- MBSB Research noted that BNM struck a “slightly more confident view” on Malaysia’s economic prospects at its September meeting, compared to the more cautious tone in July that prompted the pre-emptive cut to 2.75%—the first rate adjustment in nearly two years.

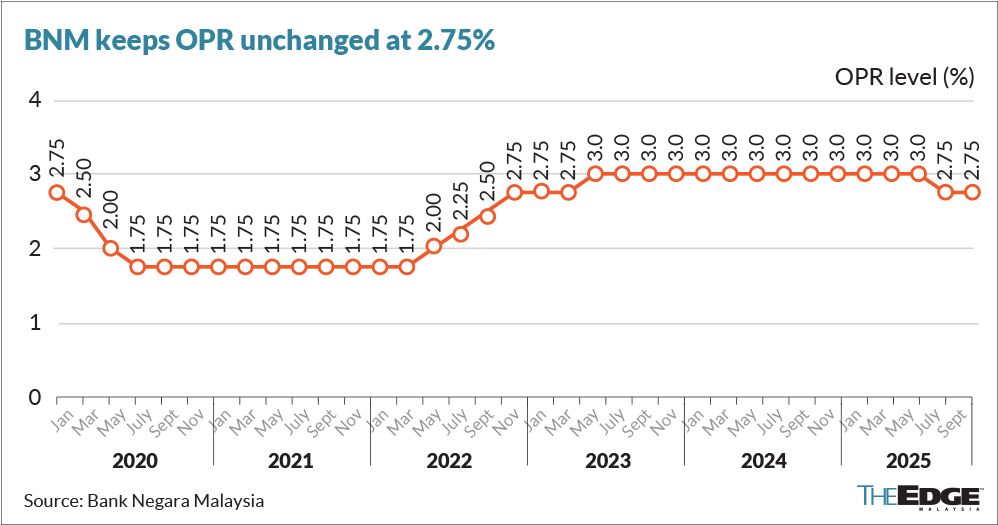

KUALA LUMPUR (Sept 4): Economists expect Bank Negara Malaysia (BNM) to keep the benchmark interest rate at 2.75%, as resilient domestic demand and easing global trade tensions reduce the likelihood of further cuts this year and in 2026.

MBSB Research noted that BNM struck a “slightly more confident view” on Malaysia’s economic prospects at its September meeting, compared to the more cautious tone in July that prompted the pre-emptive cut to 2.75%—the first rate adjustment in nearly two years.

“We expect that the impact from the previous policy rate adjustments, given the lagged impact for it to be fully priced in in the economy and could provide support to the economy even into next year.

“On that note, we think that the previous pre-emptive action will be a one-off decision and will not be a start of a rate-cutting cycle in the near term, overlayed by the still encouraging spending activities in the domestic economy and healthy labour market situation,” it said in a note.

Instead of further overnight policy rate (OPR) adjustments, MBSB suggested that targeted support for industries most exposed to external uncertainties would be more effective.

Meanwhile, RHB Research is also expecting the OPR to stay put for the rest of the year, provided gross domestic product (GDP) growth remains within the official 4%-4.8% range and inflation stays contained.

“Despite external risks, Malaysia’s domestic demand is resilient, underpinned by a robust labour market, policy support and sustained investment in infrastructure and development initiatives. Current developments, including signs of easing global tariff and trade tensions alongside solid domestic demand, do not suggest another OPR cut in 2026,” it said.

HSBC Global Investment Research similarly sees BNM standing pat on interest rates through its forecast horizon, pending clarity on the government’s RON95 subsidy rationalisation plan to be unveiled with Budget 2026 on Oct 10.

BNM’s decision to keep the OPR unchanged was widely expected, with 22 of 24 economists polled by Bloomberg predicting no change, while the remaining two had anticipated a 25-basis-point cut.

Capital Economics and OCBC Global Markets Research believe there is still scope for one more 25-basis-point cut to 2.50%, citing a weakening growth outlook and subdued inflation.

Capital Economics noted that the economy is likely to remain under pressure in the months ahead as tighter fiscal policy curbs domestic demand, Trump tariffs weigh on exports, and softer commodity prices erode revenues. It forecasted GDP growth of 4.1% this year—the lower end of BNM’s 4%-4.8% target range.

“Meanwhile, inflation has undershot expectations. Headline CPI was just 1.2% y-o-y in July—up only slightly from the four-year low of 1.1% that was recorded the previous month. And although the government is still planning to go ahead with subsidy cuts to petrol prices, the timing is highly uncertain. Prime Minister Anwar Ibrahim is facing calls to water down or scrap the planned cuts due to the worsening economic outlook. Even if the subsidy cuts go ahead, low global commodity prices and sluggish GDP growth should keep broader price pressures in check,” it added.

OCBC, meanwhile, said it will closely monitor upcoming data—including August and September trade (Sept 19 and Oct 17), August industrial production and wholesale and retail trade (Oct 10), and the advance 3Q2025 GDP print (Oct 17)—to gauge the potential for a rate move at BNM’s Nov 6 meeting.

As Penang girds itself towards the last lap of its Penang2030 vision, check out how the residential segment is keeping pace in EdgeProp’s special report: PENANG Investing Towards 2030.