Eastern & Oriental Bhd (April 6, RM1.66)

Maintain buy with a target price (TP) of RM2.40: Eastern & Oriental Bhd (E&O) could see unrealised foreign exchange (forex) losses in the fourth financial quarter ended March 31, 2016 (4QFY16) for its UK property investment due to the 13% depreciation of the British pound against the ringgit. The proposed listing of its UK operation has been delayed due to the weak UK stock market conditions. We believe these concerns are reflected in the current share price. We see the potential entry of a strategic partner to develop Seri Tanjung Pinang Phase 2 (STP2) as an upward rerating catalyst for the stock.

Market uncertainties due to Brexit concerns have delayed E&O’s plan to list its UK operation on the London Stock Exchange’s Alternative Investment Market as potential investors are cautious about new initial public offerings (IPOs).

The translation of the £54.5 million (RM301.19 million) loan to its UK subsidiary into ringgit could lead to unrealised forex loss of about RM47 million in 4QFY16, based on our estimate. But offsetting that is unrealised forex gain of RM43 million for the nine financial months ended Dec 31, 2015 (9MFY16), giving an estimated net forex loss of RM4 million in FY16.

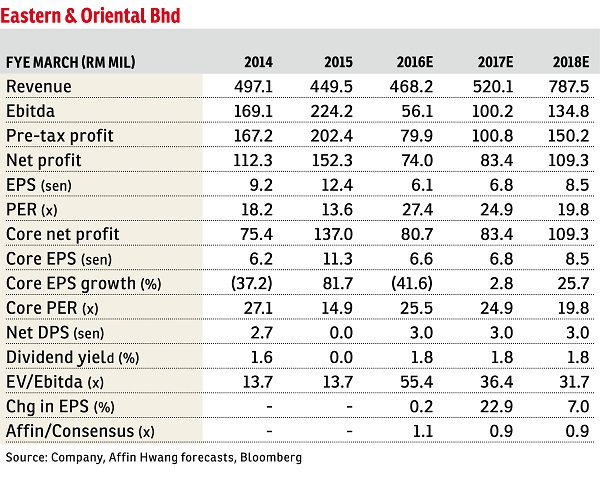

The change in Strata Title Act 1985 led to delays in recognising the strong presales for its Tamarind Condominium in Penang with close to 90% take-up rate for total gross development value (GDV) of RM950 million. Total domestic presales of over RM1 billion in FY16 is a new high for E&O, a sharp increase from RM672 million in 9MFY16. We estimate unbilled sales of RM1.2 billion as at end-FY16, equivalent to 2.7 times FY15 revenue, will support long-term earnings growth. We upgrade our earnings per share forecasts by 7% to 23% for FY17 to FY18 to reflect the higher-than-expected presales.

E&O is targeting to secure a strategic partner to take up to a 40% stake in the STP Phase 2A project (253 acres [102ha]) by June or July, partially unlocking the value of its reclamation rights. We gather that the GDV of Phase 2A could be RM20 billion to RM21 billion and hence our assumed GDV of RM25 billion for the entire STP2 (760 acres) is conservative.

We believe that the current share price does not attribute any value to its STP2 project. E&O remains one of our top picks among the Malaysian property stocks and top country pick. Key risks to our positive call would be slow property sales and execution risk on the STP2 project. Maintain “buy” with target price of RM2.40, based on a 40% discount to revalued net asset valuation. — Affin Hwang Investment Bank Bhd, April 6

Start your search for a condominium of your choice HERE.

This article first appeared in The Edge Financial Daily, on April 7, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

TAMAN PADANG TEMU PERMATA

Melaka Tengah, Melaka

Graham Garden @ Eco Grandeur

Bandar Puncak Alam, Selangor

Taman Makmur, Telok Panglima Garang

Telok Panglima Garang, Selangor

Savanna Executive Suites @ Southville City

Bangi, Selangor

Bandar Sri Damansara

Damansara, Kuala Lumpur

Setia Indah 9, Setia Alam

Shah Alam, Selangor

Saville Residence

Jalan Klang Lama (Old Klang Road), Kuala Lumpur

Sendayan Tech Valley Industrial Park

Siliau, Negeri Sembilan