Gadang Holdings Bhd (Nov 14, RM2.63)

Upgrade to buy with an unchanged target price (TP) of RM3.50: We are positive about Gadang Holdings Bhd’s medium-term earnings visibility, coupled with longer-term growth prospects for other business units. Together with its earlier proposed one-into-two share split, one-for-four bonus issue and one-for-four free warrant (on subdivided shares) with entitlements projected by the end of November, the recent selldown resulting in the stock trading at more than seven times forward price-earnings ratio (PER) presents a good buying opportunity, in our view.

We upgrade the stock to “buy” and maintain our sum-of-parts-based TP of RM3.50, which implies a forecast financial year ending May 31, 2017 (FY17F) PER of 9.2 times versus the small-cap construction sector PER of 10 to 12 times. Key risks include inability to replenish its construction order book, a significant slowdown in the local property sector and hikes in input costs.

Last week, we hosted a corporate digest series with Gadang’s management for our institutional clients. The knee-jerk selldown in the company’s stock post-release of its slow first quarter ended Aug 31, 2016 (1QFY17) results may have prompted some fund managers and buy-side analysts to revisit the counter, in our view.

While Gadang has yet to win any construction jobs thus far in FY17, its management appears confident of at least maintaining its robust earnings recorded in FY16. The outstanding construction order book (RM604 million as at August) that is partly made up of variation order (VO) claims and unbilled property sales (RM211 million as at September) should provide strong earnings visibility over the next 12 to 18 months. Separately, its utilities unit continues to churn out stable earnings from four water supply concessions in Indonesia — more than offsetting minor losses at its plantations.

Gadang has established itself as a niche player in large-scale earthwork contracts. With its track record in mass rapid transit (MRT) Line 1, we see a good chance for it to play a role in MRT Line 2. Meanwhile, its tender book of about RM5 billion includes hospital and expressway jobs. The company is also keen on participating in the light rail transit 3 and high-speed rail projects. We deem our RM300 million to RM500 million annual order book replenishment assumption to be prudent.

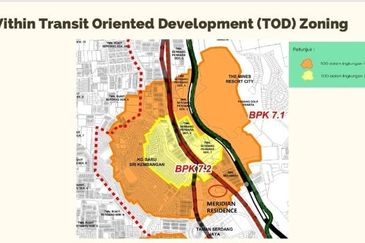

Aside from existing land banks, Gadang was recently awarded the development rights for a 24.08-acre (9.74ha) plot called R3-1 within the Kwasa Damansara township by the master developer, Kwasa Land Sdn Bhd, with an estimated gross development value of RM700 million. Management expects its 2,600 acres of planted oil palm with an average age of between four and five years to start contributing positively from FY18, while contributions from the 60%-owned 9mw new hydro power plant in Indonesia should begin from FY19. — RHB Research Institute, Nov 14

This article first appeared in The Edge Financial Daily, on Nov 15, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Kampung Baru Seri Kembangan

Seri Kembangan, Selangor

Taman Perindustrian Bukit Serdang

Seri Kembangan, Selangor

Kawasan Perindustrian Nilai

Nilai, Negeri Sembilan

Kawasan Perindustrian Nilai 3

Nilai, Negeri Sembilan

Bandar Bukit Tinggi

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Section 19 (Seksyen 19) @ Shah Alam

Shah Alam, Selangor