Eco World Development Group Bhd (Sept 28, RM1.32)

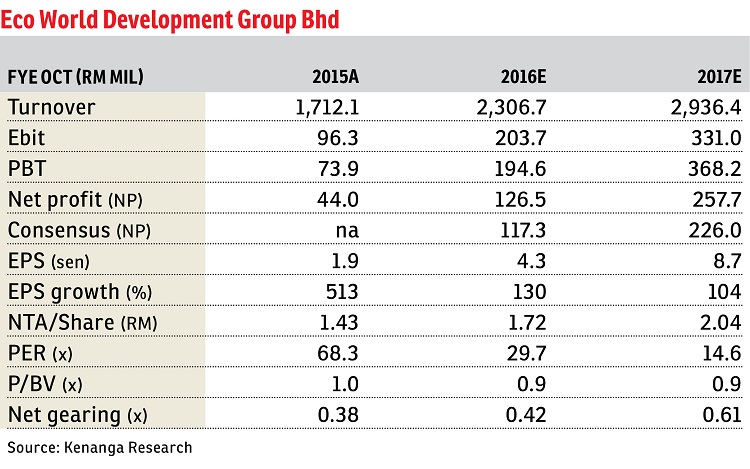

Maintain outperform with target price (TP) of RM1.58: Nine months ended of financial year 2016 (9MFY16) earnings of RM99.9 million for EcoWorld is above market consensus but within our expectations, accounting for 85% and 78% of street estimate (FY16E) earnings and ours, respectively. Sales of RM2.2 billion for 10M16 came within expectations at 73% of management’s and our FY16E local sales target of RM3 billion (RM4 billion including Eco World International [EWI] sales).

Earnings for 9MFY16 jumped 312% year to date year-over-year, largely due to the normalisation of billings from new sales garnered when EcoWorld were established. Third quarter (3Q) of FY16 earnings of RM44.6 million were up 29% quarter-on-quarter on improved billings (+18%) and earnings before interest and tax margins (+0.7 percentage points to 10.5%) on proportionately lower sales/marketing and administrative expenses as top line picked up.

Net gearing has increased to 0.65 times. However, given that we expect project deliveries (Eco Botanic, Eco Sky) by 4Q calendar year (CY) 2016/1QCY17 and the 25% placement (completion in 4QCY16), net gearing is expected to come down to our forecasted levels.

We have been on the ground recently to compare EcoWorld projects with competitors, and we note its strong marketing and concept offerings have set it apart from its competitors. This is critical when buyers are more discerning and cautious in the current challenging times. The group recently rolled out a global launch of four new projects (Eco Ardence, Eco Grandeur, Eco Bloom and Eco Business Park II) consisting of 1,524 units with a gross development value of slightly more than RM1 billion, and an average indicative take-up rate of 81%.

We expect landbanking activities to continue (for example, it was reported that EcoWorld may revisit the Eco Marina deal), but management prefers to explore non-dilutive fundraising options, including its “partnership for growth model”. EWI’s listing has been delayed to December 2016. While a FY16E sales target of RM4 billion includes EWI sales (25%), there is no major earnings impact as EWI sales are based on completion rather than progressive recognition. Unbilled sales of RM4.72 billion provide about 1.8 years’ visibility.

Maintain outperform and TP of RM1.58 based on 51% property revised net asset value discount and implied fully diluted sum-of-parts discount of 45%. Note our valuations are already imputed for: (i) EcoWorld’s stake in Eco Horizon/Sun and Eco Gardens/EBPV at 60% each; (ii) Eco Ardence at 50% stake, (iii) EWI at 30% stake, and (iv) 25% placement to raise RM768 million.

The group is set to benefit from some major news flows this year, particularly when there is no major excitement in the sector. — Kenanga Research Investment Bank, Sept 28

Try out one of our super tools, the rental yield calculator, here.

This article first appeared in The Edge Financial Daily, on Sept 29, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Kawasan Perindustrian Taman Johor

Johor Bahru, Johor

Sri Anggerik 2 Apartment

Bandar Kinrara Puchong, Selangor