Poh Huat Resources Holdings Bhd (Sept 27, RM1.52)

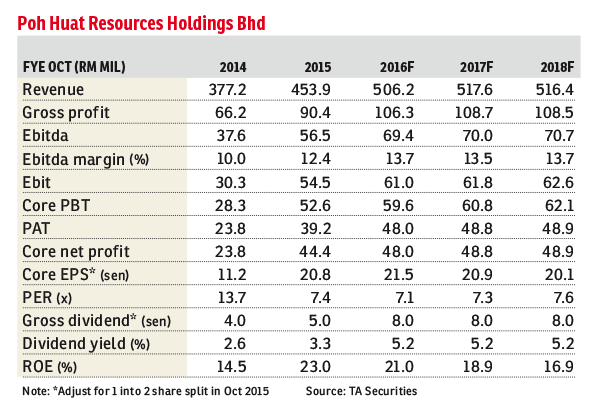

Maintain buy with a higher target price (TP) of RM2.08: Poh Huat Resources Holdings Bhd’s nine months of financial year 2016 (9MFY16) net profit of RM28 million came in within our expectations, accounting for 58.3% of our full-year estimate. Poh Huat’s sales of furniture is typically stronger in the fourth quarter of the financial year as demand picks up before year-end festivities.

Poh Huat has declared a third interim dividend of two sen per share (third quarter of FY15 [3QFY15]: 1.5 sen per share), bringing 9MFY16 dividend payout to six sen a share (9MFY15: three sen per share). Year-on-year, Poh Huat’s 9MFY16 net profit jumped 19.8% to RM28 million as revenue increased by 22.1% to RM383.2 million, coming from both the Malaysia and Vietnam operations. Successful launches of several ranges of office furniture during the Malaysian furniture exhibition in March 2016 and sustained improved US business sentiment and employment boosted the sales of its office furniture. New bedroom products developed earlier this year increased the shipment of home furniture to the US.

However, the profit before tax margin recorded in 3QFY16 was lower at 9.7% compared with 10.8% achieved a year ago as the margin for export sales denominated in US dollar normalised after sustained weakening of the ringgit. Meanwhile, the margin for operation in Vietnam was also slightly lower due to the temporary shift in the composition of mid-range products, in line with US consumers’ preference.

Quarter-on-quarter, Poh Huat’s 3QFY16 revenue and net profit surged by 18% and 156.7% respectively due to seasonality. The increase in net profit was due mainly to higher utilisation rates of its plants in the reporting quarter, as in the immediate preceding quarter both of its plants in Malaysia and Vietnam were off during the Chinese New Year holiday, which fell in February.

In line with our in-house forecast, we revise our FY17 and FY18 ringgit/US dollar assumptions to 4.125 and 4.10 respectively from 4.05.

We raise our FY17 and FY18 earnings forecasts by 1.3% and 0.8% respectively. The US housing starts, which are considered to be a bellwether for the group’s furniture exports to the US, remain in the uptrend since hitting bottom in early 2011. We expect Poh Huat’s earnings prospects to remain robust in the foreseeable future.

The group is expanding into Australia to capture a new target market. While it may take some time to establish its brand and gain meaningful market acceptance, the move is expected to provide growth potential to the group and may, in the long term, reduce the over-reliance on the North America market.

Following the revision in earnings forecasts, we raise the TP a tad higher from RM2.05 to RM2.08, based on an unchanged 10 times calendar year 2017 earnings per share. We reiterate our “buy” call on Poh Huat. — TA Securities, Sept 27

Try out one of our super tools, the rental yield calculator, here.

This article first appeared in The Edge Financial Daily, on Sept 28, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Kawasan Perindustrian Taman Johor

Johor Bahru, Johor

Sri Anggerik 2 Apartment

Bandar Kinrara Puchong, Selangor