Just like how retailers offer discounts to keep sales up during a slow period, developers also have a few tricks up their sleeves to sell their properties amidst the current unfavourable economic climate. Besides attractive promotions and perks to draw buyers, some companies are open to bulk sale and underwriting deals, in which purchasers can enjoy reduced prices.

The slowdown has seen some developers accepting bulk sales as minimal as 10 units, says Malaysian Institute of Estate Agents (MIEA) national vice-president Lim Boon Ping. “The number of units were much bigger when the market was better, but things have changed,” he tells TheEdgeProperty.com.

CBD Properties group managing director Datuk Adrian Wang concurs that buyers and investors will definitely be getting more bulk purchase opportunities in a market slowdown as some developers may be laden with a high number of unsold units.

Compared with property underwriting deals, developers will often offer higher price cuts in a property bulk sale as it usually involves a group of genuine buyers or investors, Wang points out.

“There is more uncertainty in property underwriting deals because they may not be able to sell all the units underwritten.”

Although buyers can get more discounts under bulk buying, Wang warns buyers to be careful. “You can buy a property at a lower price today, but you might lose more in the future because there could be other possibilities behind the cheaper prices.”

For instance, the properties might be sitting in an unfavourable location, or it may turn out to be of bad quality, or may even end up being abandoned by the developer.

As such, he urges buyers to not just focus on the price of a property but also take note of its location and the developer’s reputation. “You can buy at a higher price, but you should never buy in a wrong location,” he stresses.

MIEA’s Lim also does not encourage normal buyers to take part in bulk buying due to the possible risks involved.

“With the tightened lending policy by banks, it is very difficult for property buyers to get a loan. In view of this, if one buyer in a group that has already reached an agreement with a developer to do property bulk purchase fails to get a loan, the group has to find someone to replace the buyer or the entire deal will have to be re-negotiated,” he explains.

If this problem cannot be solved within a certain period, the bulk purchase deal will lapse and the developer will forfeit the deposit. Hence, Lim doesn’t think it is worth the risk.

There is also a risk of the developer giving a different discount when they sell the property to other buyers, he adds.

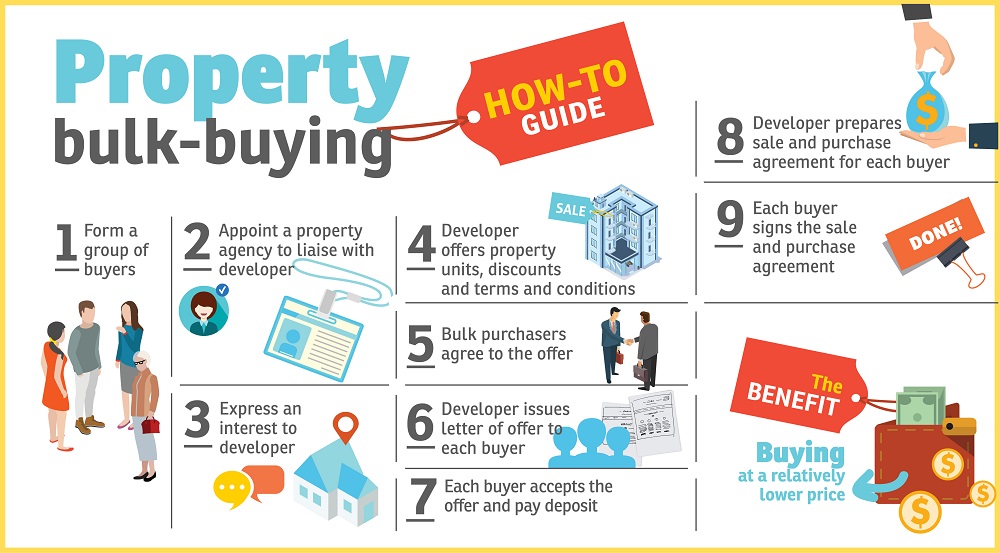

What is property bulk purchase?

However, for some real estate negotiators such as Chester Properties Sdn Bhd group marketing director Jei Chew, there are several benefits to bulk buying through a real estate agency.

It is easier to negotiate with a developer as a group as a normal buyer may lack confidence negotiating with the developer. On top of that, a developer may be reluctant to take the risk of dealing with a group of strangers, unless they have reputable investors in the group.

Generally, bulk buyers could receive discounts of between 3% and 5% after negotiations, says Chew.

Upon receiving the interest from buyers, a developer will offer the property units available for the bulk purchase, the proposed discounts and related terms and conditions, says Wang.

The developer will then issue a letter of offer to each buyer once all of them have agreed on the offer. Once the letter of offer is accepted, each buyer has to pay the deposit, after which the developer will prepare the Sale and Purchase Agreement for each buyer, explains Wang.

“For a group of buyers who are unfamiliar with the process, they might want to appoint a property agency to help them negotiate with the developer,” he suggests.

According to Chur Associates founder and lawyer Chris Tan, an entity such as an individual person, private firm or a limited liability partnership that buys more than four units is considered bulk buying and the developer has to register the sale with the Urban Wellbeing, Housing and Local Government Ministry.

“This is a guideline issued by the ministry and sometimes it will appear as a condition under the advertising permit and developer’s licence,” he adds.

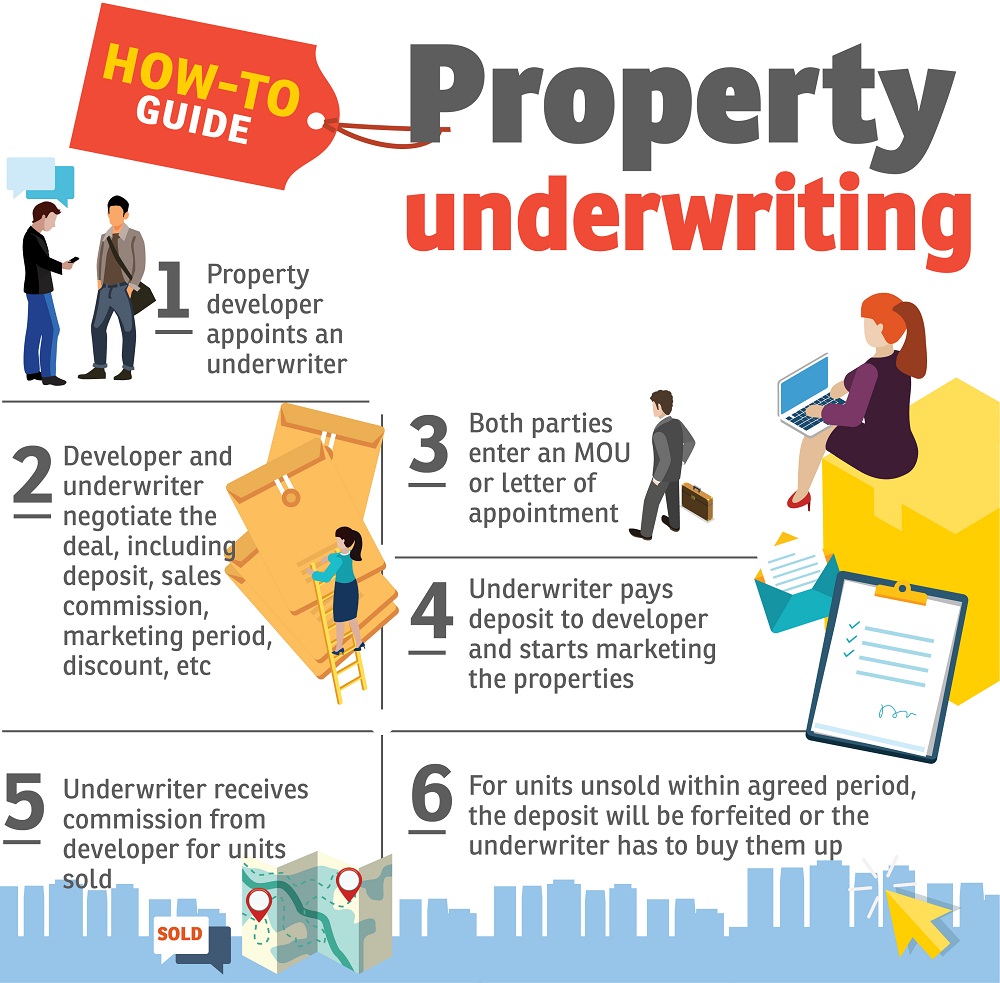

What is underwriting?

Buying from a property underwriter is another way for buyers to acquire properties at a lower price as the underwriter may pass on the discount to the buyer, says Wang.

However, sometimes there is no difference between buying from a developer and an underwriter, he notes. “Whether there is a discount or not, it is subject to the agreement between the developer and the underwriter.”

He explains that property underwriting occurs when a developer appoints an underwriter, which can be a funding house, a property agency or a group of investors, to help the developer sell its properties, en bloc or individually, within a mutually agreed period of time. In some cases, a developer may be approached by an underwriter offering its service, he adds.

A developer will negotiate the terms and conditions of the deal with the underwriter, including the sales period, commission rate and underwriting discount, before both parties sign a memorandum of understanding (MoU), he elucidates.

The underwriter has to pay a deposit to the developer. “The underwriter usually gets some discount from the developer on the properties which are underwritten by them and they will be given a period of three to six months to sell, depending on the terms and conditions of the MoU. They will get a commission for the properties sold, but if any of the properties remain unsold within the set time period, the underwriter will have to buy them or forfeit the deposit,” offers Wang.

While it is possible for individual buyers to buy properties at a discounted price from the underwriter, Wang points out that some underwriters may not pass on the price cut as they want to earn some profit from the deal.

“Property underwriting is usually a private and confidential business deal between a developer and an underwriter, so the deal is not so clear cut,” says Wang. In some cases, unethical underwriters could claim that they are the owners of the property when selling it, he cautions.

Hence, it is better for buyers to enlist the underwriting services provided by professional real estate agencies. “The property agency will help buyers to project comparisons on which would be a good investment, to help them make better decisions. Furthermore, the agency can help the buyer resell or look for tenants later.”

From a property agency’s perspective, Chew of Chester Properties reckons that property underwriting could be a good business strategy for an agency during a weak market.

“Many people say that it is hard to do business in the current slowdown, but in my opinion, the economy is not as bad as people think and we can still achieve good results with the right strategy. This is why we decided to do this bulk purchasing deal,” he says. Chester Properties had undertaken several underwriting deals including for The Duo @ USJ 1, Boulevard 51 and Suria Residence. Early this year, it had also inked an agreement with I-Bhd to underwrite 30 units in i-Suite and 120 units in i-SoHo located at i-City in Shah Alam.

Chew says Chester Properties came out with a marketing campaign after inking the agreement and the units were fully sold within a short period, with most buyers being individual young investors.

“We received some discount from I-Bhd which were passed on to end buyers,” says Chew.

This story first appeared in TheEdgeProperty.com pullout on Nov 18, 2016, which comes with The Edge Financial Daily every Friday. Download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Henna Residence @ The Quartz

Wangsa Maju, Kuala Lumpur

M Adora @ Wangsa Melawati

Wangsa Maju, Kuala Lumpur

M Adora @ Wangsa Melawati

Wangsa Maju, Kuala Lumpur

The Ridge @ KL East (Residensi Rabung KL Timur)

Setapak, Kuala Lumpur

Sunway Avila Residences

Wangsa Maju, Kuala Lumpur

S2 HEIGHTS(SEREMBAN 2)

Seremban, Negeri Sembilan

LSH33 ( Laman Seri Harmoni )

Sentul, Kuala Lumpur

M Adora @ Wangsa Melawati

Wangsa Maju, Kuala Lumpur

M Adora @ Wangsa Melawati

Wangsa Maju, Kuala Lumpur

Sunway Rydgeway Puncak Melawati

Taman Melawati, Selangor

Kenwingston Platz Residence

Setapak, Kuala Lumpur

Henna Residence @ The Quartz

Wangsa Maju, Kuala Lumpur

M Adora @ Wangsa Melawati

Wangsa Maju, Kuala Lumpur

M Adora @ Wangsa Melawati

Wangsa Maju, Kuala Lumpur

The Ridge @ KL East (Residensi Rabung KL Timur)

Setapak, Kuala Lumpur

Sunway Avila Residences

Wangsa Maju, Kuala Lumpur

S2 HEIGHTS(SEREMBAN 2)

Seremban, Negeri Sembilan

LSH33 ( Laman Seri Harmoni )

Sentul, Kuala Lumpur

M Adora @ Wangsa Melawati

Wangsa Maju, Kuala Lumpur

M Adora @ Wangsa Melawati

Wangsa Maju, Kuala Lumpur

Sunway Rydgeway Puncak Melawati

Taman Melawati, Selangor

Kenwingston Platz Residence

Setapak, Kuala Lumpur