Mitrajaya Holdings Bhd (Aug 19, RM1.42)

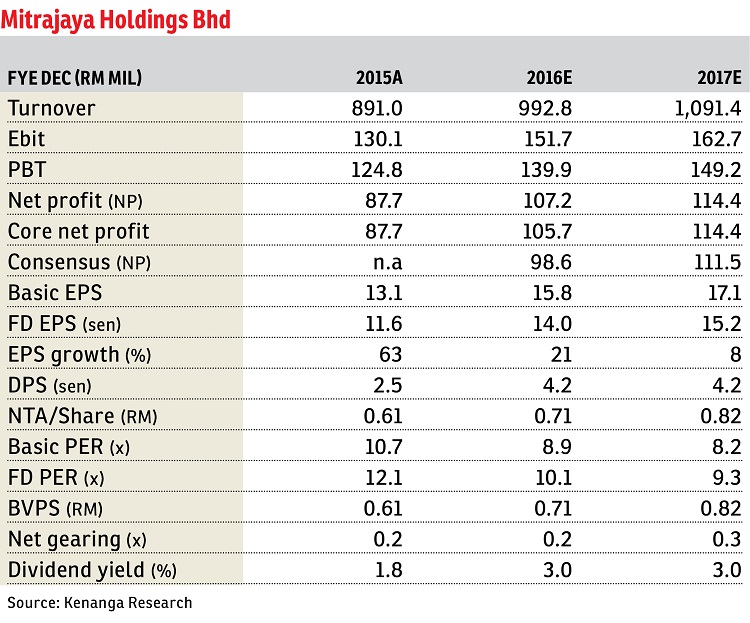

Maintain outperform with a higher target price of RM1.79 from RM1.77 previously: First-half of financial year 2016 (1HFY16) core net profit (CNP) of RM46.9 million was in line with our and consensus forecasts, representing 45% and 48% of estimates respectively. No dividends were declared as expected.

1HFY16 CNP of RM46.9 million was up 32% year-on-year, underpinned by an 11% increase in top line as a result of higher construction billings, improvement in construction earnings before interest and tax margins of 1.4 percentage points driven by better cost controls and a lower effective tax rate.

Second quarter of FY16 CNP of RM28.4 million improved 54% quarter-on-quarter, underpinned by a 26% increase in revenue, improved margins from construction, and lower share option expense.

The increase in revenue was attributed to higher construction billing as a number of projects had already moved towards advanced billings stages.

Currently, Mitrajaya Holdings Bhd’s outstanding order book stands at RM1.49 billion, providing earnings visibility for another 1.5 years.

Year to date, Mitrajaya has secured RM503 million worth of contracts, making up 63% of our RM800 million order book assumption with a remainder of RM297 million to be achieved.

We feel our replenishment target is achievable given the existing RM2 billion tender book in hand.

Within its property segment, Mitrajaya’s unbilled sales of RM160 million from Wangsa 9 and 280 Park Homes provide visibility for another 1.5 years.

Meanwhile, its South Africa division will see unbilled sales of 67 million South Africa rand (RM19.9 million) recognised progressively upon completion of the transfer of ownership by FY16.

We make no changes to our FY16 and FY17 earnings forecasts of RM105.7 million and RM114.4 million respectively.

Risks to our call include lower-than-expected margins, a delay in construction works, lower-than-expected order book replenishment and lower-than-expected property sales. — Kenanga Research, Aug 19

Want to know the price trends of a development? Click here.

This article first appeared in The Edge Financial Daily, on Aug 22, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

METROCITY SQUARE SOHO APARTMENT

Sarawak, Sarawak