang)

Rawang, Selangor